The 2020 Investment Crossroad

Recent facts and comparison

At the time of writing, the novel COVID-19 virus had spread to over 150 countries, with more than 200k confirmed cases, 8k deaths, while over 81k cases were reported as recovered. Perhaps, when compared to the number of casualties in absolute terms caused by the seasonal flu, deaths caused by COVID-19 seem to be modest. However, when viewing the numbers in percentage terms, one would get a different perspective of these figures. Round about 0.1% of people contracted with the seasonal flu end up dead, or 1 person for every 1,000 contracted. The figure is even less than that for individuals up to 64 years of age according to official statistics by Centres for Disease Control and Prevention (CDC). On the other hand, the percentage death-rate caused by confirmed COVID-19 cases so far is between two and 13 times more than that for individuals up to 60 years of age.

However, when compared to other major viruses we’ve experienced in the past years, the fatality rate is far less. In fact, deaths arising from the Ebola virus, first identified in 1976, led to around 13.6k out of 33.6k recorded cases – equivalent to a fatality rate of 40.4%. SARS in 2002 spread across 29 countries, impacted 8.1k individuals and led to 774 recorded deaths (9.6% fatality rate). MERS in 2012 impacted 28 countries, but had a much higher fatality rate, as some 860 people died out of the 2.5k cases recorded (34.4%). Lastly, estimates for the H1N1 “Swine Flu” a decade ago, range between 700 million to 1.4 billion cases, but with a much lower mortality, at a rate of 0.02%.

Why are markets panicking?

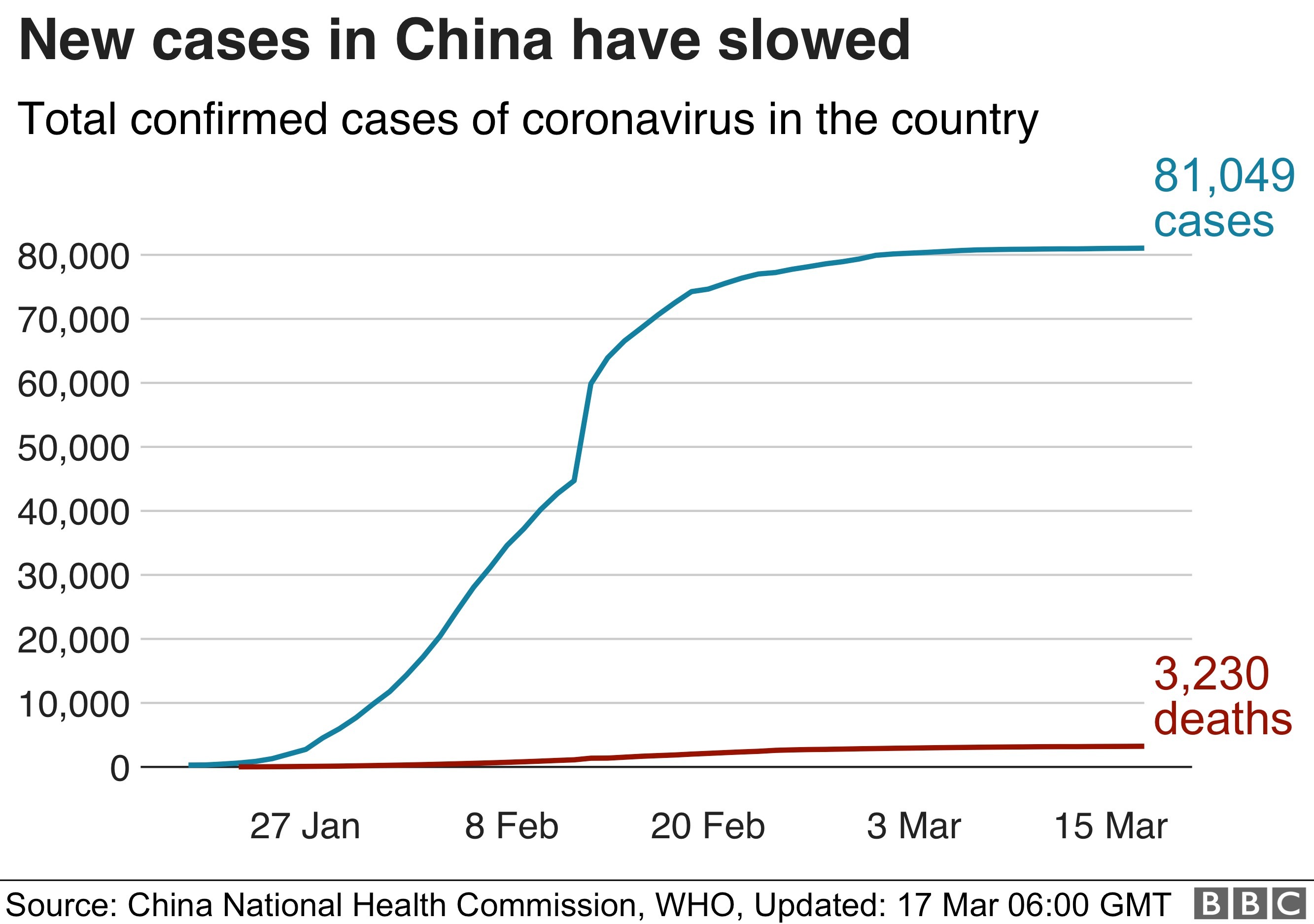

Markets are panicking because of two main reasons. For one, it remains a fact that the virus is new, and no cure has been found yet. The other major factor which is causing markets to act irrationally is because of the way the virus is spreading outside of China. Some 10 days ago, German Chancellor Angela Merkel stated that up to 70% of the German population may be infected by the coronavirus. As opposed to China, where figures have somewhat stalled since four weeks ago – currently reading around 81k confirmed cases, the percentage increase of reported cases in other regions across the globe has increased exponentially since the spike in reported cases in Italy on February 23.

Moreover, on Wednesday evening, March 11, the World Health Organisation (WHO) officially declared the coronavirus outbreak a pandemic, which led to quite a roller-coaster ride since then, coupled with further central banks’ intervention and increased fiscal measures coming into effect.

How did markets react lately, and why?

As volatility spiked since mid-February, markets went back into free-fall last Monday, triggering once again a circuit breaker on the US equity market following a staggering drop of 7% in the S&P 500 index. Trading was in fact halted for some 15 minutes, to end the session down by 12%.

Comparing how equity markets have fared, the CSI 300 Index (China) has declined by a much smaller magnitude, registering some 11.2% fall since the beginning of the year, and a 13.6% decline since its high reached earlier in March. On the other hand, falls registered across developed market indices were much more significant. Starting off with the broader European market, the Eurostoxx 600 index read a decline of some 33.5% since the turn of the year and over 36% since this year’s high. As one should expect, the fall in the Italian equity index was more severe, with the FTSE MIB nose-diving by 37% since January 1 and 42% since this year’s high.

The FTSE 100 Index in the UK, which index is represented by some 30% by the financial services and energy-related companies was also hit hard as a result of the recent panic selling, down by some 33% since the beginning of 2020.

Meanwhile, a somewhat less severe decline across the S&P 500 Index was recorded, down by over 22% year-to-date and by over 25% since highs reached in February (in dollar terms). Figures were expected to be even more severe, with futures on Wednesday morning indicating a negative open of around 4-5% as hopes that new fiscal measures will avoid a sharp recession faded away. However, it is also believed that computer trading has further exacerbated any moves emanating from the coronavirus outbreak.

How has the Euro currency reacted so far?

Typically, the euro currency falls under pressure at times of market distress. Nevertheless, we have seen the currency initially picking up momentum against the dollar, surpassing the $1.14 barrier on March 9, to then progressively going back below the $1.10 level. Why? Up to a few weeks ago, the euro was a rather popular currency for investors to sell (borrowing in euro) and betting their money in higher-yielding asset classes elsewhere. As markets turned south, such bets had to be closed off, translating into traders/investors buying back the euro, and causing upward pressure on the currency. According to the head of FX strategy at UBS, James Malcolm, the coronavirus is what essentially triggered risk-seeking bets to fold.

Nevertheless, this was short-lived, as the euro currency headed back south over the past couple of weeks as news relating to the impact the virus will have on the broader European economy continued to be digested. This was likewise mirrored across the sovereign debt market, with the 10-year German Bund plunging to a record low of -0.9% on March 9, to then reverse back towards the -0.2% territory by mid-week, March 18.

Albeit to a lesser extent, yield reversals were also witnessed across US Treasuries. Such a reaction could be the result of two main factors. On one hand, markets could be weighing in the benefits increased fiscal measures could have on cushioning the negative impact brought about by COVID-19 against the long-term consequences of higher debt and deficit burdens on an economy (as a percentage of GDP). On the other hand, the unusual complementary selloff across safe haven assets at the same time of an equity sell-off could also be the result of forced selling by those in need of most of meeting liquidity requirements, such as redemptions.

Should one panic vis-à-vis their investment portfolio?

With the WHO declaring the COVID-19 as a global pandemic, it is only natural for markets to turn into panic mode and acting irrationally at times. My two cents opinion is that cooperation at times like these is what matters most. Cooperation between central banks might be a bit trickier, and essentially, I believe that, given the circumstances, there is little impact monetary policy can have on the global economy. Additional fiscal stimulus could perhaps be more effective at such times, whereby money is physically injected into the economy, running deficits (or bigger ones) if need be, in a joint effort to quickly recover from the current stale situation the COVID-19 has caused in a matter of weeks.

Although the past few weeks have reminded us of the severe consequences we’ve witnessed during the 2008 subprime crisis, the fact that this time round the shock is derived from a health crisis rather than from the financial sector, makes it less destabilising. This would in turn mean a higher probability of a quick rebound – at least by the time the rate of registered new cases starts slowing down. We did observe some form of stabilisation across the Chinese equity market as soon as the spread became more contained. An all-out quarantine is perhaps warranted, and more countries should follow suit with immediate drastic measures just like Nordic countries have done as soon as the first cases were registered.

After seeking professional investment advice, one should re-evaluate whether it is opportune to re-address one’s risk-profile and asset class combination within his portfolio – while taking the most advantage of the current bear market scenario across markets. For argument’s sake, one should also reflect on the fact that markets would have doubled in value by the time they rebound back from a 50% decline – in essence, making any form of correction more attractive to take advantage of.

Colin Vella, CFA is Head of Wealth Management at Jesmond Mizzi Financial Advisors Limited. This article does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Investors should remember that past performance is no guide to future performance and that the value of investments may go down as well as up. For further information contact Jesmond Mizzi Financial Advisors Limited of 67, Level 3, South Street, Valletta, on Tel: 2122 4410, or email [email protected]