MSE Trading Report for Week ending 20 February 2026

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index advanced further by 0.1%, closing at 9,094.508 points. Out of 29 active equities, 11 headed north while another 13 closed in the opposite direction. Total weekly turnover jumped to a staggering €8.1m across 826 transactions, mainly through Hili Properties plc.

The MSE Corporate Bonds Total Return Index closed the week 0.3% higher at 1159.745 points. A total of 80 issues were active, as 36 increased while another 17 closed in the red. The 3.9% Browns Pharma Holdings plc Unsecured Callable € 2027-2031 headed the list of gainers with a 6.5% increase, as it closed at €96.95. Meanwhile, the 5% CF Estates Finance plc Secured € 2028-2033 lost 5%, ending the week at €95.01.

The MSE MGS Total Return Index recorded a positive 0.5%, as it reached 975.117 points. Out of 23 active issues, 16 advanced while another three closed in the opposite direction. The top performer was the 4% MGS 2038, as it closed 1.9% higher at €103. On the other hand, the 3.4% MGS 2042 lost 0.3%, to close at €94.

| Market Highlights: |

Hili Properties plc stood out as a strong performer this week, climbing 12.5% to close at €0.27 — a price last seen in early 2022, shortly after the company’s IPO. The stock saw exceptionally high trading activity, with 603 transactions covering 24,356,404 shares, generating €6.6m in turnover.

Harvest Technology plc was another equity in the spotlight as it surged by 68.6% to close at €1.18 – its highest level in almost two years. Trading activity was concentrated across five deals, with a total of 22,962 shares changing hands worth €16,619.

HSBC Bank Malta plc extended its recent upward momentum by 2.8%, closing at €1.49. The banking equity reached a six-month high, with 98,053 shares traded across 20 transactions, amounting to €141,613.

Bank of Valletta plc recorded a modest weekly gain of 1%, extending its winning streak to four consecutive weeks. The equity moved within a range of €2.00 to €2.10, ultimately closing at €2.06. Trading remained robust, with 64 transactions covering 370,917 shares and generating a total turnover of €764,788.

FIMBank plc retreated by 13.3% to close at $0.17. Trading included 134,211 shares exchanged across eight deals. Weekly turnover amounted to $17,359.

Simons Farsons Cisk plc was under pressure, shedding 12.5% to close at a weekly low of €4.90. Trading activity was relatively moderate with 4,111 shares changing hands across a turnover of €20,646.

LifeStar Insurance plc experienced a sharp decline, plunging by 32.3% to close at a price level of €0.44. A total of 5,500 shares through a sole deal was executed.

RS2 plc advanced by 8.3%, closing at €0.34. The equity traded a total of 19,935 shares across four deals, generating €6,070 in turnover.

Malta Properties Company plc advanced to €0.39, reflecting a 14% increase in its share price. Trading activity included 759,472 shares across 23 trades worth €276,180.

Malta International Airport plc edged higher this week, posting a 0.9% increase to finish at €5.85. Activity remained moderate, as 10,465 shares were exchanged over 11 trades, amounting to €61,040.

| Company Announcements: |

Plaza Centres plc has convened an Extraordinary General Meeting for March 25, 2026 in Sliema, following a requisition by Virgata HQ Limited. The EGM will consider amendments to the Company’s memorandum to revise the size of the Board depending on shareholder-appointed members. Shareholders will also vote on authorising a share buyback of up to 2.4m shares at prices between €0.75 and €0.95 over an 18-month period, subject to regulatory approval. In addition, the Board is proposing a 1-for-2 bonus share issue through the capitalisation of €2.6m from the share premium account, increasing issued share capital to 38.24m shares.

Last Thursday, MaltaPost plc held the AGM during which all ordinary resolutions on the agenda were approved.

The Board of AX Real Estate plc will meet on February 20, 2026 to review and approve the company’s financial statements for the year ended October 31, 2025.

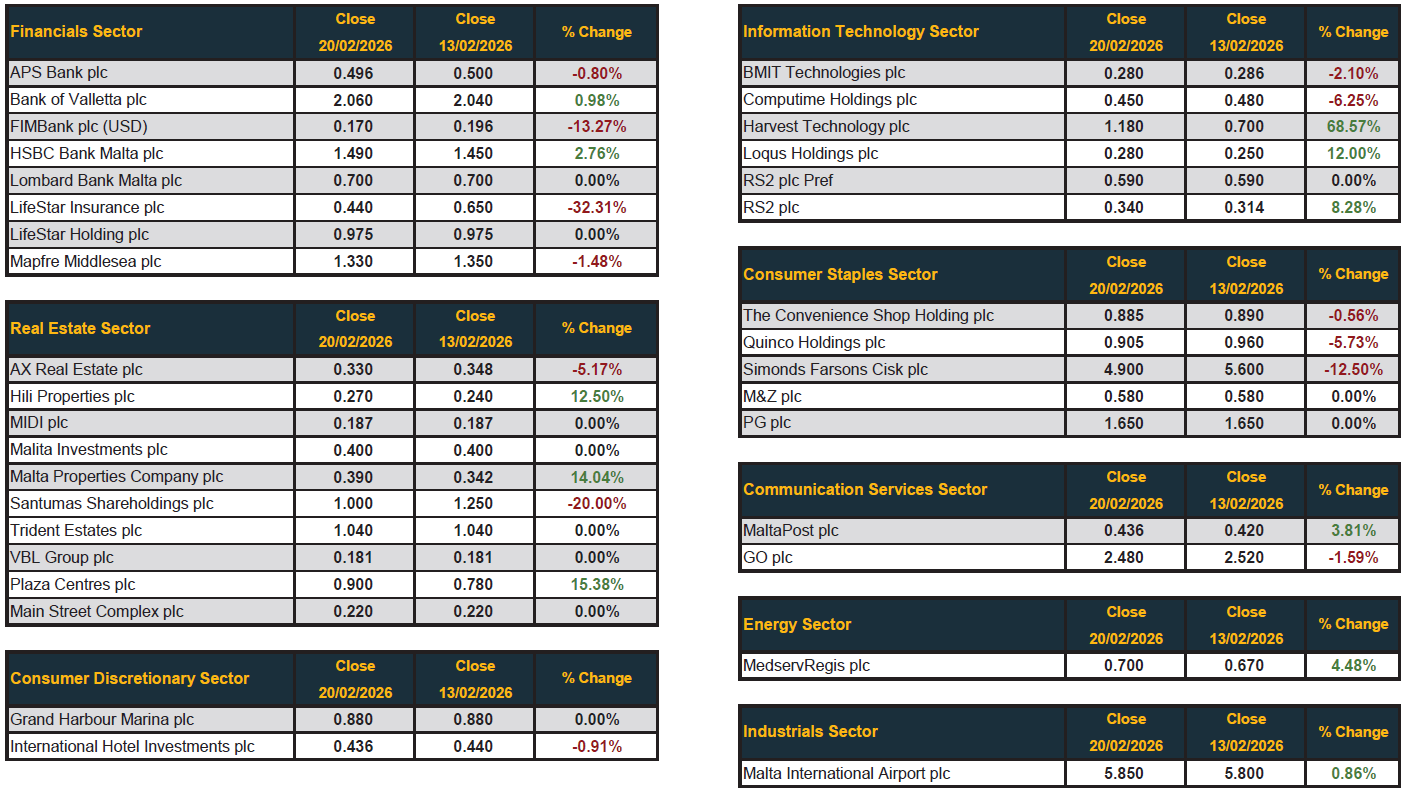

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]