MSE Trading Report for Week ending 22 May 2020

| MSE Equity Total Return Index: |

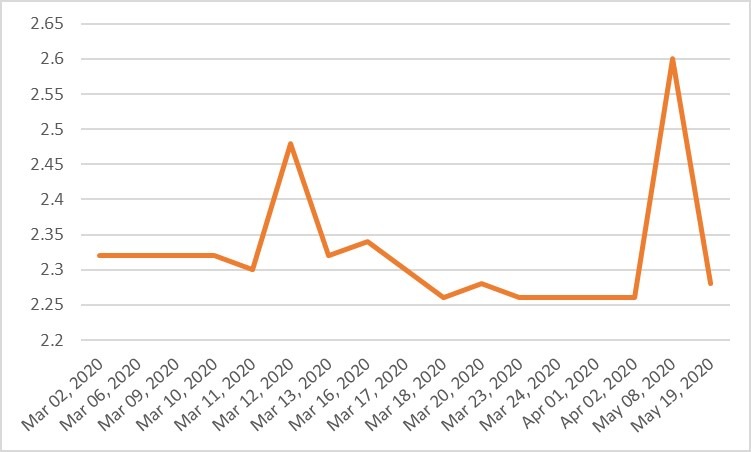

| Chart of the Week: Mapfre Middlesea plc |

| Highlights: |

- The MSE Equity Total Return Index extended the previous week’s decline by a further 1.3%, as it reached 8,060.937 points. A total of 17 equities were active, of which gainers and losers tallied to seven-apiece. A total weekly turnover of €717k was generated across 129 transactions.

- This contrasts to the broader European and US equity market, which headed north as focus shifted on the vaccine development with hope of an economy recovery in the near future – stymied by increased tensions between the US and China, showing a potential threat to the first phase of the trade deal signed earlier this year. The weekly rally has also run out of steam as earlier in the week, the US senate passed legislation which could restrict listing from Chinese companies on American exchanges if they do not abide by US regulations and audit standards.

- In the banking industry, Bank of Valletta plc reached a six-week low of €1.00 but managed to recoup part of its lost ground by end of week, to close at the €1.02 price level. A total of 13 deals involving 35,988 shares were executed.

- Its peer, HSBC Bank Malta plc, traded 0.5% higher as 29,422 shares changed hands across nine transactions. The bank ended the week at the €0.96 price mark.

- Last Wednesday, Lombard Bank Malta plc announced its interim directors statement and COVID-19 update.

- The bank’s financial performance stands to be negatively impacted since economic forecasts have been suggesting that the local economy is set for a contraction this year. Though it is unlikely that the bank’s original objectives will be achieved, it is not considered prudent to attempt any medium-term forecasts, given the current level of uncertainty. Apart from the reduction in international trade and increased caution by local businesses, other relevant factors are still evolving, such as higher unemployment together with a subdued business sentiment.

- Some highlights taken from the latest financial information are relevant. Net interest income declined marginally due to higher interest payable on increased volumes of customer deposits and pressure from negative interest rates on excess liquidity. Fees and commission also decreased as the second quarter progresses. Likewise, transaction banking activity and international payments experienced lower volumes.

- Meanwhile costs remain well under control and in line with expectations. Net loans and advances to customers remained virtually unchanged and customer deposits continued to increase from the end of the previous year. The bank maintains a strong total capital ratio, which is well above the minimum regulatory requirements.

- The bank’s balance sheet remains strong, with total assets at the same levels of the previous year, while healthy liquidity ratios continue to be actively managed and monitored. The loans to deposits ratio stands at a prudent 59%. Moreover, the bank’s loans and advances portfolio includes facilities for medium-term projects which should not be unduly impacted by the short-term economic environment and, to date, the bank has not experienced any need to increases provisions for expected credit losses as a direct result of the pandemic. The bank is well equipped to increase provisions should the economic situation deteriorate such that the repayment ability of its borrowing customers becomes impaired. Meanwhile, the bank has introduced its own support measures to complement those introduced by Government to assist the economy.

- Despite the challenges being faced by the bank’s main subsidiary, MaltaPost plc continued to deliver postal services uninterruptedly, with only minor disruptions, mainly in deference to consideration of health and safety issues. However, other operational activity areas have been severely impacted, not least by the sharp decline in flight connections to and from Malta. This unplanned interruption has negatively affected some of the subsidiary’s more important revenue streams, and which are in part being rigorously mitigated through the efficient and judicious management of costs, together with other related efficiencies.

- The bank registered a 1% drop in price, as it reached €2.08. Two deals involving a mix of 10,000 shares were executed.

- Last Friday, FIMBank plc issued an announcement following that published by the bank’s majority shareholder, United Gulf Holding Company BSC on the Bahrain Bourse as well as subsequent media reports indicating that the bank has an exposure to Phoenix Commodities Pvt Ltd. The latter is an agri-trader, with offices in Dubai and Singapore, and has recently encountered significant financial difficulties. The bank confirmed that it has a business relationship, in their capacity as co-borrowers with Phoenix Commodities and with Phoenix Global DMCC. Phoenix Commodities, being the holding company, has recently entered into liquidation. The bank’s assessment of net exposure towards the Phoenix Group is $8.5 million, and in this early stage, the bank is evaluating its legal position and implementing all risk mitigants which have been created when establishing the facility in discussion. The equity last traded on April 1, 2020.

- Last Tuesday, GO plc announced that the board has not yet taken a final decision regarding the re-evaluation of the recommendation to pay a dividend of €0.14, net of tax. The equity reached a 20-month low of €3.56 during the week but managed to off-set the loss by end of week. The previous week’s closing price of €3.60 was not impacted, as 19,058 shares changed ownership across 11 transactions. Its subsidiary, BMIT Technologies plc, was up by 4% as it closed at €0.478. Two deals involving 1,000 shares were executed.

- International Hotel Investments plc registered the highest liquidity with a total weekly turnover of €294,036. A total of 15 deals involving 542,272 shares dragged the price into the red by 5.3%. The equity closed at a six-week low price of €0.54.

- Heading the list of fallers, Mapfre Middlesea plc shares plunged by 12%, as two deals of 2,171 shares led to a closing price of €2.28. On the other hand, second to none, GlobalCapital plc registered a double-digit gain of 43%. Two deals involving 29,055 shares pushed the price upwards to €0.33.

- The MSE MGS Total Return Index remained relatively flat as it registered a 0.01% increase, ending the week at 1,107.17 points.

- A Franco-German proposal for a €500 billion recovery fund is expected to be an essential relief, ECB President Christine Lagarde said last Monday. This COVID-19 relief fund still requires the consent of all EU members, which is aimed to be used as grants for sectors and regions impacted the most by the ongoing pandemic.

- In the local sovereign market, a total of 15 issues were active, of which eight advanced while another seven closed in the red. The 2.3% MGS 2029 (II) headed the list of gainers with a 5% increase, as it closed at €121.20. Meanwhile, the 4.3% MGS 2033 (I) lost 6%, ending the week at €141.49.

- The MSE Corporate Bonds Total Return Index lost 0.234% as it reached 1,062.54 points. Out of 38 active issues, nine headed north while another 19 closed in the opposite direction. The top performer was the 4% International Hotel Investments plc Unsecured € 2026, as it closed 0.7% higher at €99.00. On the other hand, the 3.75% AXI 2029 S2 lost 2.2%, to close at €100.75.

- In the Prospects MTF market, seven issues were active. The 5.75% Pharmacare Finance plc Unsecured EUR Bonds 2025-2028 was the most liquid, with a total turnover of €10,000

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. GCL | +43.48% | |||

| 27 MAY 2020 | MT: Simonds Farsons Cisk plc – Results | 2. MSC | +6.90% | |

| 29 MAY 2020 | MT: MaltaPost plc – Interim Results | 3. BMIT | +3.91% | |

| 29 MAY 2020 | MT: Medserv plc – Results | |||

| 04 JUN 2020 | EU: ECB – Monetary Policy Meeting | Worst Performers: | ||

| 10 JUN 2020 | US: FED – Monetary Policy Meeting | 1. MMS | -12.31% | |

| 2. IHI | -5.26% | |||

| 3. MTP | -3.31% | |||

| Price (€): 22.05.2020 | Price (€): 15.05.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 8,060.937 | 8,169.326 | -1.327 | -16.169 |

| BMIT Technologies plc | 0.478 | 0.460 | 3.91 | -8.08 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.020 | 1.040 | -1.92 | -3.77 |

| FIMBank plc (USD) | 0.470 | 0.470 | 0.00 | -21.67 |

| GlobalCapital plc | 0.330 | 0.230 | 43.48 | 17.86 |

| Grand Harbour Marina plc | 0.750 | 0.750 | 0.00 | 36.36 |

| GO plc | 3.600 | 3.600 | 0.00 | -15.49 |

| Harvest Technology plc | 1.490 | 1.460 | 2.05 | -0.67 |

| HSBC Bank Malta plc | 0.960 | 0.955 | 0.52 | -26.15 |

| International Hotel Investments plc | 0.540 | 0.570 | -5.26 | -34.94 |

| Lombard Bank plc | 2.080 | 2.100 | -0.95 | -8.77 |

| Loqus Holdings plc | 0.097 | 0.097 | 0.00 | 50.39 |

| MIDI plc | 0.420 | 0.420 | 0.00 | -22.22 |

| Medserv plc | 0.700 | 0.700 | 0.00 | -36.36 |

| Malta International Airport plc | 4.940 | 4.900 | 0.82 | -28.41 |

| Malita Investments plc | 0.890 | 0.890 | 0.00 | -1.11 |

| Mapfre Middlesea plc | 2.280 | 2.600 | -12.31 | 5.56 |

| Malta Properties Company plc | 0.540 | 0.540 | 0.00 | -14.29 |

| Main Street Complex plc | 0.496 | 0.464 | 6.90 | -17.33 |

| MaltaPost plc | 1.170 | 1.210 | -3.31 | -10.69 |

| PG plc | 1.900 | 1.850 | 2.70 | 3.26 |

| Plaza Centres plc | 0.980 | 0.980 | 0.00 | -2.97 |

| RS2 Software plc | 1.950 | 1.970 | -1.02 | -8.88 |

| Simonds Farsons Cisk plc | 8.050 | 8.250 | -2.42 | -30.00 |

| Santumas Shareholdings plc | 1.360 | 1.360 | 0.00 | -3.55 |

| Tigné Mall plc | 0.850 | 0.850 | 0.00 | -5.56 |

| Trident Estates plc | 1.550 | 1.550 | 0.00 | 0.00 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].