MSE Trading Report for Week ending 08 November 2019

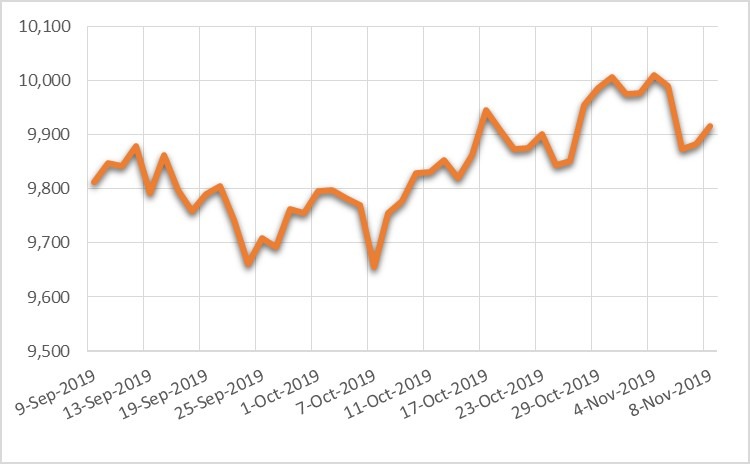

| MSE Equity Total Return Index: |

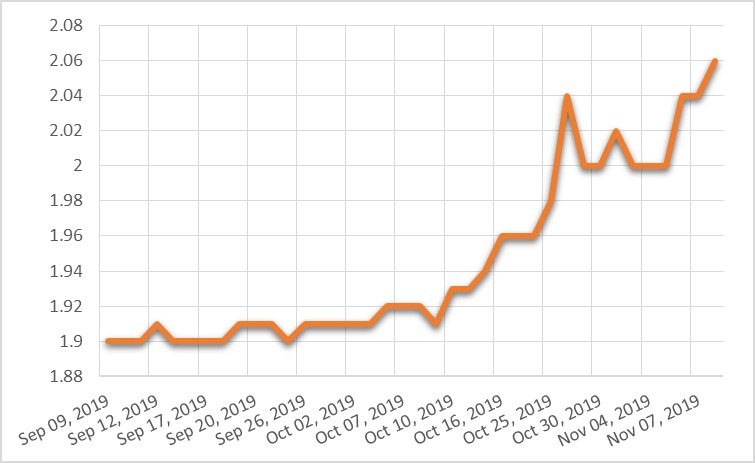

| Chart of the Week: RS2 Software plc |

| Highlights: |

- The local equities market managed to recoup part of its previous loss, as it closed 0.522% higher at 9,866.644 points. A total of 21 equities were active, of which seven headed north while another six closed in negative territory. A total weekly turnover of €1.3 million was generated over 156 deals.

- HSBC Bank Malta plc registered a 2.26% decline last Monday to €1.30 and did not recoup any of the loss during the week. A total of eight deals involving 57,308 shares were executed.

- Its peer, Bank of Valletta plc was active over 17 deals with a spread 69,598 shares. Last Thursday, the equity reached a high price of €1.12 but did not manage to maintain the gain as it closed unchanged at €1.10.

- Last Tuesday, International Hotel Investments plc (IHI) issued their interim directors’ report, delineating the company’s performance since the beginning of this year. The targets set for the current financial year are expected to be reached and EBITDA is expected to exceed the previous year’s figure. As at end of October, business continued to show strength, and the company’s outlook remains positive.

- Last Tuesday, a sole deal of 1,000 IHI shares pushed its price 3.66% higher to €0.85. The equity was also active on Thursday and Friday over two deals involving 13,000 shares, with no impact on its previous closing price.

- Last Wednesday, Malta International Airport plc issued their interim directors’ report and confirmed that since its previous announcement, issued on July 25, 2019 to date, there were no material events or any transactions which might have impacted its financial position, pursuant to the applicable listing rules.

- The company’s financial position for first three quarters of 2019 remained sound and its performance was superior to 2018.During the period under review, revenue increased by 9.2% to €77.3 million when compared to the same period last year. Similarly, profit before tax has also increased to €41.7 million by 8.1%. Total expenditure increased by a moderate 3.7% to €27.7 million and capital expenditure amounted to €12.8 million for the first nine months of the year.

- MIA was active over 16 transactions involving 22,483 shares. This resulted into a 0.69% gain and total weekly turnover stood at €164,575, being the second most traded equity for the week.

- Last Wednesday, Trident Estates plc announced the results following the rights issue of circa €15million worth of new ordinary shares,. The rights issue period closed on October 29, 2019, whereby eligible shareholders could subscribe for the 12,000,003 new shares. A total of 761 provisional allotment letters were received by the company from both eligible shareholders and transferees. Total subscription amounted to 11,152,571 new shares for a value of €13,940,713.75, of which all were accepted and allotted in full.

- The company also received 365 lapsed rights application forms for eligible shareholders. Bid prices ranged between €1.25 and €2.00 per new share worth €2,739,526.88. Since the balance of the lapsed rights stood at 847,432 new shares, the company had to adopt an allocation policy, having to accept only a limited number.

- Applications with a bid price above €1.27 per lapsed right were allotted in full, representing 836,363 new shares, the equivalent of €1,045,453.75. This resulted in a lapsed rights premium of €128,967.35. Applications received with a bid price of €1.27 per lapsed right totaled to 36,350 new shares. The company has adopted an allocation policy on a pro-rata basis, that of 30.45% of the lapsed rights applied for at €1.27. By rounding up to the nearest lapsed right, new shared allotted stood at 11,069 new shares, the equivalent of €13,836.25 and a lapsed rights premium of €221.38. Applications with a bid price lower than €1.27 per lapsed right were not accepted.

- Trident traded 0.66% lower this week as nine deals involving 46,080 shares were executed. The week’s closing price stood at a six-month low of €1.50.

- Last Tuesday, Santumas Shareholdings plc announced that the issued and paid up capital of the company has increased to €2,011,384 divided into 7,314,122 ordinary shares with a nominal value of €0.275 each fully paid up. This resulted into an increase in the number of voting rights, which as at November 4, 2019 counts to 7,314,122 votes.

- Three deals involving 9,726 shares dragged the price 6.67% lower to €1.40 – the lowest price in four months. The equity registered the worst performance for the week

- The MSE MGS Total Return Index registered a further 0.891% to 1,122.474 points. All 20 active issues closed lower as yields went up. The 3% MGS 2040 (I) registered the largest decline in price of 1.36% as it closed the week at €140.80.

- The MSE Corporate Bonds Total Return Index advanced by a further 0.188% to 1,083.424 points. A total of 43 issues were active, of which 13 advanced while another 18 traded lower. The best performer was the 6% AX Investments plc € 2024 as it closed 1.76% higher at €114. This gain came following a company announcement stating that the company has submitted an application to the listing authority requesting the listing of €25 million in new unsecured bonds. If approved, preference will be granted to bondholders of the 6% AX Investments plc 2024 who appear on the Company’s register as at November 14, 2019.

- In the prospects market, seven issues were active. The most liquid bond was once again the 5.35% D Shopping Mall Unsecured Bonds 2028 as a total turnover of € 22,988.50 was generated over three deals. It ended the week slightly higher at €0.995.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. MDS | +8.33% | |||

| 12 NOV 2019 | MT: Trident Estates plc – Trading of New Shares commence | 2. RS2 | +4.00% | |

| 11 DEC 2019 | US: FED – Interest Rate Decision | 3. IHI | +3.66% | |

| 12 DEC 2019 | EU: ECB – Interest Rate Decision | |||

| 19 DEC 2019 | UK: BoE – Interest Rate Decision | Worst Performers: | ||

| 20 DEC 2019 | MT: MaltaPost plc – Annual General Meeting | 1. STS | -6.67% | |

| 2. HSBC | -2.26% | |||

| 3. BMIT | -1.89% | |||

| Price (€): 08.11.2019 | Price (€): 01.11.2019 | Weekly Change (%) | Year-to-date Change (%) | |

| MSE Equity Total Return Index | 9,866.644 | 9,815.449 | +0.522 | 9.641 |

| BMIT Technologies plc | 0.520 | 0.530 | -1.89 | 6.122 |

| Bank of Valletta plc | 1.100 | 1.100 | 0.00 | -9.016 |

| FIMBank plc (USD) | 0.640 | 0.640 | 0.00 | -14.67 |

| GlobalCapital plc | 0.270 | 0.270 | 0.00 | -18.67 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | -21.43 |

| GO plc | 4.280 | 4.340 | -1.38 | 8.08 |

| HSBC Bank Malta plc | 1.300 | 1.330 | -2.26 | -28.96 |

| International Hotel Investments plc | 0.850 | 0.820 | 3.66 | 37.10 |

| Lombard Bank plc | 2.240 | 2.240 | 0.00 | -8.20 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | -14.00 |

| MIDI plc | 0.715 | 0.710 | 0.70 | 6.72 |

| Medserv plc | 1.300 | 1.200 | 8.33 | 13.04 |

| Malta International Airport plc | 7.300 | 7.250 | 0.69 | 25.86 |

| Malita Investments plc | 0.925 | 0.910 | 1.65 | 5.11 |

| Mapfre Middlesea plc | 2.180 | 2.140 | 1.87 | 9.55 |

| Malta Properties Company plc | 0.660 | 0.660 | 0.00 | 15.79 |

| Main Street Complex plc | 0.600 | 0.600 | 0.00 | -7.69 |

| MaltaPost plc | 1.250 | 1.250 | 0.00 | -20.89 |

| PG plc | 1.840 | 1.870 | -1.60 | 38.35 |

| Plaza Centres plc | 1.030 | 1.030 | 0.00 | 0.98 |

| RS2 Software plc | 2.080 | 2.000 | 4.00 | 48.57 |

| Simonds Farsons Cisk plc | 11.500 | 11.500 | 0.00 | 31.43 |

| Santumas Shareholdings plc | 1.400 | 1.500 | -6.67 | -1.41 |

| Tigné Mall plc | 0.905 | 0.905 | 0.00 | -6.22 |

| Trident Estates plc | 1.500 | 1.510 | -0.66 | 0.67 |

This report which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].