MSE Trading Report for Week ending 09 April 2020

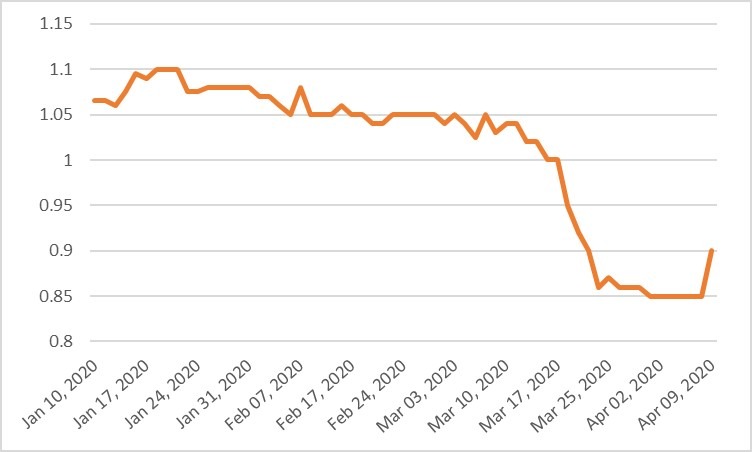

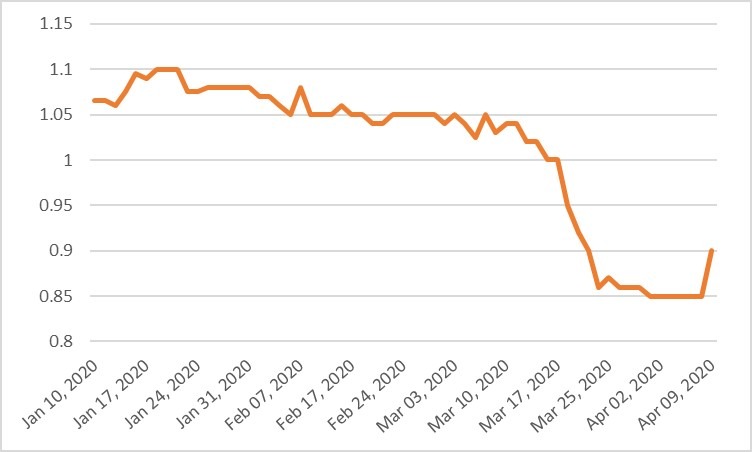

| MSE Equity Total Return Index: |

| Chart of the Week: Bank of Valletta plc |

| Highlights: |

- The MSE Equity Total Return Index dropped by 1% as it ended the four-day trading week at 7,774.899 points. A total of 14 equities were active, of which four headed north while another six closed in the opposite direction. A total weekly turnover of circa €0.5 million, down from €0.9m the previous week, was generated over 132 transactions.

- The top performer for the week was Bank of Valletta plc as it gained 6%. The bank closed the week at €0.90 after trading at a weekly low of €0.84. A total of 119,290 shares changed hands over 37 transactions worth €101,230.

- Its peer, HSBC Bank Malta plc traded flat at €0.95, as seven transactions worth €44,000 were recorded.

- On Tuesday, Lombard Bank Malta plc announced that the Annual General Meeting (AGM) which was scheduled for April 23, 2020 has been postponed to a later date when circumstances allow. During the AGM, the board shall approve the payment of a final gross dividend of 7 cents per nominal €0.25 share – translating into a net dividend of 4.55 cent. The board re-assessed such dividend in line with the Covid-19 impact, the European Central Bank’s dividend distribution recommendation and the relative MFSA circular of April 2, 2020. On this basis, the recommended dividend shall be revised when the situation is stable and will not be paid earlier than October 1, 2020. The bank’s shares were active on Tuesday as four deals involving 18,084 shares were executed. The price was up by 5% to €2.10.

- On Friday, the board of FIMBank plc approved the annual report and financial statements for the financial year ended December 31, 2019. The bank recorded a lower profit before tax of $7.3 million versus $13 million in 2018. Net operating income declined by 13% to $51.3 million. This was mainly due the implementation of certain measures and economic conditions. The Group’s earning per shares was down to $0.86 cents versus the $2.22 cents for the previous year.

- The bank’s total consolidated assets were up by $24 million as they amounted to $1.89 billion. Due to the de-risking process, portfolios have seen significant shifts. Loans and advanced decreased by $90.6 million and financial assets held at fair value were also down by $56.2 million. Meanwhile, there was an increase in trading assets and treasury balance, as they increased by $113 million and $56.4 million, respectively. Total consolidated liabilities registered a $21.7 million increase as it stood at $1.61 billion. Such growth was mainly the result of an increase in deposits from corporate and retails clients – an increase of $30.3 million. This was partly offset by wholesale funding sources, as they declined by $9.7 million. The Group’s CET1 ratio decreased by 1.1% as it stood at 16.9% for the financial year ended December 31, 2019.

- The bank did not record any trading activity during the week.

- Meanwhile, Malta International Airport plc was the most liquid equity for the week, as total turnover stood at €134,649. A total of 27,278 shares changed hands over 40 transactions, dragging the price 4% into the red, to close at €4.80 after trading at a weekly high of €5 earlier in the week

- On Wednesday, MIA announced its traffic results for the month of March. As expected, passenger movements dropped by 64.5% when compared to the same period last year. This was the result of the Covid-19 pandemic, as more stringent measures were being introduced to avoid the spread. From March 21, 2020 travelling was banned for all inbound commercial flights. Such restriction led to a 46.6% fall in aircraft movements and a 48.1% decline in seat capacity. Seat load factor also dropped by a significant 55.6% after having increased by over 8% in March 2019. The month of March brought the winter season to a close for the aviation industry. During this season, which starts in November, MIA welcomed nearly 2 million passengers. The strong growth registered in the first four months of the winter season partly offset the substantial drop in traffic experiences last March.

- Harvest Technology plc announced that the board shall meet on April 24, 2020 to consider and approve the audited consolidated financial statements for the financial year ended December 31, 2019. The board will also review the management accounts of the first quarter of 2020 and continue assessing the possible impact of the current coronavirus on operations and prospects.

- On Wednesday, International Hotel Investments plc issued an announcement, with reference to the publication of its audited financial statements for 2019, which were due by April, 30 2020. The Covid-19 situation has put the company’s human resources and auditors under constraints, which has led to a delay in the finalisation of the audited financial statements. These are expected to be published by June 30, 2020. The company assured its stakeholders of its strength, following a number of measures which have reduced all operating costs and payroll expenses. Moreover, the company has also entered into ad hoc agreements with some of its principal lending banks to defer capital, and in a few cases, interest payments too. The company has also prepared separate lines of credit in the event of any cash flow shortfall. These measures will safeguard the company’s assets and liquidity during times when little or no income is expected to be generated among the company’s hotels and businesses.

- On the basis of the measures taken thus far and projecting a scenario of marginal income for the rest of 2020, the Company has sufficient liquidity to honour its payment obligations, not least bond interest payments as they arise through the course of the year. The board of directors and senior management remain vigilant on developments and will be taking further measures as and when necessary to ensure the continued viability of the Company. The share price of the hotels operators declined by just over 9% as seven deals involving 25,000 shares were executed. The equity’s closing price stood at €0.54 and is down by 35% since the beginning of the year.

- On Tuesday, Mesderv plc announced that despite the current challenges these unprecedented times have presented, all the group’s facilities continue to remain operational and to service clients. The Covid-19 pandemic and the downward pressure on the price of oil impacted the oil and gas industry, especially in the exploratory offshore drilling projects as the majority have been postponed. Meanwhile, the demand for the company’s services for the development and production facilities remained consistent, both locally and internationally, especially in the Middle East. The company’s Earnings before interest, tax, depreciation and amortisation (EBITDA) for this year, 2020, is expected to be negatively impacted. The main objective is liquidity preservation and ensuring that EBITDA remains positive. The company is therefore reducing costs across the group by adopting different measures. One measure is by lowering operating costs and delaying capital expenditure.

- The group will benefit from varying schemes adopted by respective governments in which it operates. These include Malta, Cyprus, Egypt, UAE, Oman and Iraq. Medserv announced that, following its mitigation plan, it will be able to meet all its payment obligations for the year. In light of the current situation, the company’s auditors have requested for a one-month extension to finish the audit engagement as a result of the difficulties in collecting audit evidence. The audited financial statements will be published by May 31, 2020.

- On Tuesday, Santumas Shareholdings plc announced that the results for the financial year ending April 30, 2020 are expected to reflect the negative effects of the downturn in the equity markets. It is still too early to quantify such impact, however, the other operations of the company in the property segment continue, despite with a reduced pace. There may also be some valuation adjustments at the reporting date.

- On Wednesday, Simonds Farsons Cisk plc announced that it is still too early to quantify the potential impact on the group’s revenues and profitability from the current crisis. However, the company’s food and beverages sectors will be materially impacted as a result of the restrictions imposed by the government. The board have been examining different scenarios for contingency purposes. To mitigate the impact of the current situation, the company will be undertaking certain measures. These include strict cost containment and working capital measures, lower production runs and the deferral of a number of capital expenditure programmes. Moreover, where possible, employees are working remotely, different working patterns, anticipate leave and a limited number of shut down days. In the meantime, recruitment has been suspended as well as the engagement of subcontracted and casual employments have been implemented.

- The MSE Corporate Bonds Total Return Index declined by 0.716% to 1,036.43 points. A total of 48 issues were active, of which 12 advanced while another 24 lost ground. The 4.5% Izola Bank plc € Unsecured 2025 was the best performer, as it closed 5% higher at €105.00. On the other hand, the 6% Mediterranean Investments Holding plc Euro 2021 lost 6.93%, to close at €94.00.

- In the sovereign debt market, the MSE MGS Total Return Index was up by 0.8% at it ended the week at 1,121.53 points. A total of 16 active issues were active, as nine registered gains while the other seven closed in the red. The 3% MGS 2040 (I) registered the best performance with a 4.32% increase, to close at €145.00. Conversely, the 4.65% MGS 2032 (I) traded 1.14% lower at €145.87.

- In the Prospects MTF market, six issues were active. The 4.75% Gillieru Investments plc Secured Bonds 2028 closed higher at €98.00, while the rest closed unchanged.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. BOV | +5.88% | |||

| 2. LOM | +5.00% | |||

| 3. MLT | +3.90% | |||

| Due to the current Covid-19 pandemic, upcoming events shall be postponed to a future date, when circumstances allow. | ||||

| Worst Performers: | ||||

| 1. MTP | -18.18% | |||

| 2. IHI | -9.24% | |||

| 3. GO | -7.69% | |||

| Price (€): 09.04.2020 | Price (€): 03.04.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 7,774.899 | 7,862.881 | -1.119 | -19.144 |

| BMIT Technologies plc | 0.490 | 0.490 | 0.00 | -5.77 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.900 | 0.850 | 5.88 | -15.09 |

| FIMBank plc (USD) | 0.470 | 0.470 | 0.00 | -21.67 |

| GlobalCapital plc | 0.230 | 0.230 | 0.00 | -17.86 |

| Grand Harbour Marina plc | 0.750 | 0.750 | 0.00 | 36.36 |

| GO plc | 3.600 | 3.900 | -7.69 | -15.49 |

| Harvest Technology plc | 1.460 | 1.460 | 0.00 | -2.67 |

| HSBC Bank Malta plc | 0.950 | 0.950 | 0.00 | -26.92 |

| International Hotel Investments plc | 0.540 | 0.595 | -9.24 | -34.94 |

| Lombard Bank plc | 2.100 | 2.000 | 5.00 | -7.89 |

| Loqus Holdings plc | 0.080 | 0.080 | 0.00 | 24.03 |

| MIDI plc | 0.370 | 0.380 | -2.63 | -31.48 |

| Medserv plc | 1.000 | 1.000 | 0.00 | -9.09 |

| Malta International Airport plc | 4.800 | 5.000 | -4.00 | -30.43 |

| Malita Investments plc | 0.800 | 0.770 | 3.90 | -11.11 |

| Mapfre Middlesea plc | 2.260 | 2.260 | 0.00 | 4.63 |

| Malta Properties Company plc | 0.490 | 0.490 | 0.00 | -22.22 |

| Main Street Complex plc | 0.480 | 0.480 | 0.00 | -20.00 |

| MaltaPost plc | 0.900 | 1.100 | -18.18 | -31.30 |

| PG plc | 1.690 | 1.630 | 3.68 | -8.15 |

| Plaza Centres plc | 0.940 | 0.940 | 0.00 | -6.93 |

| RS2 Software plc | 1.920 | 1.920 | 0.00 | -10.28 |

| Simonds Farsons Cisk plc | 9.200 | 9.200 | 0.00 | -20.00 |

| Santumas Shareholdings plc | 1.360 | 1.360 | 0.00 | -3.55 |

| Tigné Mall plc | 0.730 | 0.730 | 0.00 | -18.89 |

| Trident Estates plc | 1.280 | 1.290 | -4.48 | -17.42 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].