MSE Trading Report for Week ending 24 January 2020

| MSE Equity Total Return Index: |

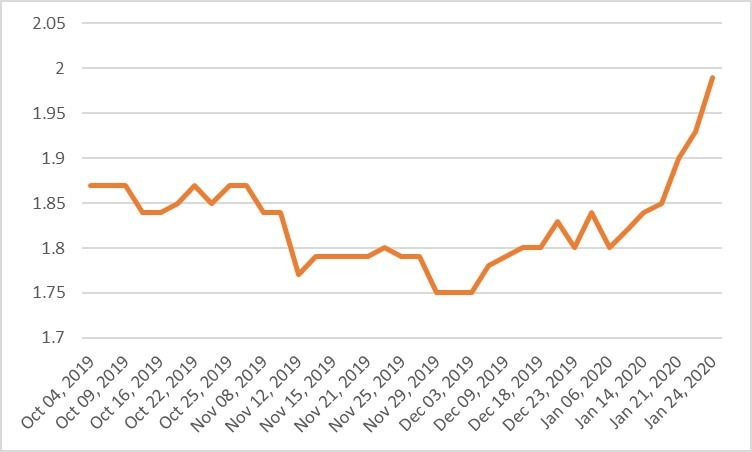

| Chart of the Week: PG plc |

| Highlights: |

- The MSE Equity Total Return Index was back in the red as it ended the week 0.579% down, at 9,469.298 points. A total of 19 equities were active, out of which four traded higher while another nine declined. A total turnover of €1.86 million was generated across 172 transactions.

- In the banking industry, three equities were active. FIMBank plc headed the list of fallers within the industry and overall market alike, as six deals involving a total of 107,572 shares dragged the price 4.76% lower, to close at $0.60.

- Similarly, Bank of Valletta plc (BOV) and HSBC Bank Malta plc also closed on the negative part of the spectrum. The former traded between a high of €1.10 and a low of €1.06, to then close 1.38% down at €1.075, while the latter roamed between the €1.12 and €1.07 price limits, and subsequently closed at €1.08 – a 3.57% decline. Turnover in HSBC was almost half that of BOV, as 21 deals worth a total of €78,335 were recorded. On the other hand, BOV featured in 29 trades worth a total of €142,417.

- Retail conglomerate PG plc was by far the most liquid equity, as 34 trades worth a total of €1.04 million pushed the price 7.57% higher, to close at €1.99. On the other hand, property company Trident Estates plc registered the best weekly performance despite trading only once on a turnover of less than €5,000. The equity appreciated by 14.19%, to close at €1.77.

- Malta International Airport plc was active over 22 deals involving 20,445 shares, resulting into a 1.45% loss, to close at €6.80. International Hotel Investments plc was another equity to close in the red, as two trades worth just less than a combined €12,000 resulted in a 0.61% drop in price to close the week at €0.81.

- The MSE Corporate Bonds Total Return Index recouped some lost ground as a 0.074% appreciation was registered, to close at 1,081.041 points. A total of 48 issues were active of which 16 headed north, while another 14 closed in the opposite direction. The 6% International Hotel Investments plc € 2024 headed the list of gainers, as it closed 1.44% higher at €105.50. On the contrary, the 3.75% Tumas Investments plc Unsecured € 2027 declined by 1.45%, to close at €101.01.

- On the Sovereign debt front, the MSE MGS Total Return Index rose by 0.74% to 1,120.314 points. Out of 20 active issues, all but five registered gains – reflecting the broader European bond market, as yields continued to head south. Such trajectory was further exacerbated last Thursday following a new policy review launched by the European Central Bank (ECB) at its first policy meeting for 2020. Apart from being the most liquid issue, the 2.1% MGS 2039 (I) registered an exceptionally positive performance, as it closed 7% higher at €130. On the other hand, the 3% MGS 2040 (I) lost 0.36%, as it closed the week at €138.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. TRI | +14.19% | |||

| 29 JAN 2019 | US: FED – Interest Rate Decision | 2. PG | +7.57% | |

| 30 JAN 2019 | UK: BoE – Interest Rate Decision | 3. MPC | +4.62% | |

| 18 FEB 2019 | MT: HSBC Bank Malta plc – Results | |||

| 26 FEB 2019 | MT: Malta International AIrport plc – Results | Worst Performers: | ||

| 12 MAR 2019 | MT: Mapfre Middlesea plc – Results | 1. MDI | -6.00% | |

| 2. FIM | -4.76% | |||

| 3. MLT | -4.26% | |||

| Price (€): 24.01.2020 | Price (€): 17.01.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 9,469.298 | 9,524.417 | -0.579 | -1.523 |

| BMIT Technologies plc | 0.520 | 0.525 | -0.95 | 0.00 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.075 | 1.090 | -1.38 | 1.415 |

| FIMBank plc (USD) | 0.600 | 0.630 | -4.76 | 0.00 |

| GlobalCapital plc | 0.300 | 0.300 | 0.00 | 7.14 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | 0.00 |

| GO plc | 4.160 | 4.160 | 0.00 | -2.35 |

| Harvest Technology plc | 1.500 | 1.500 | 0.00 | 0.00 |

| HSBC Bank Malta plc | 1.080 | 1.120 | -3.57 | -16.92 |

| International Hotel Investments plc | 0.810 | 0.815 | -0.61 | -2.41 |

| Lombard Bank plc | 2.180 | 2.180 | 0.00 | -4.39 |

| Loqus Holdings plc | 0.066 | 0.066 | 0.00 | 1.55 |

| MIDI plc | 0.470 | 0.500 | -6.00 | -12.96 |

| Medserv plc | 1.100 | 1.100 | 0.00 | 0.00 |

| Malta International Airport plc | 6.800 | 6.900 | -1.45 | -1.45 |

| Malita Investments plc | 0.900 | 0.940 | -4.26 | 0.00 |

| Mapfre Middlesea plc | 2.200 | 2.200 | 0.00 | 1.85 |

| Malta Properties Company plc | 0.680 | 0.650 | 4.62 | 7.94 |

| Main Street Complex plc | 0.550 | 0.550 | 0.00 | -8.33 |

| MaltaPost plc | 1.350 | 1.350 | 0.00 | 3.05 |

| PG plc | 1.990 | 1.850 | 7.57 | 8.15 |

| Plaza Centres plc | 1.010 | 1.010 | 0.00 | 0.00 |

| RS2 Software plc | 2.300 | 2.280 | 0.88 | 7.48 |

| Simonds Farsons Cisk plc | 10.900 | 11.000 | -0.91 | -5.22 |

| Santumas Shareholdings plc | 1.410 | 1.410 | 0.00 | 0.00 |

| Tigné Mall plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Trident Estates plc | 1.770 | 1.550 | 14.19 | 14.19 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].