MSE Trading Report for Week ending 17 April 2020

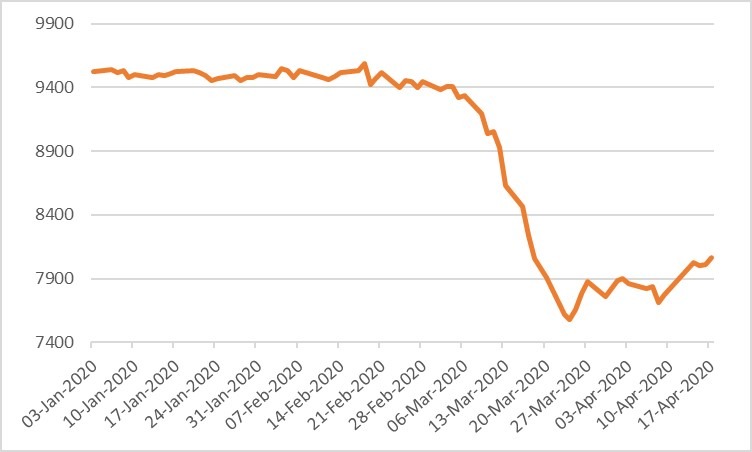

| MSE Equity Total Return Index: |

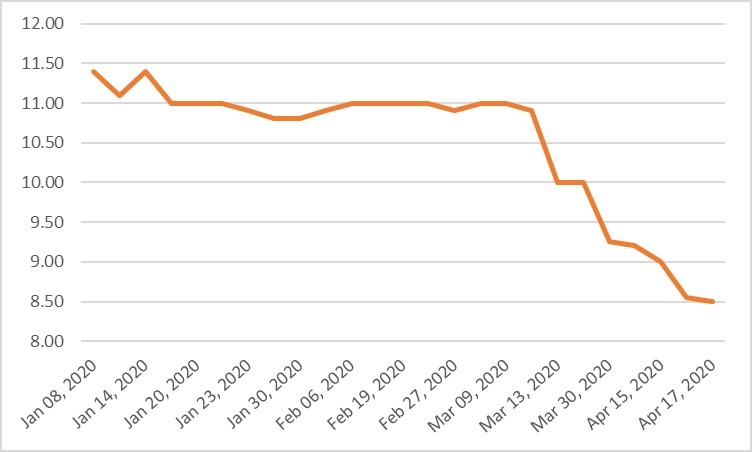

| Chart of the Week: Simonds Farsons Cisk plc |

| Highlights: |

- The MSE Equity Total Return Index recouped its previous week’s lost ground as it closed 3.79% higher at 8,069.366 points over the four-day trading week. A total weekly turnover of €1.1 million was generated over 204 transactions. Out of 13 active equities, eight headed north while another three closed in negative territory.

- In the banking industry, Bank of Valletta plc headed the list of gainers once again, as it registered a 13.33% increase in price. The bank reached a five-week high of €1.03 during the week, to then close one cent lower at €1.02 on Friday. Total weekly turnover stood at €46,674 over 27 deals involving 47,524 shares were executed.

- Its peer, HSBC Bank Malta plc was up by 2.11%, ending the week at the €0.97 price level. This was the result of 63,750 shares spread over 10 transactions.

- The most liquid equity this week was RS2 Software plc as total turnover amounted to €285,915. A total of 150,400 shares were executed over 20 deals, oscillating between a high of €1.93 and a low of €1.86, to then close 1.04% lower on the week at the €1.90 price level.

- Malta International Airport plc was the second most traded equity during the week, generating a total turnover of €224,031. The company’s shares recovered the previous’ week lost ground, as 59 deals involving 45,233 shares pushed the price to €5.00 – a gain over the week of 4.17%.

- Simonds Farsons Cisk plc ended the week at its 13-month low price of €8.50, as 14 deals of 5,107 shares dragged the equity’s price by 7.61%.

- On Monday, Trident Estates plc announced the board shall be meeting on May 13, 2020 to consider and approve the audited financial statements for the year ended January 31, 2020. During the meeting, the declaration or otherwise of a final dividend shall be recommended to the Annual General Meeting (AGM). However, in view of the current COVID-19 restrictions it may not be possible to hold the meeting on that date. A further company announcement will be issued concerning the fixing of a date for the AGM, as soon as it is practicable to do so.

- The equity traded twice over a mix of 10,643 shares. This resulted into a 3.13% rise in price, to close at €1.32.

- On Monday, MaltaPost plc announced that it is constantly monitoring developments resulting from the impact of the COVID-19 pandemic. The company continues to implement its contingency plans within its overall Risk Assessment policies, together with the recommendations issued by the Government of Malta, the Public Health Authorities, as well as other Regulators. To date, all the services normally provided by MaltaPost and its national network of offices remain fully functional, however circumstances have called for certain measures to be implemented and some delays and reduction in business are inevitable. The Company relies on foreign postal operators and international flight connections for the transport of mail, however flight connections to and from Malta are currently limited.

- On Wednesday, Medserv plc announced that the board is scheduled to meet on May 29, 2020 to consider, and if thought fit, approve the annual financial statements of the company for the financial year ended December 31, 2019. The following day, the company was informed by its two major shareholders that due to the current COVID19 pandemic, the intended sale to AMT S.A. (including the intended share for share exchange and launch of the voluntary offer) has been aborted. The decision not to proceed was reached by both parties on an amicable basis and a termination agreement to this effect was signed yesterday. The major shareholders advised that this transaction was terminated for reasons outside of the parties’ control, and that for this reason they will embark on a series of discussions with AMT S.A. to determine whether there still is scope for a transaction to take place between the parties.

- The major shareholders’ intent remains to source a strategic purchaser to acquire their shareholding in the company and to accelerate and further supplement the Company’s growth and internationalisation strategy. It is to be noted that the failure between the parties to conclude with AMT S.A. is likely to impact the speed at which it can expand but will not stop it from expanding in a sustainable manner. As already announced to the market, the company has already put into place cost-cutting measures in response to the postponement of some offshore exploration projects resulting from the COVID19 pandemic. The Middle East operations continue to perform regularly. The business pipeline has been retained, albeit with exploration projects being postponed. Importantly, the company again reiterates that it can meet all its financial obligations for the year.

- On Wednesday, Loqus Holdings plc gave the market an update on the effects of the COVID-19 situation since the last company announcement. Local back office operations have been impacted. Closing down of local Tribunals and Law Courts beyond the short-term has already had an effect on the operations and reduced revenue in this department. Their ongoing fleet operations continue to function normally with a number of the fleet clients in Transport & Logistics, Postal & Courier experiencing a boost in activity. One of their UK clients has however shut down operations for the next three months. As the crisis hit their major market in the beginning of April, current and prospective clients in the UK have started to postpone new projects indefinitely. This will affect the short-term forecasted revenues and potentially the medium-term revenues as well.

- On Thursday, Main Street Complex plc announced that the board is scheduled to meet on April 21, 2020 to consider and, if deemed appropriate, approve, the company’s audited financial statements for the financial year ended December 31, 2019. The board shall also consider whether to declare and make a recommendation to the shareholders for the payment of a final dividend for the financial year ended December 31, 2019.

- The MSE MGS Total Return Index reached 1,132.72 points, translating into a one percent weekly increase. A total of 18 issues were active, of which 11 advanced while another five traded lower. The 4.1% MGS 2034 (I) registered the best performance, as it closed 3.08% higher at €150.50. Conversely, the 5.1% MGS 2022 (I) was down by 0.34%, to close at €111.97.

- The MSE Corporate Bonds Total Return Index was up by 1.26%, as it closed at 1,049.49 points. Out of 46 active issues, 23 traded higher while another 14 lost ground. The 5.75% International Hotel Investments plc Unsecured € 2025 headed the list of gainers with a 5.21% increase, to close at €101.00. On the other hand, the 5% Mediterranean Investments Holding plc Unsecured € 2022 lost 5.64%, ending the week at €92.00.

- In the Prospects MTF market, six issues were active. The 4.75% Orion Finance plc € Unsecured 2027 and the 4.25% Calamatta Cuschieri Finance plc Unsecured Callable 2024-2026 were active on 10,000 nominal each. Both issues closed unchanged at €99.00 and €100.00, respectively.

| Best Performers: | ||||

| 1. BOV | +13.33% | |||

| 20 APR 2020 | MT: TIgne Mall plc – Results | 2. IHI | +10.19% | |

| 21 APR 2020 | MT: Mains Street Complex plc – Results | 3. GO | +7.78% | |

| 24 APR 2020 | MT: Harvest Technology plc – Results | |||

| 25 APR 2020 | MT: MIDI plc – Results | Worst Performers: | ||

| 29 APR 2020 | US: FED – Monetary Policy Meeting | 1. SFC | -7.61% | |

| 2. MDI | -2.70% | |||

| 3. RS2 | -1.04% | |||

| Price (€): 17.04.2020 | Price (€): 09.04.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 8,069.366 | 7,774.899 | 3.787 | -16.081 |

| BMIT Technologies plc | 0.490 | 0.490 | 0.00 | -5.77 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.02 | 0.900 | 13.33 | -3.77 |

| FIMBank plc (USD) | 0.470 | 0.470 | 0.00 | -21.67 |

| GlobalCapital plc | 0.230 | 0.230 | 0.00 | -17.86 |

| Grand Harbour Marina plc | 0.750 | 0.750 | 0.00 | 36.36 |

| GO plc | 3.880 | 3.600 | 7.78 | -8.92 |

| Harvest Technology plc | 1.460 | 1.460 | 0.00 | -2.67 |

| HSBC Bank Malta plc | 0.970 | 0.950 | 2.11 | -25.38 |

| International Hotel Investments plc | 0.595 | 0.540 | 10.19 | -28.31 |

| Lombard Bank plc | 2.100 | 2.100 | 0.00 | -7.89 |

| Loqus Holdings plc | 0.080 | 0.080 | 0.00 | 24.03 |

| MIDI plc | 0.360 | 0.370 | -2.70 | -33.33 |

| Medserv plc | 1.000 | 1.000 | 0.00 | -9.09 |

| Malta International Airport plc | 5.000 | 4.800 | 4.17 | -27.54 |

| Malita Investments plc | 0.800 | 0.800 | 0.00 | -11.11 |

| Mapfre Middlesea plc | 2.260 | 2.260 | 0.00 | 4.63 |

| Malta Properties Company plc | 0.525 | 0.490 | 7.14 | -16.67 |

| Main Street Complex plc | 0.480 | 0.480 | 0.00 | -20.00 |

| MaltaPost plc | 0.900 | 0.900 | 0.00 | -31.30 |

| PG plc | 1.800 | 1.690 | 6.51 | -2.17 |

| Plaza Centres plc | 0.940 | 0.940 | 0.00 | -6.93 |

| RS2 Software plc | 1.900 | 1.920 | -1.04 | -11.21 |

| Simonds Farsons Cisk plc | 8.500 | 9.200 | -7.61 | -26.09 |

| Santumas Shareholdings plc | 1.360 | 1.360 | 0.00 | -3.55 |

| Tigné Mall plc | 0.730 | 0.730 | 0.00 | -18.89 |

| Trident Estates plc | 1.320 | 1.280 | 3.13 | -14.84 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].