Avoid market timing through regular investing

Investing a small sum of money every month is one of the simplest ways to start investing. If you had to ask the average investor which is the safest; investing €50 a month in a savings account or in the stock market, most probably the majority would opt for the savings account, which makes sense for the short term. However, for the longer term, a well-diversified investment, will outperform by far. Since interest rates have reached record low levels, the opportunity cost of holding money in a bank account has increased.

Investing a small sum of money every month is one of the simplest ways to start investing. If you had to ask the average investor which is the safest; investing €50 a month in a savings account or in the stock market, most probably the majority would opt for the savings account, which makes sense for the short term. However, for the longer term, a well-diversified investment, will outperform by far. Since interest rates have reached record low levels, the opportunity cost of holding money in a bank account has increased.

On the other hand, investing in the stock market on a regular basis will reduce the negative impact of sudden and sharp declines in investment prices. This strategy is often referred to as cost averaging. This technique will eliminate market timing, which is impossible especially during market turmoil – something which we have experienced recently when the markets fell by more than 25% due to the chaos caused by COVID-19.

Like any other investment, when you opt for a regular investment plan, you need to determine what your investment objective is. This will define the goal of your investment which could either be a saving pot for when you retire, or even an accumulated sum of money for your child or grandchild. The next step, is to determine how much you can invest. Can you start off with a lump sum together with regular monthly contributions? What will be the monthly contribution sum you can afford?

An investment advisor would normally help you set your objective based on your risk tolerance and needs. This will determine the regular monthly contributions you need to fork out together with the percentage allocation invested in stocks and bonds. This is generally done by selecting an investment strategy according to your risk tolerance with the desired diversification in terms of securities and sectors. When one invests in a regular investment plan, the minimum initial sum invested is normally waived to encourage investors to start from a young age and getting into the habit of investing. The longer the term of investment, the greater the possibility of a higher return. Over the long term, stock markets tend to rise. Thus, the earlier you can enter the market and keep your money there, the greater the potential to generate higher returns compared to investors who try to time the market.

Once all these factors have been determined, you need to be disciplined to stick to your monthly commitment and drip feed your plan to accumulate a lump sum over the years. In order to make the plan run smoothly without any hiccups, it is suggested that you have a standing order or a direct debit mandate set by your bank when your monthly wage falls due. This arrangement will not make you hesitant to effect contributions if the market drops, as in actual fact, you will be buying more shares at a cheaper price. Investing in such a manner will give you the opportunity to lower the average cost of shares with the chance of increasing your returns in the long term when the market will bounce back. It is very common that during a market turmoil, investors try to time the market bottom in order to buy at the lowest price or stay away from investing as they fear from an economic meltdown. In reality, the longer you delay your investment the more likely you will miss out on the opportunity when markets rebound. This all adds up to the fact that it is better to spend more time in the market than spending your time timing the market.

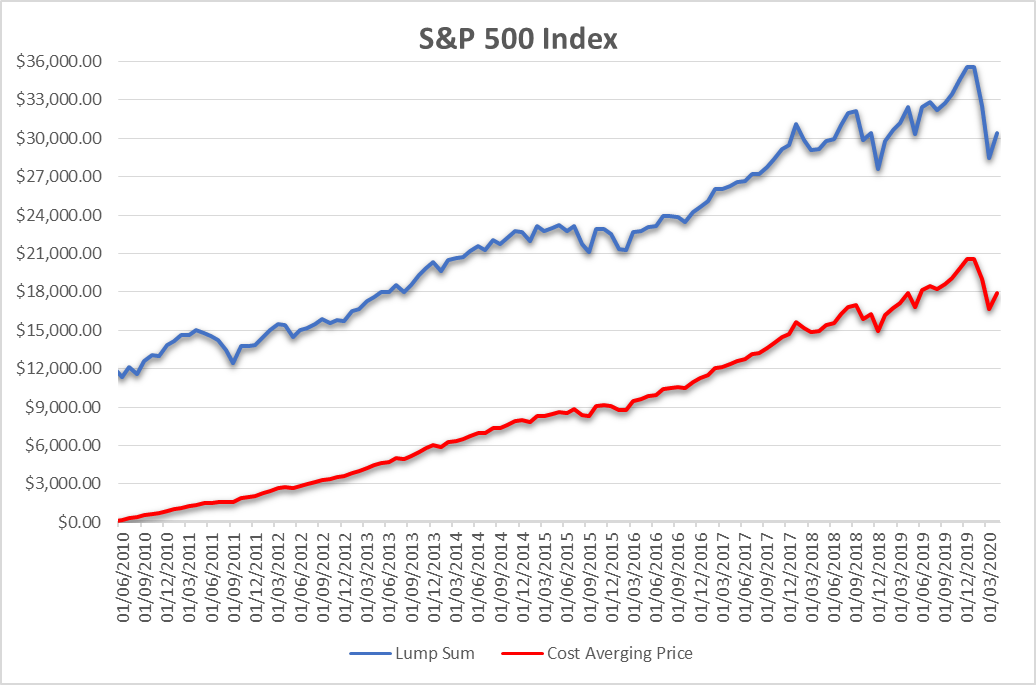

Over the long term, the stock market has the potential to generate attractive returns for your money. If for example an investor had to invest a lump sum of $12,000 in the S&P 500 index in June 2010, it would now be worth over $30,000. This would entail the investor to stick to his investment and be able to digest the volatility the market has experienced throughout the years. On the other hand, if an investor would have started investing $100 a month for the past 10 years the accumulated sum of $12,000 would be worth nearly $18,000. It is not hard to realise the outperformance of a lump sum investment, due to the uninterrupted bull market the US market went through since hitting bottom in the early 2009. Then again, by drip feeding you are eliminating the risk of having large fluctuations in your portfolio if the market is faced with sharp declines soon after you would have invested. It is a fact that long term averaging hides the bumps, resulting in a smoother performance.

All in all, long term regular investment contributions or drip feeding will help you exploit the benefit of cost averaging. This strategy will eliminate the headache of investors trying to time the market and remove the fear of buying at a high price during times where the market is increasing and sell low when markets drop. Markets tend to fluctuate considerably, and this causes many investors to feel anxious. Regular contribution is a key to avoid such anxiety and make your investment strategy a success.

Matthew Magro, B.Com (Hons) Banking & Finance, is an Investment Advisor at Jesmond Mizzi Financial Advisors Limited. This article does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Investors should remember that past performance is no guide to future performance and that the value of investments may go down as well as up. For further information contact Jesmond Mizzi Financial Advisors Limited of 67, Level 3, South Street, Valletta, on Tel: 2122 4410, or email [email protected]