MSE Trading Report for Week ending 30 January 2026

| Movement in Equity and Bond Indices: |

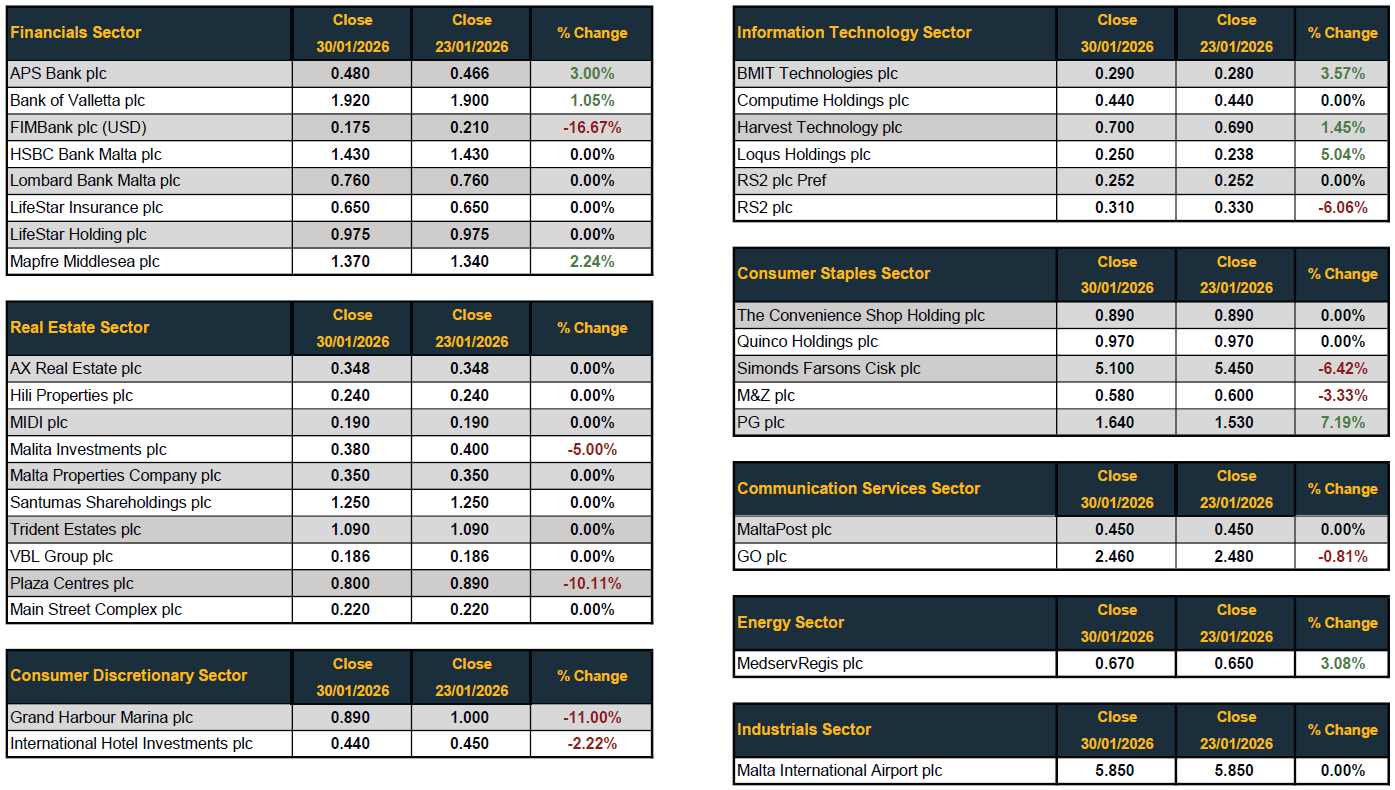

The MSE Equity Total Return Index ended the week in negative territory, closing 0.3% lower at 8,870.413 points. A total of 21 equities were active, as eight headed north while another nine closed in the opposite direction. The total weekly turnover stood at just over €0.6m across 139 transactions, with Hili Properties plc being a primary contributor to market activity.

The MSE Corporate Bonds Total Return Index closed 0.7% lower at 1,148.582 points. A total of 78 issues were active, 18 of which traded higher while another 34 lost ground. The 6.25% Together Gaming Solutions plc Unsecured Callable 2030-2032 was the best performer, as it closed 4.1% higher at €102. On the other hand, the 3.75% AX Group plc 20.12.2029 ended the week 6% lower at €94.

The MSE MGS Total Return Index posted a marginal 0.2% gain, as it closed at 969.572 points. Out of 23 active issues, 18 advanced while another three closed in the red. The 3.5% MGS 2035 headed the list of gainers, as it closed at €100, equivalent to a positive 1% change. Conversely, the 3.15% MGS 2027 closed 0.1% lower at €101.

| Market Highlights: |

In the banking sector, Bank of Valletta plc closed 1.1% higher at €1.92. Trading activity involved 88,904 shares changing ownership over 37 trades, resulting in a weekly turnover of €169,614.

Meanwhile, FIMBank plc experienced a slide of 16.7% – the largest weekly drop, to close at $0.175. The banking equity traded twice with 6,969 shares changing hands. Trading turnover totalled $1,225.

APS Bank plc rebounded with a positive 3% movement in its share price, closing at a weekly high of €0.48. This was the result of 14 deals spread across 29,149 shares. APS shares generated a total turnover of €13,718.

BMIT Technologies plc registered 11 deals involving the exchange of 40,300 shares. The equity closed the week at a high of €0.29. On a week-on-week basis the equity increased by 3.6%.

Trading in Hili Properties plc remained stable at €0.24. The equity’s shares were the most liquid, as 679,152 shares were exchanged across 11 deals, generating a turnover of €162,996. This marks the second week in which the equity was the most traded, following several announcements.

Plaza Centres plc shares decreased by 10.1% to close at €0.8, making it the third biggest loser of the week. This decrease was the result of just two trades which generated a weekly turnover of a mere €1,708.

Grand Harbour Marina plc also ended the week in negative territory, recording a 11% fall in its share price. The equity closed at a weekly low of €0.89 after being traded three times – over a minimal turnover of €578.

Malta International Airport plc remained steady, closing at a price of €5.85. A total of 12,475 shares were traded across 16 transactions, amounting to €72,407.

Simonds Farsons Cisk plc was among the list of losers as its share price lost 6.4% of its value. The consumer staple equity was traded five times with 10,292 shares changing hands. Total turnover amounted to to €53,016.

Sector peer, PG plc, recorded a positive gain of 7.2%, closing at a weekly high of €1.64. Trading activity was limited to just a sole trade involving 100 shares valued at €164.

| Company Announcements: |

HSBC Bank Malta plc announced that, following the receipt of all necessary regulatory approvals, the Company exercised the early repayment option on its €30m loan agreement with HSBC Continental Europe. The loan was redeemed in full on January 30, while all other loan facilities previously disclosed remain unchanged and in force.

Bank of Valletta plc confirmed that no shares were repurchased under its ongoing share buy-back programme during the week ended January 23, 2026. Since the launch of the programme, the Bank has acquired 564,032 shares, equivalent to 0.09% of its issued share capital, at an average price of €1.90 per share, for a total consideration of approximately €1.07m.

Malta International Airport plc announced that it repurchased 3,298 shares under its share buy-back programme during the week ended January 23, 2026, with all shares acquired at a price of €5.85 per share. The Company also stated that the share buy-back programme has been suspended with immediate effect and will resume on the business day following the publication of its next annual financial results.

International Hotel Investments plc announced that the Group, through its subsidiary Corinthia Hotels Limited, has entered into an agreement to manage a new luxury resort development in Lake Como, Italy. The 58-key Corinthia Lake Como will be the brand’s second property in Italy and will form part of an integrated resort overlooking Lake Como, developed in partnership with RoundShield, with construction expected to commence following final planning approvals and operations targeted for late 2028.

Hili Properties plc announced that it received a notification of major holdings from Hili Ventures ltd, confirming an increase in its shareholding from 89.96% to 90.1% following the acquisition of 571,360 ordinary shares. As a result, Hili Ventures ltd now holds 361.2mshares, representing 90.1% of the Company’s voting rights.

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]