MSE Trading Report for Week ending 21 February 2020

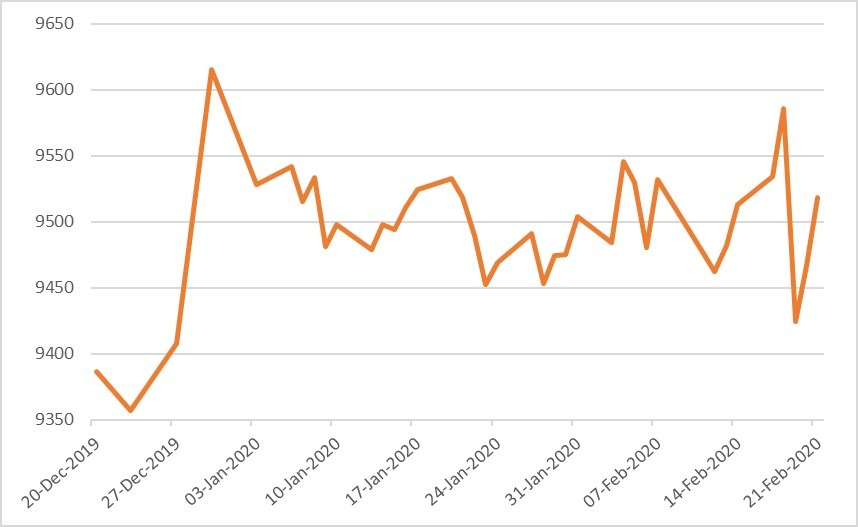

| MSE Equity Total Return Index: |

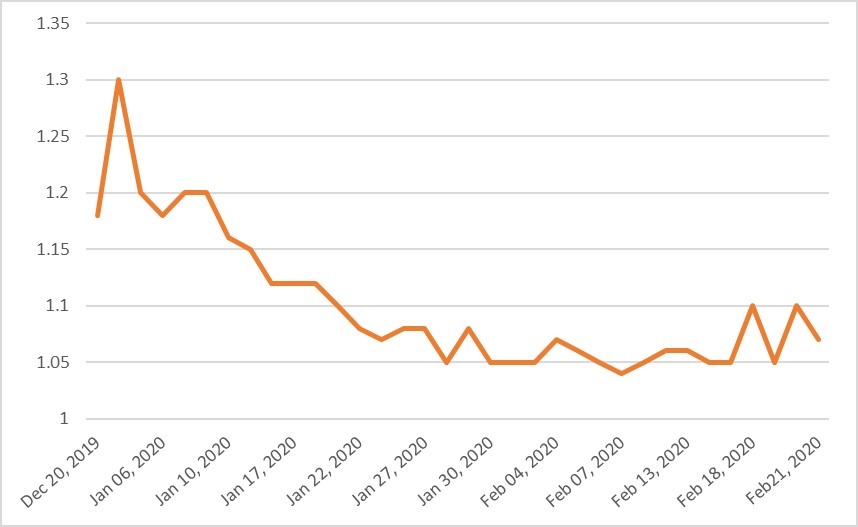

| Chart of the Week: HSBC Bank Malta plc |

| Highlights: |

- The MSE Equity Total Return Index registered a marginal increase of 0.05% as it ended the week at 9,518.124 points. A total of 23 equities were active, out of which 10 traded higher while another nine closed in the red. A total weekly turnover of over €1.7 million was generated over 236 transactions.

- HSBC Bank Malta plc was the most active equity as €444,366 were traded over 53 deals. The equity closed the week with a 1.9% gain as it closed at €1.07 after having fluctuated between a weekly low of €1.05 and a high of €1.14. Last Tuesday, the bank held a meeting during which the preliminary statements of annual results, for the year ended December 31, 2019, were approved. Adjusted profits exceeded management expectations as it stood at €45.3 million, translating into a 24% increase from the previous year, mainly due to the continued focus on cost reduction and credit quality. If the impact of a one-off restructuring provision is taken in to account, pre-tax profit amounts to €30.7m. That is, a 20% decrease or €7.8m over the previous year.

- Reported profit attributable to shareholders amounted to €20.2 million as earnings per share stood at 5.6 cents per share versus an 8.0 cents during the same period last year. Moreover, the bank’s net interest income advanced by 1% to €110.1 million, when compared to 2018. Net trading income has also increased by €1.8 million as a result of a fair value gain on VISA shares. Meanwhile net non-interest income marginally declined with strong fee performance within commercial banking. This was due to the new fees offset by a reduction in fee income within insurance due to the disposal of a specific insurance portfolio in December 2018. Net loans and advances to customers increased by 5% to €3,257m while deposits grew by 2% to €4,977m.

- The bank’s capital ratios registered a positive performance as CET1 increased to 16.4%, in line with its strong capital base and compliance with the regulatory capital requirements. This increase was also driven by a €13 million net dividend paid from the insurance subsidiary. Total dividend for 2019 adds up to 3.8 cents as the final gross dividend will be 2.1 cents per share (gross of tax), together with the gross interim dividend of 1.7 cents per shares paid in September 2019. The final dividend shall be paid on April 15, 2020 to all shareholders listed on the bank’s register as at March 9, 2020.

- Meanwhile, Bank of Valletta plc was active over 42 deals with a spread of 200,762 shares. The bank lost 0.94% as it ended the week at €1.05. On Friday, the Bank announced that the next Annual General Meeting (AGM) shall be held on May 15, 2020.

- Telecommunications company, GO plc traded 0.48% lower on Wednesday as seven deals involving 29,768 shares were executed. The loss was erased on Friday as 8,442 shares were traded over two transactions. As a result, the equity closed unchanged at €4.20. Its subsidiary, BMIT Technologies plc, was up by 0.96% as it closed the week at €0.525. A total of 100,050 shares changed ownership over 10 deals.

- Global payments software and managed services provider, RS2 Software plc, registered 3.28% rise. The equity closed at an all-time-high price of €2.52, as 26 deals involving 66,553 shares were executed. Yesterday, the equity also reached an intra-day high price of €2.56.

- Malta International Airport plc kicked off the week on a positive note, as it reached the €7.00 price level. However, the gain was erased until end of week as it closed at €6.90. A total of 29 transactions with a mix of 37,526 shares were executed.

- Malta Properties Company plc (MPC) lost 0.75% to close at €0.665. Six deals involving 43,076 were executed. On Wednesday, the board announced that the annual report and consolidated financial statements for the year ended December 31, 2019 were approved. These shall be submitted for the approval of the shareholders during the next AGM, which will be held on May 27, 2020.

- The Group’s revenue was up by 3.5% from the previous year as it amounted to €3.43 million. Meanwhile, its operating profit has declined by 6.6% as it stood at €2.12 million. During 2019, the company continued to seek investment opportunities. Profit before tax decreased by €9.16 million from the previous year, as it reached €3.62 million. This is mainly due to a lower fair valuation gain as well as a lower gain on disposal. In 2018, the promise of sale agreement for the St George’s Exchange and the sale of the old Sliema Exchange positively impacted the company’s annual results. However, the Group’s revenue is secured by the long-term leases with several tenants while revenues are expected to increase in line with inflation and with rents from new developments.

- MPC’s financial position is still strong. Its total non-current assets have increased by 4.56%, as it stood at €76.74 million while current assets were down by 18.6% since the previous year, as it amounted to €7.44 million. The main movements relating to the cash conversion of inventories sold were partly set-off by the dividend payment made during the year 2019. Moreover, the company is still relatively unleveraged with a gearing ratio of 0.39 and a loan to value rate of 0.27. A final net dividend of €0.01 per share, shall be recommended for approval at the AGM. The payment of this net dividend, which sums up to over €1 million, will be paid on June 1, 2020 to all shareholders on the register as at April 28, 2020.

- Yesterday, the directors of Loqus Holdings plc approved the half-yearly report for the six months ended December 31, 2019. The company recorded a positive 121% change in profit before tax, as it ended the year at a profit of €23,074 versus the loss of over €110,000 in the previous year. This results into a 0c7 profit per share. The equity traded once on slim volume last Monday, closing 2.56% higher at €0.08.

- In the Corporate Bonds market, 42 issues were active, of which 22 headed north while another seven closed in the opposite direction. The 5.8% International Hotel Investments plc 2021 headed the list of gainers as it closed at €104.40 – translating into a 2.45% increase in price. On the other hand, the 5% Global Capital plc Unsecured € 2021 closed 1% lower at €98.00.

- In the sovereign debt market 19 issues were active – 14 advanced while another four lost ground. The 3% MGS 2040 (I) registered the best performance with a 1.25% increase to €142.95. Conversely, the 2.4% MGS 2041 (I) traded 0.49% lower at €130.00.

- In the Prospects MTF market, seven issues were active, as the 5.35% D Shopping Malls Finance plc € Unsecured 2028 traded higher and closed at €99.35.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. STS | +7.14% | |||

| 26 FEB 2019 | MT: Malta International Airport plc – Results | 2. RS2 | +3.28% | |

| 26 FEB 2019 | MT: MaltaPost plc – Results | 3. MDI | +2.94% | |

| 10 MAR 2019 | MT: FIMBank plc – Results | |||

| 11 MAR 2019 | MT: Malita Investments plc – Results | Worst Performers: | ||

| 12 MAR 2019 | MT: Mapfre Middlesea plc – Results | 1. GHM | -15.23% | |

| 2. MDS | -5.50% | |||

| 3. LOM | -5.26% | |||

| Price (€): 21.02.2020 | Price (€): 14.02.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 9,518.124 | 9,513.432 | 0.049 | -1.015 |

| BMIT Technologies plc | 0.525 | 0.520 | 0.96 | 0.962 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.050 | 1.060 | -0.94 | -0.943 |

| FIMBank plc (USD) | 0.580 | 0.580 | 0.00 | -3.33 |

| GlobalCapital plc | 0.290 | 0.290 | 0.00 | 3.57 |

| Grand Harbour Marina plc | 0.462 | 0.545 | -15.23 | -16.00 |

| GO plc | 4.200 | 4.200 | 0.00 | -1.41 |

| Harvest Technology plc* | 1.500 | 1.480 | 1.34 | 0.00 |

| HSBC Bank Malta plc | 1.070 | 1.050 | 1.90 | -17.69 |

| International Hotel Investments plc | 0.800 | 0.800 | 0.00 | -3.61 |

| Lombard Bank plc | 2.160 | 2.280 | -5.26 | -5.26 |

| Loqus Holdings plc | 0.080 | 0.078 | 2.56 | 24.03 |

| MIDI plc | 0.490 | 0.476 | 2.94 | -9.26 |

| Medserv plc | 1.030 | 1.090 | -5.50 | -6.36 |

| Malta International Airport plc | 6.900 | 6.950 | -0.72 | 0.00 |

| Malita Investments plc | 0.890 | 0.890 | 0.00 | -1.11 |

| Mapfre Middlesea plc | 2.280 | 2.360 | -3.39 | 5.56 |

| Malta Properties Company plc | 0.665 | 0.670 | -0.75 | 5.56 |

| Main Street Complex plc | 0.570 | 0.570 | 0.00 | -5.00 |

| MaltaPost plc | 1.300 | 1.340 | -2.99 | -0.76 |

| PG plc | 2.000 | 1.970 | 1.52 | 8.70 |

| Plaza Centres plc | 1.030 | 1.010 | 1.98 | 1.98 |

| RS2 Software plc | 2.520 | 2.440 | 3.28 | 17.76 |

| Simonds Farsons Cisk plc | 11.000 | 11.000 | 0.00 | -4.35 |

| Santumas Shareholdings plc | 1.500 | 1.400 | 7.14 | 6.38 |

| Tigné Mall plc | 0.880 | 0.900 | -2.22 | -2.22 |

| Trident Estates plc | 1.680 | 1.650 | 1.82 | 8.39 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].