MSE Trading Report for Week ending 20 March 2020

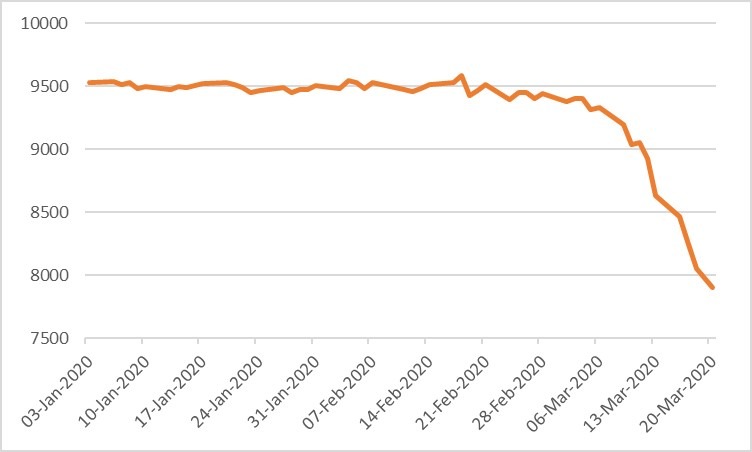

| MSE Equity Total Return Index: |

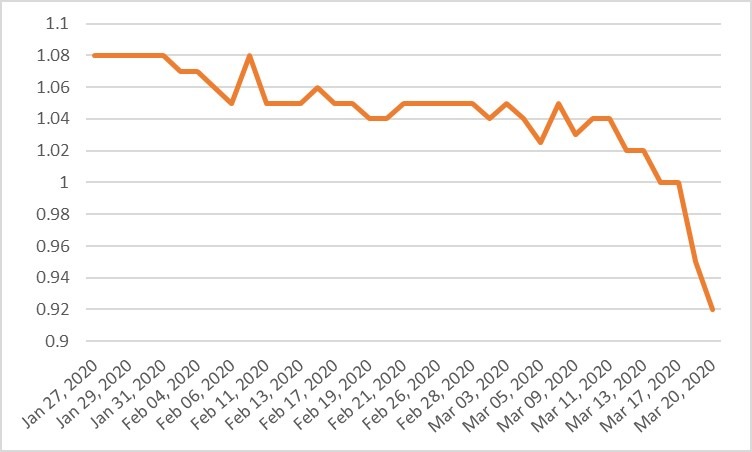

| Chart of the Week: Bank of Valletta plc |

| Highlights: |

- The MSE Equity Total Return Index extended its loss by a further 8.4% as the coronavirus continued to grip economies across the world. The index reached a 7,905.795 points, as 376 transactions were executed over 20 equities, 16 of which traded lower while the rest closed unchanged. A total weekly turnover of €2.2 million was generated, as the MSE Index was active over four trading session due to a public holiday on Thursday.

- On Wednesday, Bank of Valletta plc reported a 25.3% increase in profit before tax when compared the previous year’s figure. The bank’s interest on loans and advances increased to nearly €170 million, yet the Bank’s operating income declined by 3% to €250 million as fee and commission income declined. The bank’s operating profit before litigation provision, declined from €138 million to €98.3 million. However, after taking in consideration the litigation provision for the financial year ended 2019 of €25 million, the bank’s profit before tax amounted to €89.2 million, up from €71.2m in 2018, during which the bank made a litigation provision of €75m.

- The bank’s return on equity, after tax, increased to 6.2% from 5.3% the previous year. Similarly, earnings per share was up to 10.9 cents per share, resulting into a €63.5 million profit attributable to shareholders. The Bank’s IT security infrastructure was strengthened following the February 2019’s cyber-attack. Most misappropriated funds were recovered since action was taken promptly. Operating expenses were up by 6.5% to €139.1 million, as the bank continued to invest in IT and HR. In addition to this, €23.9 million were incurred for the transformation programme, which is expected to run over 2 years. The ratio of non-performing exposures to total lending registered a positive result, as it was down by 0.7% from last year to 4.6%. The bank also registered a strong Common Equity Tier 1 ratio, as it increased by 1.2% to 19.5% from the previous year.

- The board is recommending the payment of a final gross dividend of €0.026 per share, translating to a final net dividend of €0.017 per share, to be approved during the AGM. This would amount to a total gross dividend of €15,384,615 for the year. The audited financial statements for the financial year ended December 31, 2019, are to be submitted for the approval of the shareholders at the forthcoming AGM. Due to the current scenario, the bank has decided to postpone the AGM to a future date within regulatory requirements.

- During the trading week, the bank’s equity lost ground by a substantial 9.8% as it closed the week at the €0.92 price level. This was the result of 72 transactions involving a mix of 472,363 shares.

- HSBC Bank Malta plc announced that due to the current Covid-19 situation, the Annual General Meeting (AGM) shall be postponed to a future date when circumstances allow. The bank decided to still proceed with the payment of a final net dividend of €0.014 per share to its shareholders. This shall be paid on April 15, 2020 to all shareholders listed on the registers as at March 9, 2020.

- The bank kicked off the week on a positive note as it reached €1.03 on Monday but did not manage to sustain the gain as it closed at €0.90 on Friday. As a result the equity finished the week down by 10% over 22 deals involving 79,175 shares.

- On Wednesday, Malta International Airport plc announced that the Covid-19 outbreak negatively impacted its passenger traffic in the first weeks of March. Seat capacity dropped by 14% due to a number of cancellations. Similarly, seat loads declined by 22.4% as travel demand continued to weaken in line with the restrictions imposed by the authorities. This resulted into a 38% fall in traffic during the first 17 days of the month when compared to March 2019. When taking into consideration the week starting from March 11, 2020 to March 17, 2020, passenger movement dropped by a significant 62% when compared to March 2019. The company expects the situation to deteriorate further over the coming weeks given the authorities’ decision to suspend to suspend all inbound commercial flights. Original financial guidance for the year are therefore not expected to be delivered.

- The board agreed to postpone the AGM to July 29, 2020. While constantly monitoring the current situation, an extraordinary board meeting has been called for April 22, 2020 to consider the impact this virus outbreak will have. During the meeting, the board shall re-consider the then current state of affairs and any measures which the company may need to implement and to discuss whether the current situation merits a re-consideration of the proposed dividend.

- The equity headed the list of fallers, as it lost 20.40% but was also the most liquid equity, as total turnover stood at €672,649. A total of 146,563 shares changed hands across 111 transactions, dragging the price down to €4.02. Since the beginning of the year the share price of the airport operator is down by nearly 42%.

- RS2 Software plc generated a total turnover of €396,551 as 198,132 shares changed hands over 55 deals. The equity lost a substantial 18.8% in price, as it managed to close at €1.90 after touching a weekly low of €1.80.

- On Wednesday, MIDI plc announced that the board is scheduled to meet on April 25, 2020 to consider and approve the audited financial statements for the year ended December 31, 2019. During the meeting, the board will consider the declaration of a dividend to be recommended to its shareholders at the AGM, to be held on June 15, 2020. The equity did not record any trading activity during the week.

- Trident Estates plc was the worst performing property equity, as it shed 19.35% or €0.30 to end the week at €1.25. Five deals involving 10,177 shares were executed.

- The Corporate Bond market was highly liquid this week, as 55 issues were active. Investors turned negative on local bonds with 46 issues losing ground while three advanced. The 4.25% GAP Group plc Secured € 2023 headed the list of gainers, as it closed 0.67% higher at €104.00. On the other hand, the 3.75% Premier Capital plc Unsecured € 2026 traded 13.89% lower at €90.00. Meanwhile, 3.8% Hili Finance Company plc Unsecured € 2029 registered the highest liquidity, as it generated a total turnover of €488,501.

- In the Sovereign Debt market, 18 issues were active, of which 17 closed in the red while the 2.1% MGS 2039 (I) closed 1.61% higher at €126.50. The 3% MGS 2040 (I) closed 8.45% lower at €132.00. Such negative performance is in line with the global bond market as the coronavirus pandemic continues to keep investors concerned. On Wednesday, the ECB announced that it will deploy €750 billion to buy securities to keep the European economy strong. Moreover, on Thursday, the Bank of England cut interest rate to an all-time low at 0.1%. This is expected to be followed by additional stimulus measures.

- In the Prospects MTF market, six issued were active. The 5% Busy Bee Finance Company plc Unsecured € 2029 was the most liquid, as it generated a total turnover of €18,053. The bond closed the week at €102.50.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. | ||||

| 2. | ||||

| 23 MAR 2020 | MT: Lombard Bank plc – Full year results | 3. | ||

| 26 MAR 2020 | EU: BOE – Monetary Policy Meeting | |||

| 23 APR 2020 | MT: Lombard Bank plc – AGM | Worst Performers: | ||

| 1. MIA | -20.40% | |||

| 2. TRI | -19.35% | |||

| 3. RS2 | -18.80% | |||

| Price (€): 20.03.2020 | Price (€): 13.03.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 7,905.795 | 8,630.297 | -8.395 | -17.782 |

| BMIT Technologies plc | 0.510 | 0.530 | -3.77 | -1.923 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.920 | 1.020 | -9.80 | -13.208 |

| FIMBank plc (USD) | 0.500 | 0.500 | 0.00 | -16.67 |

| GlobalCapital plc | 0.230 | 0.230 | 0.00 | -17.86 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | 0.00 |

| GO plc | 4.100 | 4.200 | -2.38 | -3.76 |

| Harvest Technology plc | 1.500 | 1.500 | 0.00 | 0.00 |

| HSBC Bank Malta plc | 0.900 | 1.000 | -10.00 | -30.77 |

| International Hotel Investments plc | 0.560 | 0.625 | -10.40 | -32.53 |

| Lombard Bank plc | 2.100 | 2.140 | -1.87 | -7.89 |

| Loqus Holdings plc | 0.080 | 0.080 | 0.00 | 24.03 |

| MIDI plc | 0.400 | 0.400 | 0.00 | -25.93 |

| Medserv plc | 1.000 | 1.000 | 0.00 | -9.09 |

| Malta International Airport plc | 4.020 | 5.050 | -20.40 | -41.74 |

| Malita Investments plc | 0.800 | 0.900 | -11.11 | -11.11 |

| Mapfre Middlesea plc | 2.280 | 2.320 | -1.72 | 5.56 |

| Malta Properties Company plc | 0.500 | 0.600 | -16.67 | -20.63 |

| Main Street Complex plc | 0.500 | 0.520 | -3.85 | -16.67 |

| MaltaPost plc | 1.150 | 1.210 | -4.96 | -12.21 |

| PG plc | 1.900 | 1.900 | 0.00 | 3.26 |

| Plaza Centres plc | 0.980 | 0.980 | 0.00 | -2.97 |

| RS2 Software plc | 1.900 | 2.340 | -18.80 | -11.21 |

| Simonds Farsons Cisk plc | 10.000 | 10.000 | 0.00 | -13.04 |

| Santumas Shareholdings plc | 1.360 | 1.500 | -9.33 | -3.55 |

| Tigné Mall plc | 0.730 | 0.860 | -15.12 | -18.89 |

| Trident Estates plc | 1.250 | 1.550 | -19.35 | -19.35 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].