MSE Trading Report for Week ending 29 November 2019

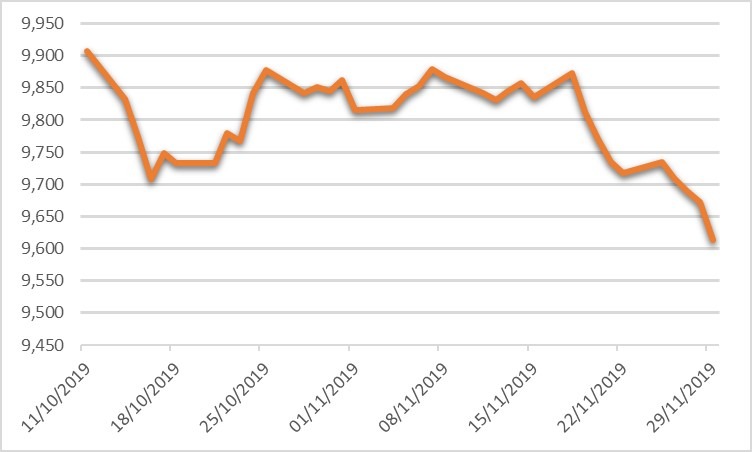

| MSE Equity Total Return Index: |

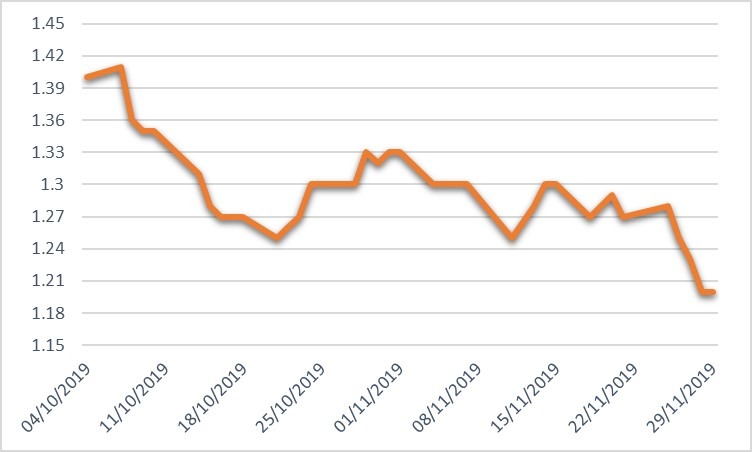

| Chart of the Week: HSBC Bank Malta plc |

| Highlights: |

- The local equities market declined registered a further decline of 1.071% as it ended the week at 9,613.402 points. A total of 13 equities were active, of which only one gained ground while another nine closed in the red. A total weekly turnover of circa €0.7 million was generated over 121 transactions.

- The only equity registering a positive performance was RS2 Software plc as it managed to recoup its previous loss, to close 2.86% higher at €2.16. This was the result of seven deals involving 42,585 shares. This gain further enhanced the positive year-to-date performance, as the equity headed the list of gainers with 54.29% rally.

- Three equities were active in the banking sector. Bank of Valletta plc kicked off the week on a positive note having traded at the €1.10 level. However, the bank lost ground over the week to close 2.75% lower at €1.06. A spread of 111,191 shares changed hands across 31 deals.

- Similarly, HSBC Bank Malta plc headed north last Monday as it closed at €1.28. The bank did not manage to sustain this gain as it ended the week 5.51% lower at €1.20. A total of 19 deals involving 43,799 shares were executed.

- Last Monday, GO plc announced the approval of three transactions to be entered into inter alia with Cablenet Communications Limited, a limited liability company incorporated under the Laws of Cyprus, in which the company holds 51% of the issued share capital.

- The first transaction relates to the loan agreement dated March 28, 2019, whereby company agreed to make available to Cablenet a loan with a maximum amount of €3 million. On November 25, 2019, the parties have amended and restated the terms and conditions of the original agreement, which will come into effect when the issue and allotment of the New Share in terms of the settlement agreement occurs. It was agreed to extend the facility to €7 million and to be repaid by November 25, 2024. In the event of a default, GO plc shall have the right to capitalise any amount owing to it.

- The second transaction relates to the capitalisation of two loans, of which settlement amounts were €15.8 million and €0.8 million, respectively. On November 25, 2019, the parties have agreed to capitalise these debts and hence release Cablenet from any related obligations and liabilities. Following the issue and allotment of the new shares, GO plc will hold 60.26% of the Cablenet’s issued share capital.

- The third transaction is related to the option agreement between the Company and Nicolas Shiacolas, who together with GO plc, are the sole subscribers to the issued share capital of Cablenet, have on the 25 November 2019 entered into an option agreement under which Mr Shiacolas has been given an option to subscribe for additional shares in Cablenet subject to the Option becoming exercisable once the New Shares have been issued and allotted to the Company and provided that such issue and allotment takes place on or prior to December, 31 2019. The Option shall be exercisable commencing on the Effective Date up to and including March 31, 2020. The Option shall permit Mr Shiacolas to subscribe for additional shares in Cablenet up to a maximum of 49% of the issued share capital in Cablenet at any point in time.

- Go plc shares were active over five deals involving 2,875 shares which pushed the price 0.95% lower to €4.18.

- Last Monday, PG plc approved the distribution of a net interim dividend of €2 million, the equivalent of €0.0185185 per ordinary share. The interim dividend shall be paid on December 5, 2019 to ordinary shareholders on the company’s register of members list as at November 25, 2019. The equity registered a 2.78% decline as seven deals involving 9,400 shares were executed.

- Last Tuesday, Malta Properties Company plc (MPC) issued an announcement with respect to the St. Paul’s Bay Old Exchange Deed of Sale. On November 26, 2019, SPB Property Company Limited (SPB), being MPC’s subsidiary, and Vienna Company Limited (VCL), executed the aforementioned final deed of sale. This related to the property which SPB sold and transferred to VCL who accepted and purchased the property. The property has been sold tale quale. As a result, there will be no more rental income from such property since it is no longer in the property portfolio of MPC. Sale proceeds are expected to be utilised for funding MPC’s development projects or any acquisition opportunities. No transactions were recorded last week in MPC.

- The MSE MGS Total Return Index ended the week 0.032% lower at 1,121.168 points. A total of 20 issues were active, of which seven headed north while another 13 closed in the opposite direction. The 2.1% MGS 2039 (I) headed the list of gainers as it ended the week 0.68% higher at €125.35.

- The MSE Corporate Bonds Total Return Index lost ground as it closed 0.984% lower at 1,072.464 points. Out of 41 active issues, seven registered a gain while another 29 ended the week in negative territory. The best performer was the 5% GlobalCapital plc Unsecured € 2021 as it closed 2.62% higher at €0.98.

- In the Prospects MTF market, two issues were active during the week. The 5% Borgo Lifestyle Finance 2026-2029 was the most liquid and ended the week at €100.25.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. RS2 | +2.86% | |||

| 05 DEC 2019 | MT: PG plc – Dividend Payment Date | |||

| 11 DEC 2019 | US: FED – Interest Rate Decision | |||

| 12 DEC 2019 | EU: ECB – Interest Rate Decision | |||

| 19 DEC 2019 | UK: BoE – Interest Rate Decision | Worst Performers: | ||

| 20 DEC 2019 | MT: MaltaPost plc – Annual General Meeting | 1. TRI | -6.78% | |

| 2. HSBC | -5.51% | |||

| 3. PG | -2.78% | |||

| Price (€): 29.11.2019 | Price (€): 22.11.2019 | Weekly Change (%) | Year-to-date Change (%) | |

| MSE Equity Total Return Index | 9,613.402 | 9,717.441 | -1.071 | 6.827 |

| BMIT Technologies plc | 0.510 | 0.520 | -1.92 | 4.082 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.060 | 1.090 | -2.75 | -12.32 |

| FIMBank plc (USD) | 0.625 | 0.625 | 0.00 | -16.67 |

| GlobalCapital plc | 0.280 | 0.280 | 0.00 | -15.66 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | -21.43 |

| GO plc | 4.180 | 4.220 | -0.95 | 5.56 |

| HSBC Bank Malta plc | 1.200 | 1.270 | -5.51 | -34.43 |

| International Hotel Investments plc | 0.800 | 0.800 | 0.00 | 29.03 |

| Lombard Bank plc | 2.260 | 2.260 | 0.00 | -7.38 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | -14.00 |

| MIDI plc | 0.645 | 0.650 | -0.77 | -3.73 |

| Medserv plc | 1.250 | 1.250 | 0.00 | 8.70 |

| Malta International Airport plc | 7.150 | 7.200 | -0.69 | 23.28 |

| Malita Investments plc | 0.900 | 0.915 | -1.64 | 2.27 |

| Mapfre Middlesea plc | 2.140 | 2.140 | 0.00 | 7.54 |

| Malta Properties Company plc | 0.680 | 0.680 | 0.00 | 19.30 |

| Main Street Complex plc | 0.600 | 0.600 | 0.00 | -7.69 |

| MaltaPost plc | 1.310 | 1.310 | 0.00 | -17.09 |

| PG plc | 1.750 | 1.800 | -2.78 | 31.58 |

| Plaza Centres plc | 1.020 | 1.020 | 0.00 | 0.00 |

| RS2 Software plc | 2.160 | 2.100 | 2.86 | 54.29 |

| Simonds Farsons Cisk plc | 11.500 | 11.500 | 0.00 | 31.43 |

| Santumas Shareholdings plc | 1.400 | 1.400 | 0.00 | -1.41 |

| Tigné Mall plc | 0.900 | 0.900 | 0.00 | -6.74 |

| Trident Estates plc | 1.650 | 1.77 | -6.78 | 10.00 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi is a non-executive director of Hili Ventures Limited, which has a controlling interest in Harvest Technology plc. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].