MSE Trading Report for Week ending 18 October 2019

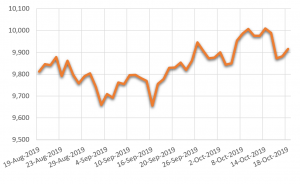

| MSE Equity Total Return Index: |

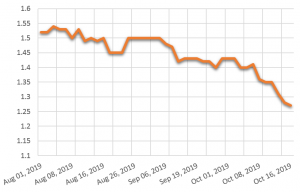

| Chart of the Week: HSBC Bank Malta plc |

| Highlights: |

- The local equities market extended its negative streak to three straight weeks, as the MSE Equity Total Return Index contracted sharply by 1.75% to end the week at 9,733.718 points.

- A total of 23 equities were active, 12 of which posted falls, while six traded in positive territory. Investor participation continued at relatively high levels, as a turnover of €2.3 million was generated over 267 deals.

- The main driver of the negative performance was the banking sector, led by HSBC Bank Malta plc which suffered a further 5.93% price decline.

- Similarly, Bank of Valletta plc continued to trade in negative territory for the third week in a row. The share price lost 4.02% over the week, to settle at a price of €1.075.

- The gain registered by Malta International Airport plc during the previous week proved unsustainable, as it surrendered 2.61% in value to close at €7.45.

- Following the previous week’s impressive rally, Simonds Farsons Cisk plc retracted 3.97% to settle at €12.10.

- RS2 Software plc extended its positive run to three successive weeks, as it was up 1.55% to the highest closing price in over 10 weeks of €1.96.

- Santumas Shareholdings plc announced that during the fifty-sixth Annual General Meeting held on October 11, 2019 all ordinary resolutions on the agenda were approved. The equity recorded the worst performance of the week, declining 7.41% and ending the week at a price of €1.50.

- In the property sector, performances were in the balance, as gainers and fallers amounted to three-a-piece.

- The largest price movement was recorded by Trident Estates plc, as it sank 3.12% to €1.86.

- The most liquid equity of the week was MIDI plc, generating a turnover of €385,085 over 16 transactions. As a result, the share price was up 0.72% to close at €0.695.

- The local sovereign debt market performed negatively this week, as the MSE MGS Total Return Index was down a sizable 0.471%, to 1,130.42 points. All 21 active Malta Government Stocks were down.

- In the local corporate debt market, 44 bonds were active, of which 16 registered gains while another 17 closed in negative territory. The MSE Corporate Bonds Total Return Index advanced another 0.217% to close at 1,084.25 points.

- On Monday, the application period for the MeDirect Bank (Malta) plc issue of €35 million of the 4% Subordinated Unsecured Bonds maturing in 2024-2029 commenced. The application period shall be closed on October 23, 2019, however the offer may close at an earlier date in the event of over-subscription.

| Upcoming Events: | ||||

| 23 OCT 2019 | MT: Medirect bond close of offer period | Best Performers: | ||

| 24 OCT 2019 | EU: ECB – Interest Rate Decision | 1. RS2 | +1.55% | |

| 24 OCT 2019 | MT: PG plc – Annual General Meeting | 2. MPC | +1.52% | |

| 30 OCT 2019 | US: FED – Interest Rate Decision | 3. Plaza | +0.98% | |

| 07 NOV 2019 | UK: BoE – Interest Rate Decision | |||

| 11 DEC 2019 | US: FED – Interest Rate Decision | Worst Performers: | ||

| 12 DEC 2019 | EU: ECB – Interest Rate Decision | 1. STS | -7.41% | |

| 19 DEC 2019 | UK: BoE – Interest Rate Decision | 2. HSBC | -5.93% | |

| 3. BOV | -4.02% | |||

| Price (€): 18.10.2019 | Price (€): 11.10.2019 | Weekly Change (%) | Year-to-date Change (%) | |

| MSE Equity Total Return Index | 9,733.718 | 9,906.713 | -1.746 | 8.164 |

| BMIT Technologies plc | 0.535 | 0.530 | 0.94 | 9.184 |

| Bank of Valletta plc | 1.075 | 1.120 | -4.02 | -11.084 |

| FIMBank plc (USD) | 0.630 | 0.630 | 0.00 | -16.00 |

| GlobalCapital plc | 0.222 | 0.222 | 0.00 | -33.13 |

| Grand Harbour Marina plc | 0.590 | 0.590 | 0.00 | -15.71 |

| GO plc | 4.200 | 4.200 | 0.00 | 6.06 |

| HSBC Bank Malta plc | 1.270 | 1.350 | -5.93 | -30.6 |

| International Hotel Investments plc | 0.780 | 0.775 | 0.65 | 25.81 |

| Lombard Bank plc | 2.260 | 2.260 | 0.00 | -7.38 |

| Loqus Holdings plc | 0.085 | 0.085 | 0.00 | 13.33 |

| MIDI plc | 0.695 | 0.690 | 0.72 | 3.73 |

| Medserv plc | 1.240 | 1.260 | -1.59 | 7.83 |

| Malta International Airport plc | 7.450 | 7.650 | -2.61 | 28.45 |

| Malita Investments plc | 0.890 | 0.895 | -0.56 | 1.14 |

| Mapfre Middlesea plc | 2.120 | 2.140 | -0.93 | 6.53 |

| Malta Properties Company plc | 0.670 | 0.660 | 1.52 | 17.54 |

| Main Street Complex plc | 0.600 | 0.600 | 0.00 | -7.69 |

| MaltaPost plc | 1.280 | 1.310 | -2.29 | -18.99 |

| PG plc | 1.840 | 1.870 | -1.60 | 38.35 |

| Plaza Centres plc | 1.030 | 1.020 | 0.98 | 0.98 |

| RS2 Software plc | 1.960 | 1.930 | 1.55 | 40.00 |

| Simonds Farsons Cisk plc | 12.100 | 12.600 | -3.97 | 38.29 |

| Santumas Shareholdings plc | 1.500 | 1.620 | -7.41 | 5.63 |

| Tigné Mall plc | 0.910 | 0.935 | -2.67 | -5.70 |

| Trident Estates plc | 1.860 | 1.920 | -3.12 | 24.00 |

This report which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].