MSE Trading Report for Week ending 12 December 2019

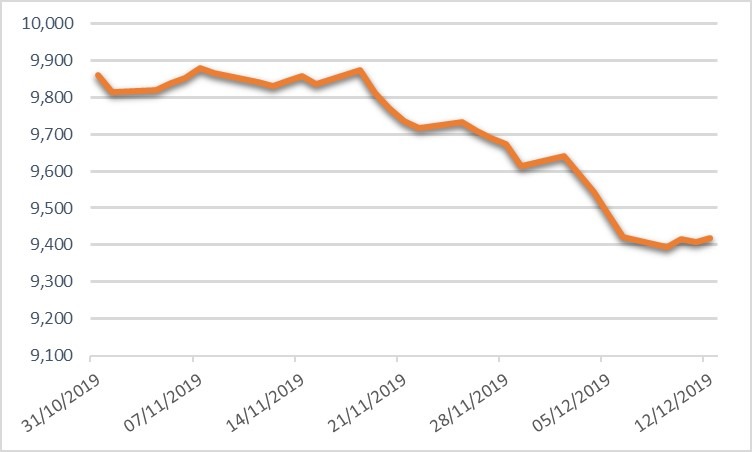

| MSE Equity Total Return Index: |

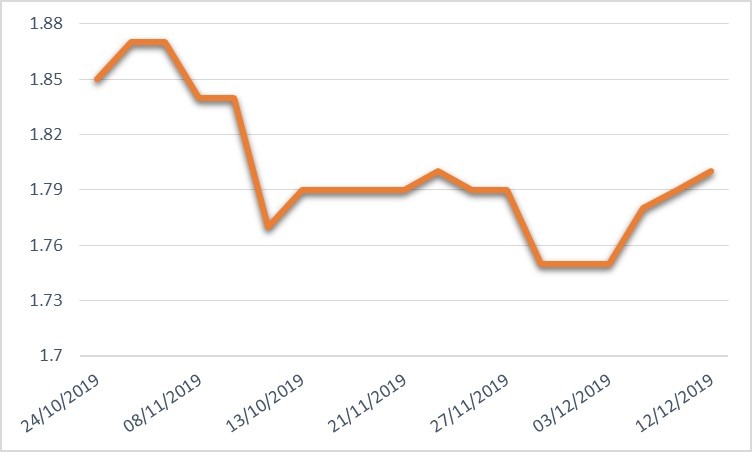

| Chart of the Week: PG plc |

| Highlights: |

- The local equities market ended the week almost unchanged, as large caps moved in opposite directions, to close at 9,420.014 points. A total of 13 equities were active, of which four registered gains while another three closed in the red. Low activity was recorded during the week, as a total of 96 transactions generated a total weekly turnover of around €0.5 million.

- The highest liquidity was registered by Bank of Valletta plc, as it generated a total weekly turnover of €203,672. The bank reached another 10-year low of €1.02 last Monday but gained ground during the week. The equity closed the week at €1.04, translating into a 0.95% decline, as 197,567 shares changed hands over 40 deals.

- Last Tuesday, BOV announced that its US Dollar clearing provider has extended its service to March 31, 2020. For continuity purposes, the bank is close to reaching its final arrangements with other service providers.

- Malta International Airport plc, closed in negative territory. The share price declined by a further 1.43% to €6.90, as 7,436 shares changed hands over seven transactions.

- The best performer was RS2 Software plc, as five deals involving 18,089 shares pushed the price 2.88% higher to €2.14.

- Last Wednesday, International Hotel Investments plc announced that, in line with the prospectus dated March 4, 2019, the €20 million 4% International Hotel Investments plc Unsecured Bonds 2026 shall be merged with the €40 million 4% Unsecured Bonds 2026, whereby trading in the former bond shall be suspended as from December 17, 2019. The merge will take place after the first interest payment, December 20, 2019 and thereafter, the two bonds shall be considered as one security.The company issued another announcement last Wednesday with respect to the Azure Services Limited restructuring.

- The equity traded three times over a spread of 20,000 shares. As a result, price was up by 1.32%, to end the week at €0.765.

- Four equities were active in the property sector, where only one registered a change in price. Santumas Shareholdings plc announced that the board shall meet on December 23, 2019 to consider and approve its interim financial statements for the half-year period ending October 31, 2019. The equity was only active last Monday, trading once on slim volume. This resulted in a 0.71% increase to €1.41 – a price it sustained during the short week.

- The MSE MGS Total Return Index registered a 0.368% decline, as it ended the week at 1,136.10 points. Out of 22 active issues, four advanced while another 17 traded lower. The best performance was registered by the 2.2% MGS 2035 (I), as it closed 0.54% higher at €122.30. On the other hand, the 4.1% MGS 2034 (I) registered the largest decline of 1.82%, to close the week at €148.70.

- The MSE Corporate Bonds Total Return Index lost ground, as it closed 0.111% lower at 1,073.44 points. A total of 38 issues were active, 10 of which headed north while another 13 closed in the opposite direction. The 3.75% Mercury Projects Finance plc Secured 2027 headed the list of gainers with a 3.59% increase to €100.50. Conversely, the 3.75% Premier Capital plc Unsecured € 2026 declined by 1.78%, ending the week at €102.

- In the Prospects MTF market, only the 5.5% IG Finance plc € Unsecured 2024-2027 was active, trading twice over a volume of 9,000. The bond closed at €101.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. RS2 | +2.88% | |||

| 2. IHI | +1.32% | |||

| 18 DEC 2019 | MT: PG plc – Annual General Meeting | 3. PG | +1.12% | |

| 19 DEC 2019 | UK: BoE – Interest Rate Decision | |||

| 20 DEC 2019 | MT: MaltaPost plc – Annual General Meeting | Worst Performers: | ||

| 1. HSBC | -1.67% | |||

| 2. MIA | -1.43% | |||

| 3. BOV | -0.95% | |||

| Price (€): 06.12.2019 | Price (€): 06.12.2019 | Weekly Change (%) | Year-to-date Change (%) | |

| MSE Equity Total Return Index | 9,420.014 | 9,422.439 | -0.026 | 4.678 |

| BMIT Technologies plc | 0.510 | 0.510 | 0.00 | 4.082 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.040 | 1.050 | -0.95 | -13.98 |

| FIMBank plc (USD) | 0.640 | 0.640 | 0.00 | -14.67 |

| GlobalCapital plc | 0.280 | 0.280 | 0.00 | -15.66 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | -21.43 |

| GO plc | 4.140 | 4.140 | 0.00 | 4.55 |

| HSBC Bank Malta plc | 1.180 | 1.200 | -1.67 | -35.52 |

| International Hotel Investments plc | 0.765 | 0.755 | 1.32 | 23.39 |

| Lombard Bank plc | 2.260 | 2.260 | 0.00 | -7.38 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | -14.00 |

| MIDI plc | 0.515 | 0.515 | 0.00 | -23.13 |

| Medserv plc | 1.100 | 1.100 | 0.00 | -4.35 |

| Malta International Airport plc | 6.900 | 7.000 | -1.43 | 18.97 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 2.27 |

| Mapfre Middlesea plc | 2.140 | 2.140 | 0.00 | 7.54 |

| Malta Properties Company plc | 0.650 | 0.650 | 0.00 | 14.04 |

| Main Street Complex plc | 0.600 | 0.600 | 0.00 | -7.69 |

| MaltaPost plc | 1.310 | 1.310 | 0.00 | -17.09 |

| PG plc | 1.800 | 1.780 | 1.12 | 35.34 |

| Plaza Centres plc | 1.010 | 1.010 | 0.00 | -0.98 |

| RS2 Software plc | 2.140 | 2.080 | 2.88 | 52.86 |

| Simonds Farsons Cisk plc | 11.500 | 11.500 | 0.00 | 31.43 |

| Santumas Shareholdings plc | 1.410 | 1.400 | 0.71 | -0.70 |

| Tigné Mall plc | 0.900 | 0.900 | 0.00 | -6.74 |

| Trident Estates plc | 1.650 | 1.650 | 0.00 | 10.00 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].