MSE Trading Report for Week ending 28 February 2020

| MSE Equity Total Return Index: |

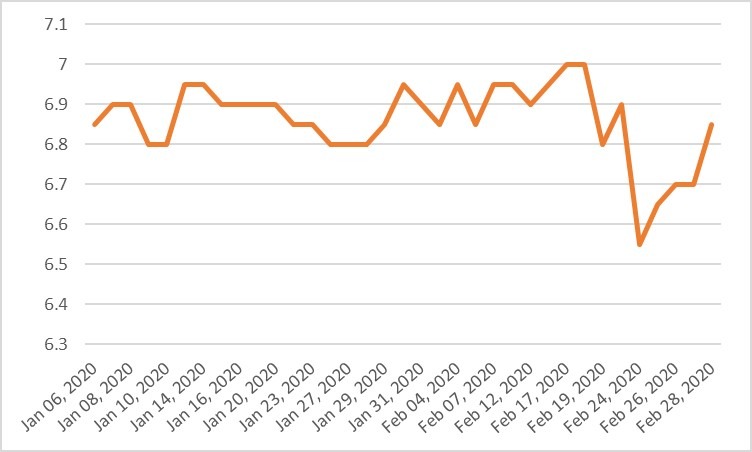

| Chart of the Week: Malta International Airport plc |

| Highlights: |

- As global equity indices experienced a correction, this week the MSE Equity Total Return Index fell a marginal 0.78% closing at 9,443.594 points as global equity markets experienced their worst week since 2008. A total of 20 equities were active, of which six headed north while another 10 closed in the opposite direction. Nearly €1.8 million were traded across 267 deals. The index ended the month of February down by a minimal 0.64%, while the Euro Stoxx 50 fell by just over 8%.

- On Monday, Malta International Airport plc announced the financial results for 2019 in which they reported a profit before tax of €62.6 million, translating into an 11.7% growth when compared to €47.1 million recorded in 2018.

- The company’s revenue also increased by €8 million as both aviation and non-aviation activities generated a total revenue of €100.2 million, translating into an 8.7% increase from the previous year. In 2019, 20 new routes were introduced while MIA reached a new record of over 7.3 million passenger movements and solid results were posted from the retail and property segment. Earnings before Interest Tax Depreciation and Amortisation (EBITDA) increased by 16%, having reached €63.2 million until end of 2019 while the EBTIDA margin was up from 59% to 63%.

- In addition to the net interim dividends paid of over €4 million, the board recommended a final net dividend of €0.10 per share, for shareholders on the register as at April 13, 2020. Dividends shall be paid on May 27, 2020 if approved at the Annual General Meeting (AGM).

- The share price of MIA reached a 10-month low of €6.55 on Monday but managed to recoup part of the loss as it ended the week at €6.85. This translated into a weekly decline of 0.72%, as a result of 52 deals involving 48,490 shares.

- In the banking industry, HSBC Bank Malta plc registered the highest liquidity for the week, as it generated a total turnover of €404,041. A total of 382,639 shares changed hands over 34 transactions, dragging the price 1.87% lower to €1.05 after having traded at a weekly high of €1.08

- Its peer, Bank of Valletta plc, closed flat all week at €1.05 after having traded at a weekly low of €1.04. The bank traded 24 times over a spread of 65,633 shares.

- On Wednesday, MaltaPost plc held its AGM. The company’s audited financial statements for the year ended September 30, 2019, were approved. Moreover, a final ordinary net dividend of €0.04 per nominal €0.25 share was declared, translating into a net cash payment of over €1.5 million. The equity was active on Friday as three deals involving 5,500 shares pulled the equity 1.54% in the red, to close at €1.28.

- On Thursday, Grand Harbour Marina plc announced that its custodian and trustee, HSBC Bank Malta plc, disposed of its entire 1,397,216 shares, on behalf of its clients, carrying voting rights held in the company. This represents an aggregate 6.98% of the total issued share capital of the company carrying voting rights. As a result, HSBC disposed of its entire shareholding in the company. The equity headed the list of gainers with a 19.05% rise in price, reaching the €0.55 price level. A total of 121,658 shares changed ownership over two transactions.

- In the Corporate Bonds market, the MSE Corporate Bonds Total Returns Index registered a decline of 0.033% as it closed at 1,090.10 points. A total of 42 issues were active, of which 17 traded higher while 13 closed in negative territory. The 3.75% AX Group plc Unsecured 2029 S2 traded 1.51% lower at €104.50 while the 4% International Hotel Investments plc Unsecured 2026 gained nearly 100 basis points

- In the Sovereign Debt market, the MSE MGS Total Return Index advanced by 0.075%, reaching 1,134.96 points. Out of 20 active issues, five registered gains while another 15 lost ground. The 2.4% MGS 2041 (I) headed the list of gainers as it closed 1.74% higher at €132.26. On the other hand, the 5% MGS 2021 (I) lost 0.61%, ending the week at €107.00.

- In the Prospects MTF market, 11 issues were active. The 5% The Convenience Shop Holding plc Unsecured Callable €2026-2029 was the most liquid as total turnover stood at €35,400 as it closed at €100.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. GHM | +19.05% | |||

| 2. BMIT | +2.86% | |||

| 10 MAR 2019 | MT: FIMBank plc – Results | 3. LOM | +2.78% | |

| 11 MAR 2019 | MT: Malita Investments plc – Results | |||

| 12 MAR 2019 | MT: Mapfre Middlesea plc – Results | Worst Performers: | ||

| 1. GCL | -25.52% | |||

| 2. TRI | -6.55% | |||

| 3. IHI | -3.75% | |||

| Price (€): 28.02.2020 | Price (€): 21.02.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 9,443.594 | 9,518.124 | -0.783 | -1.790 |

| BMIT Technologies plc | 0.540 | 0.525 | 2.86 | 3.486 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.050 | 1.050 | 0.00 | -0.943 |

| FIMBank plc (USD) | 0.580 | 0.580 | 0.00 | -3.33 |

| GlobalCapital plc | 0.216 | 0.290 | -25.52 | -22.86 |

| Grand Harbour Marina plc | 0.550 | 0.462 | 19.05 | 0.00 |

| GO plc | 4.240 | 4.200 | 0.95 | -0.47 |

| Harvest Technology plc* | 1.500 | 1.500 | 0.00 | 0.00 |

| HSBC Bank Malta plc | 1.050 | 1.070 | -1.87 | -19.23 |

| International Hotel Investments plc | 0.770 | 0.800 | -3.75 | -7.23 |

| Lombard Bank plc | 2.220 | 2.160 | 2.78 | -2.63 |

| Loqus Holdings plc | 0.080 | 0.080 | 0.00 | 24.03 |

| MIDI plc | 0.480 | 0.490 | -2.04 | -11.11 |

| Medserv plc | 1.030 | 1.030 | 0.00 | -6.36 |

| Malta International Airport plc | 6.850 | 6.900 | -0.72 | -0.72 |

| Malita Investments plc | 0.890 | 0.890 | 0.00 | -1.11 |

| Mapfre Middlesea plc | 2.340 | 2.280 | 2.63 | 8.33 |

| Malta Properties Company plc | 0.670 | 0.665 | 0.75 | 6.35 |

| Main Street Complex plc | 0.570 | 0.570 | 0.00 | -5.00 |

| MaltaPost plc | 1.280 | 1.300 | -1.54 | -2.29 |

| PG plc | 1.960 | 2.000 | -2.00 | 6.52 |

| Plaza Centres plc | 1.030 | 1.030 | 0.00 | 1.98 |

| RS2 Software plc | 2.480 | 2.520 | -1.59 | 15.89 |

| Simonds Farsons Cisk plc | 10.900 | 11.000 | -0.91 | -5.22 |

| Santumas Shareholdings plc | 1.500 | 1.500 | 0.00 | 6.38 |

| Tigné Mall plc | 0.880 | 0.880 | 0.00 | -2.22 |

| Trident Estates plc | 1.570 | 1.680 | -6.55 | 1.29 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].