MSE Trading Report for Week ending 07 February 2020

| MSE Equity Total Return Index: |

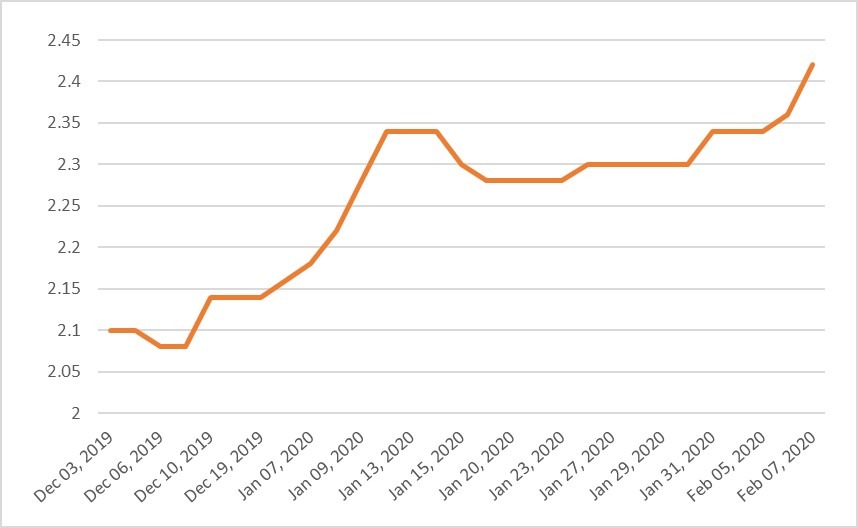

| Chart of the Week: RS2 Software plc |

| Highlights: |

- The MSE Equity Total Return Index ended the week 0.29% higher at 9,532.111 points. Out of 18 active equities, six headed north while another seven closed in the opposite direction. A total weekly turnover of €1.2 million was generated, as 156 transactions were executed.

- In the banking industry, Bank of Valletta plc, closed unchanged at €1.08 after having traded 28 times involving 123,278 shares.

- Its peer, HSBC Bank Malta plc reached an intra-week high of €1.08, to then close 0.95% lower at €1.04. A total of 308,700 shares changed ownership over 44 deals.

- Last Tuesday, FIMBank plc announced that the board shall meet on March 10, 2020 to consider, and if deemed fit, approve the group’s and bank’s audited accounts for the financial year ended December 31, 2019. The board shall also consider a dividend declaration, if any, to be recommended to the AGM of shareholders. The bank traded twice last Thursday over a spread of 75,806 shares. As a result, the price declined by 3.33% to $0.58.

- Last Friday, Malta International Airport plc announced its January traffic results. The airport started off the year on a good note as traffic has grown by 14.2%, exceeding the 400,000-passenger mark for the first time. Total number of passengers amounted to 418,096, which is comparable to the number of passengers during the peak summer month of ten years ago. Seat capacity registered an 11.3% increase, while seat load factor advanced by 1.8%. January saw Italy top the airport’s list of drivers of passenger traffic again after 11 months. This market was followed by France, Spain, and the United Kingdom. Growth in the French market is partly due to the fact that the Lyon and Nantes routes are being operated in the winter months for the first time.

- The equity gained 0.72% during the week, as 6,083 shares changed hands over 13 transactions. The equity closed at €6.95.

- Last Thursday, RS2 Software plc announced a partnership agreement with MoviiRed, one of the leading digital challenger banks in Colombia, to offer direct issuing and acquiring services to consumers and merchants. The aim of this agreement is to change the payment system in Colombia. RS2 will enable consumers to pay using a single digital platform, which will result into a more time-efficient service and at the lowest possible cost. Colombia is one of the company’s target, together with the European and Northern American markets. According to the partners, Colombia has a lot of future growth potential, as so far, only about 8% of merchants accept card payments. The partners expect to register exponential growth in its direct acquiring and issuing business, having already built a strong base of 60,000 POS terminals, serving 15 million client transactions per month.

- The equity registered a 3.42% increase, as it closed the week at €2.42. This was the outcome of 15 deals involving 74,049 shares.

- The MSE Corporate Bonds Total Return Index ended the week 0.069% higher as it reached 1,082.07 points. Out of 38 active issues, 22 registered gains while eight closed in the red. The best performer was the 5.8% International Hotel Investments plc 2023 issue as it closed 4.32% higher at €108.50. Conversely, the 5.1% 6PM Holdings plc Unsecured € 2025 bond declined by 1.59%, to close the week at €102.00.

- The MSE MGS Total Return Index registered just over a 1% decline, as it closed at 1,131.09 points – mirroring the broader European sovereign debt front as investors turned back onto a risk-on mode following hopes of cure for coronavirus A total of 18 issues were active, of which three headed north while 15 lost ground. The 2.1% MGS 2039 (I) advanced by 0.64%, to close at €125.00. On the other hand, the 5.25% MGS 2030 (I) traded 6.13% lower, closing the week at €150.20.

- In the Prospects MTF market, six issues were active. The 5.25% Klikk Finance plc € Unsecured 2027 registered the highest liquidity of €18,000 as it traded at par.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. LOM | +4.59% | |||

| 18 FEB 2019 | MT: HSBC Bank Malta plc – Results | 2. RS2 | +3.42% | |

| 26 FEB 2019 | MT: Malta International AIrport plc – Results | 3. SFC | +0.92% | |

| 11 MAR 2019 | MT: Mailta Investments plc – Results | |||

| 12 MAR 2019 | EU: ECB – Monetary Policy Meeting | Worst Performers: | ||

| 12 MAR 2019 | MT: Mapfre Middlesea plc – Results | 1. GCL | -6.67% | |

| 2. FIM | -3.33% | |||

| 3. BMIT | -1.92% | |||

| Price (€): 07.02.2020 | Price (€): 31.01.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 9,532.111 | 9,504.238 | 0.293 | -0.869 |

| BMIT Technologies plc | 0.510 | 0.520 | -1.92 | -1.923 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.080 | 1.080 | 0.00 | 1.887 |

| FIMBank plc (USD) | 0.580 | 0.600 | -3.33 | -3.33 |

| GlobalCapital plc | 0.280 | 0.300 | -6.67 | 0.00 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | 0.00 |

| GO plc | 4.140 | 4.140 | 0.00 | -2.82 |

| Harvest Technology plc | 1.480 | 1.500 | -1.33 | -1.33 |

| HSBC Bank Malta plc | 1.040 | 1.050 | -0.95 | -20.00 |

| International Hotel Investments plc | 0.815 | 0.810 | 0.62 | -1.81 |

| Lombard Bank plc | 2.280 | 2.180 | 4.59 | 0.00 |

| Loqus Holdings plc | 0.066 | 0.066 | 0.00 | 1.55 |

| MIDI plc | 0.470 | 0.470 | 0.00 | -12.96 |

| Medserv plc | 1.090 | 1.090 | 0.00 | -0.91 |

| Malta International Airport plc | 6.850 | 6.900 | 0.72 | 0.72 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Mapfre Middlesea plc | 2.340 | 2.320 | 0.86 | 8.33 |

| Malta Properties Company plc | 0.655 | 0.655 | 0.00 | 3.97 |

| Main Street Complex plc | 0.580 | 0.580 | 0.00 | -3.33 |

| MaltaPost plc | 1.340 | 1.340 | 0.00 | 2.29 |

| PG plc | 2.000 | 2.020 | -0.99 | 8.70 |

| Plaza Centres plc | 1.010 | 1.010 | 0.00 | 0.00 |

| RS2 Software plc | 2.420 | 2.340 | 3.42 | 13.08 |

| Simonds Farsons Cisk plc | 11.000 | 10.900 | 0.92 | -4.35 |

| Santumas Shareholdings plc | 1.400 | 1.410 | -0.71 | -0.71 |

| Tigné Mall plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Trident Estates plc | 1.770 | 1.770 | 0.00 | 14.19 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].