MSE Trading Report for Week ending 27 March 2020

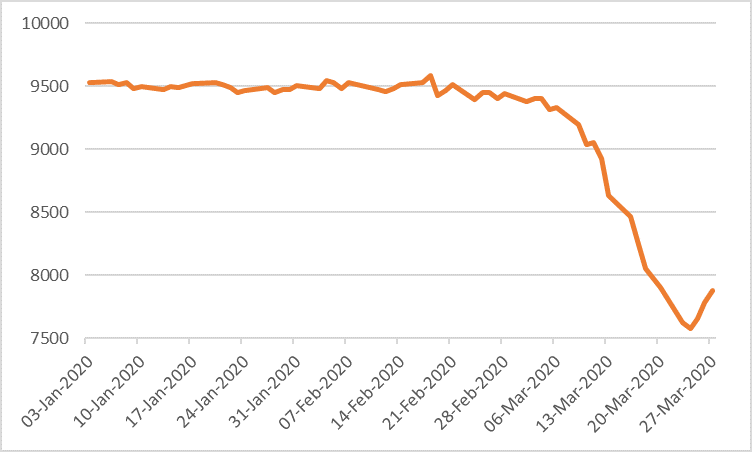

| MSE Equity Total Return Index: |

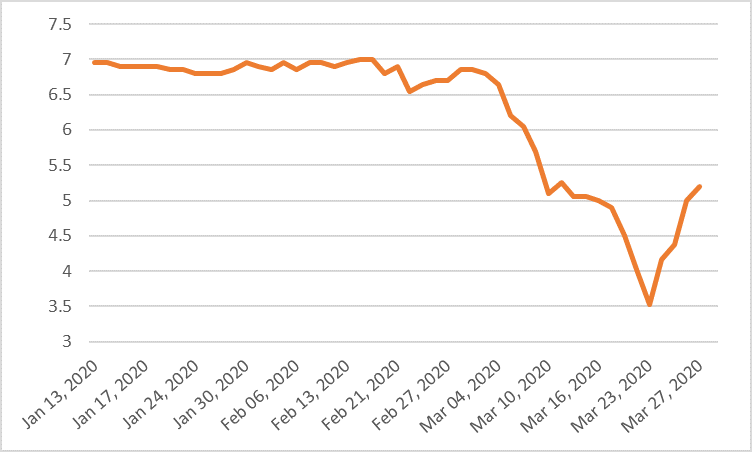

| Chart of the Week: Malta International Airport plc |

| Highlights: |

- The MSE Equity Total Return Index managed to close broadly flat during a volatile week, edging marginally lower by 0.33% to close at 7,880.005 points. Six of the 17 active equities headed north while another 10 closed in the opposite direction. A total weekly turnover of €2.2 million was generated over 469 transactions.

- Malta International Airport plc pared some of its previous losses as a 29.35% increase was recorded to close at €5.20. The equity started off the week on a negative note as it dropped to €3.50 (albeit closing the session at €3.52) on Monday but gained ground in the following days. The airport’s shares registered the highest liquidity as total turnover stood at €751,458 – the result of 171,927 shares spread over 172 transactions.

- In the banking industry, Bank of Valletta plc drifted lower with a 6.52% change in price to close the week €0.86. A total weekly turnover of €393,189 was generated as 455,305 shares changed hands over 126 deals.

- HSBC Bank Malta plc ended the week in positive territory as it closed 2.2% higher at €0.92 on Friday – the equity also reached an intra-day high price of €0.95. This was the outcome of 24 deals involving 50,382 shares.

- On Monday, Lombard Bank Malta plc announced the approval of the audited financial statements for the year ended December 31, 2019 which shall be submitted for approval at the next Annual General Meeting. This AGM has been postponed to a later date which has not been further confirmed yet due to the current coronavirus issues. The board resolved to recommend that the AGM approves the payment of a final net dividend of 4.55 cents per share. The dividend distribution date is yet to be communicated.

- The bank registered an 11.1% increase in profit before tax to €15.3 million for the year ended December 31, 2019 when compared to the previous year. As the noted during the AGM, such positive performance was the result of prudent business practices and persistent low interest rates. An increase in credit activity pushed net interest income 12.4% upwards to €19.7 million versus the previous year’s figure. This figure was also impacted by judicious treasury management intended to decrease the impact of negative interest rates together with repricing of liabilities at finer interest rates. The group’s total assets were up by 9.70% to €1,042.3 million when compared to the same period last year. Likewise, equity attributable to shareholders was up by 10%, as it amounted to €119.1 million. The group’s earnings per shares increased by 2 cents to 21.1 cents while group post tax return on equity stood at 8.2%. The bank’s total capital ratio and leverage ratio recorded were 16.0% and 10.5% – both of which are in excess of the minimum regulatory requirements. There was no exposure held in foreign government or corporate bonds.

- The equity traded four times over a mix of 16,400 shares. The price declined by 4.76%, reaching a two-year low price of €2.00.

- On Friday, FIMBank plc announced that it will be postponing its annual general meeting to another date when circumstances allow. Two deals of 105,000 shares dragged the price by 10% into the red. The bank ended the week at $0.45 – the lowest price since mid November 2015.

- On Tuesday, BMIT Technologies plc announced that in light of the current circumstances, it shall proceed with the payment of a final net dividend of €0.02157 per share, to be paid on June 4, 2020 to all shareholders listed on the register as at April 29, 2020. This shall be submitted for shareholders’ confirmation at the Annual General Meeting that will be held when circumstances allow. The equity declined by 6.27% to €0.478. A total of 268,600 shares changed hands over 23 transactions. On a similar note, its parent company, GO plc, was down by 4.88% as it ended the week at €3.90. A total of 14 deals involving 36,052 shares were executed.

- IT services provider, RS2 Software plc, began the week on shaky ground as it bottomed at €1.69 on Tuesday (but closed the session at €1.70). However, the equity gained momentum by the end of week, as it closed 1.05% higher at €1.92. This was the outcome of 40 deals involving 149,459 shares.

- Retail conglomerate, PG plc, tumbled 15.79% as it ended the week at €1.60. A total of 108,900 shares changed ownership over 25 transactions.

- On Tuesday, Mapfre Middlesea plc announced that in view of the current events, the annual general meeting shall be postponed to a future date. The equity traded five times over a mix of 14,116 shares. The equity price closed at €2.26, translating into a 0.88% fall in price.

- On Wednesday, MIDI plc announced that the results for the year ended December 2019, to be considered by the board on April 25, 2020, are not impacted by the Covid-19 pandemic. However, the 2020 results are expected to be negatively impacted on the sale of the residential units which the company holds as stock. Both the Manoel Island Masterplan appeal process and the Q3 residential block full development application process have been halted until further notice. This will therefore delay the start of any development works for both projects.

- The equity traded twice over a spread of 13,000 shares. Price declined by 5% as it closed at €0.38.

- On Monday, Medserv plc announced that one of its subsidiaries, Medserv Operations Limited, signed a long-term agreement with Air Liquide’s subsidiary – ALOS, to install and operate a compressed gases filling plant at the company’s base in the Malta Freeport, subject to required approvals. If approved, this transaction will commence, and provide diving and welding gases to the Mediterranean offshore industry. Another announcement was issued on Monday by Plaza Centres plc with respect to the implementation of its business continuity plan. Despite expecting its operating performance to be negatively impacted by the coronavirus pandemic, the company is adequately capitalised and is liquid enough to meet its financial obligations.

- No trading activity was recorded during the week for both equities.

- The MSE Corporate Bonds Total Return Index closed broadly flat, possibly as a result of a second financial aid mechanism issued by the government, in addition to the €1.8 billion package announced the previous week. This new package was agreed upon by the government, central bank and social partners. The index edged marginally lower to close at 1,044.37 points. A total of 51 issues were active, of which five advanced while another 39 lost ground. The 3.75% Premier Capital plc Unsecured € 2026 headed the list of gainers, as it closed 9.98% higher at €98.98. Conversely, the 4.5% Izola Bank plc € Unsecured 2025 lost 5.66%, ending the week at par.

- In the sovereign debt market, the MSE MGS Total Return Index was up by 1.153% as it reached 1,113.22 points. Government bonds rallied across the Eurozone as the European Central Bank (ECB) bolstered its credibility. The ECB announced flexibility in most of the bond-buying limit – that of buying no more than a third of any country’s eligible bonds. It plans to buy €750 billion bonds to avoid a financial crisis due to the current Covid-19 pandemic and provide more support to hard-hit countries. Meanwhile, the G20 leaders of major economies have agreed to inject over $5 trillion into the global economy to help minimize unemployment from businesses across the world. In the local sovereign market, out of 16 active issues, 12 registered gains while another three traded lower. The best performance was recorded by the 3% MGS 2040 (I) as it closed 5.3% higher at €139.00. On the other hand, the 5.2% MGS 2020 (I) ended the week at €101.00, translating into a 0.4% decline.

- In the Prospects MTF market, seven issues were active all of which closed unchanged. The 5% Busy Bee Finance Company plc Unsecured € 2029 was the most liquid as it registered a total turnover of €30,000.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. GHM | +36.36% | |||

| 2. MIA | +29.35% | |||

| 3. TRI | +3.20% | |||

| Due to the current Covid-19 pandemic, upcoming events shall be postponed to a future date, when circumstances allow. | ||||

| Worst Performers: | ||||

| 1. PG | -15.79% | |||

| 2. FIM | -10.00% | |||

| 3. BOV | -6.52% | |||

| Price (€): 27.03.2020 | Price (€): 20.03.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 7,880.005 | 7,905.795 | -0.326 | -18.051 |

| BMIT Technologies plc | 0.478 | 0.510 | -6.27 | -8.077 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.860 | 0.920 | -6.52 | -18.868 |

| FIMBank plc (USD) | 0.450 | 0.500 | -10.00 | -25.00 |

| GlobalCapital plc | 0.230 | 0.230 | 0.00 | -17.86 |

| Grand Harbour Marina plc | 0.750 | 0.550 | 36.36 | 36.36 |

| GO plc | 3.900 | 4.100 | -4.88 | -8.45 |

| Harvest Technology plc | 1.500 | 1.500 | 0.00 | 0.00 |

| HSBC Bank Malta plc | 0.920 | 0.900 | 2.22 | -29.23 |

| International Hotel Investments plc | 0.570 | 0.560 | 1.79 | -31.33 |

| Lombard Bank plc | 2.000 | 2.100 | -4.76 | -12.28 |

| Loqus Holdings plc | 0.080 | 0.080 | 0.00 | 24.03 |

| MIDI plc | 0.380 | 0.400 | -5.00 | -29.63 |

| Medserv plc | 1.000 | 1.000 | 0.00 | -9.09 |

| Malta International Airport plc | 5.200 | 4.020 | 29.35 | -24.64 |

| Malita Investments plc | 0.770 | 0.800 | -3.75 | -14.44 |

| Mapfre Middlesea plc | 2.260 | 2.280 | -0.88 | 4.63 |

| Malta Properties Company plc | 0.500 | 0.500 | 0.00 | -20.63 |

| Main Street Complex plc | 0.500 | 0.500 | 0.00 | -16.67 |

| MaltaPost plc | 1.100 | 1.150 | -4.35 | -16.03 |

| PG plc | 1.600 | 1.900 | -15.79 | -13.04 |

| Plaza Centres plc | 0.980 | 0.980 | 0.00 | -2.97 |

| RS2 Software plc | 1.920 | 1.900 | 1.05 | -10.28 |

| Simonds Farsons Cisk plc | 10.000 | 10.000 | 0.00 | -13.04 |

| Santumas Shareholdings plc | 1.360 | 1.360 | 0.00 | -3.55 |

| Tigné Mall plc | 0.730 | 0.730 | 0.00 | -18.89 |

| Trident Estates plc | 1.290 | 1.250 | 3.20 | -16.77 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].