MSE Trading Report for Week ending 15 November 2019

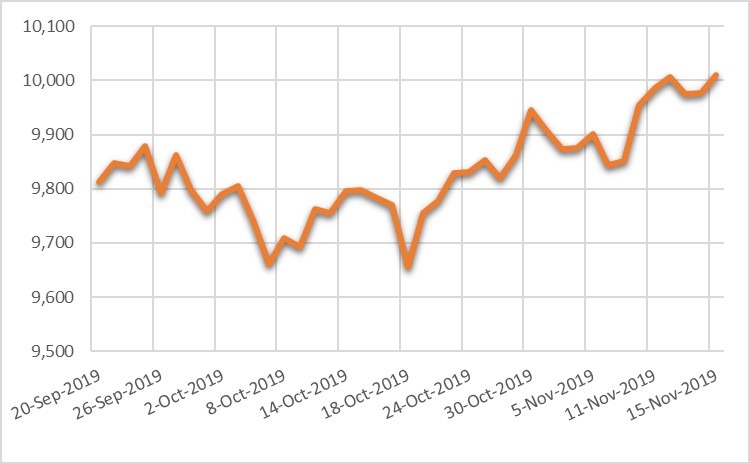

| MSE Equity Total Return Index: |

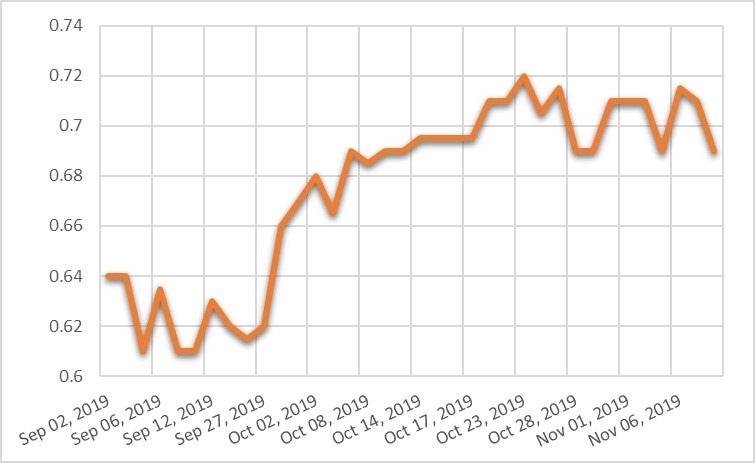

| Chart of the Week: MIDI plc |

| Highlights: |

- The local equities market lost ground as it declined to 9,847.882 points by 0.190%. A total of 21 equities were active, of which eight registered a loss while another five traded higher. A total weekly turnover of €1.33 million was generated over 198 deals.

- In the banking sector, all four equities were active. Bank of Valletta plc kicked off the week at €1.10 but declined to €1.095 last Wednesday. A total of 26 deals involving 84,985 shares were executed, generating a total weekly turnover of €93,413. As a result, a 0.45% decline in price was recorded.

- Meanwhile, its peer, HSBC Bank Malta plc was active over 17 deals of a combined 41,719 shares. The bank commenced the week on a negative note as it closed in the red but managed to off-set the loss last Thursday. The equity’s previous closing price of €1.30 was left unaltered.

- RS2 Software plc extended its positive streak to seven weeks, as it closed 3.85% higher at €2.16. This was the result of 16 deals involving 47,290 shares. During the week, the equity reached the highest closing price in over three years of €2.20.

- In the property sector, five equities were active. Last Monday, 12,000,003 new ordinary Trident Estates plc shares with a nominal value of €1 were admitted to listing on the official list of the Malta Stock Exchange. Trading commenced the next day, November 12, 2019. The equity traded 1.33% higher this week, to close at €1.52, as 46,057 shares changed hands across six deals.

- Last Friday, Malta Properties Company plc issued its directors’ statement for the first three quarters of the year. The group’s performance was in line with expectations and improved from the same period last year. This was primarily due to the increase in rental income from a full year’s lease of Floriana’s offices, ‘The Bastions’. This was also due to the marginal decrease in administrative expenses and finance costs. The company’s financial position remains satisfactory.

- Last Tuesday, Main Street Complex plc issued its interim directors’ report for the first three quarters of 2019 – January 1, 2019 to September 30, 2019. The company registered its highest ever growth in footfall, as it was up by 8% from the same period last year. This proves the popularity of the complex being the preferred retail destination for the South of Malta. The company’s income advanced further as all vacant spaces were leased out by July 2019.

- Last Tuesday, the board of 1923 Investments plc announced the approval of the sale of 40% of its shareholding in Harvest Technology plc through an initial public offering. An application has been submitted to the Listing Authority, the MFSA and the Malta Stock Exchange for the admission of its entire issued share capital to the official list of the MSE and for trading to commence thereafter.

- The MSE MGS Total Return Index declined by a further 0.172% to 1,120.54 points. A total of 18 issues were active, of which four traded higher while another 14 closed in the red. The 2.2% MGS 2035 (I) registered a 1.20% gain, as it closed at €126.50.

- The MSE Corporate Bonds Total Return Index lost ground as it closed 0.615% lower at 1,076.76 points. Out of 46 active issues, 11 headed north while another 22 closed in the opposite direction. The 3.85% Hili Finance plc Unsecured Bonds 2028 headed the list of gainers with a 1.30% increase to €101.50.

- In the Prospects MTF market, two issues were active. Both 5% Borgo Lifestyle Finance plc Secured Callable 2026-2029 and 5.35% D Shopping Malls Finance plc € Unsecured 2028 traded once on slim volumes. The latter ended the week slightly lower at €0.994.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. MTP | +4.80% | |||

| 27 Nov 2019 | MT: SD Finance plc – Consideration/Approval of unaudited interim FS | 2. RS2 | +3.85% | |

| 11 Dec 2019 | US: FED – Interest Rate Decision | 3. GCL | +3.70% | |

| 12 Dec 2019 | EU: ECB – Interest Rate Decision | |||

| 19 DEC 2019 | UK: BoE – Interest Rate Decision | Worst Performers: | ||

| 20 DEC 2019 | MT: MaltaPost plc – Annual General Meeting | 1. MDI | -3.50% | |

| 2. PG | -2.72% | |||

| 3. MMS | -1.83% | |||

| Price (€): 15.11.2019 | Price (€): 08.11.2019 | Weekly Change (%) | Year-to-date Change (%) | |

| MSE Equity Total Return Index | 9,847.882 | 9,866.644 | -0.190 | 9.433 |

| BMIT Technologies plc | 0.515 | 0.520 | -0.96 | 5.10 |

| Bank of Valletta plc | 1.095 | 1.100 | -0.45 | -9.43 |

| FIMBank plc (USD) | 0.640 | 0.640 | 0.00 | -14.67 |

| GlobalCapital plc | 0.280 | 0.270 | 3.70 | -15.66 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | -21.43 |

| GO plc | 4.260 | 4.280 | -0.47 | 7.58 |

| HSBC Bank Malta plc | 1.300 | 1.300 | 0.00 | -28.96 |

| International Hotel Investments plc | 0.850 | 0.850 | 0.00 | 37.10 |

| Lombard Bank plc | 2.260 | 2.240 | 0.89 | -7.38 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | -14.00 |

| MIDI plc | 0.690 | 0.715 | -3.50 | 2.99 |

| Medserv plc | 1.300 | 1.300 | 0.00 | 13.04 |

| Malta International Airport plc | 7.200 | 7.300 | -1.37 | 24.14 |

| Malita Investments plc | 0.915 | 0.925 | -1.62 | 3.41 |

| Mapfre Middlesea plc | 2.140 | 2.180 | -1.83 | 7.54 |

| Malta Properties Company plc | 0.660 | 0.660 | 0.00 | 15.79 |

| Main Street Complex plc | 0.600 | 0.600 | 0.00 | -7.69 |

| MaltaPost plc | 1.310 | 1.250 | 4.80 | -17.09 |

| PG plc | 1.790 | 1.840 | -2.72 | 34.59 |

| Plaza Centres plc | 1.030 | 1.030 | 0.00 | 0.98 |

| RS2 Software plc | 2.160 | 2.080 | 3.85 | 54.29 |

| Simonds Farsons Cisk plc | 11.500 | 11.500 | 0.00 | 31.43 |

| Santumas Shareholdings plc | 1.400 | 1.400 | 0.00 | -1.41 |

| Tigné Mall plc | 0.905 | 0.905 | 0.00 | -6.22 |

| Trident Estates plc | 1.520 | 1.500 | 1.33 | 1.33 |

This report which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].