MSE Trading Report for Week ending 06 November 2020

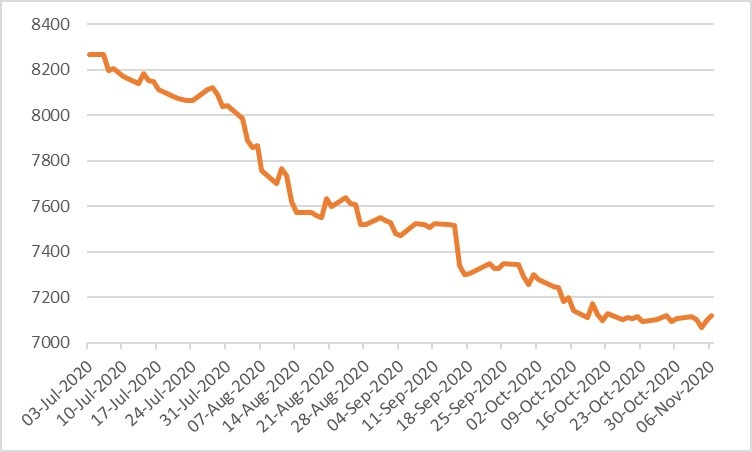

| MSE Equity Total Return Index: |

| Chart of the Week: International Hotel Investments plc |

| Highlights: |

- The MSE Equity Total Return Index advanced by a further 0.14%, as it reached 7,117.922 points. Out of 16 active equities, four headed north while 10 lost ground. Total weekly turnover increased by €0.3m to €1.1m, spread over 106 transactions.

- This week’s top performance was recorded by International Hotel Investments plc, as it bounced back with a 12% change in price, after no trades were recorded the previous week. Total turnover amounted to €194,187 as 356,509 shares were spread across 15 transactions. The equity closed at an almost four-month-high price of €0.56.

- RS2 Software plc ended the week €0.06 or 3% higher, as it reached the €2.06 price level. A total of 36,799 shares were spread across seven transactions.

- HSBC Bank Malta plc (HSBC) shares were the most liquid, as turnover reached €0.5 million – which is five times more compared to the previous week. The banking equity traded at a weekly low of €0.70 but closed unchanged at €0.71. A total of 37 deals involving 744,505 shares were executed.

- Yesterday, HSBC published the resolutions which will be considered, and if deemed fit, approved during the Annual General Meeting, which is going to be held remotely on November 27, 2020.

- The shareholders will receive and approve the audited accounts for the year ended December 31, 2019, together with the reports of the directors and auditors thereon.

- On Monday, Bank of Valletta plc issued its interim directors’ statement.

- The Covid-19 situation continued to strongly influence the activities of the bank during the third quarter of the year.

- Elements of improvement over the second quarter were experienced as restrictions were eased, but the prolongation of the situation entails overall lower business volumes and revenues, compared to last year. This is evident in lower fees and commissions, since travel, foreign exchange and transaction business activity remain subdued.

- However, conditions can be expected to deteriorate through a prolongation of the pandemic. The bank is thus regularly reviewing credit loss provisions and developing strategies to support customers who start to experience material difficulties.

- The bank is expecting some tailwinds during the second half of the year, as we see a recovery to P&L from the settlement of the Swedish Pension Agency ‘Falcon Fund’.

- In addition, a reinforced focus on recoveries of long-standing lending assets previously written-off, is leading to positive outcomes.

- While BOV remains fully committed to resolving the Deiulemar situation, it is not able to report any further tangible progress at this point.

- The bank added that an extension for over €200 million was given to clients under the bank’s Covid-19 Assist scheme, which is supported by the Malta Development Bank.

- Demand for home loans also picked up lately after the slowdown earlier in the year.

- Corporate deposits decreased marginally in recent months, in line with the Bank’s de-risking initiatives. This was offset by growth in the retail sector as personal spending was generally subdued.

- The Bank’s capital and liquidity positions remained very strong, as the Group continues to prioritise the optimisation of regulatory capital.

- Significant progress was registered in the risk management and compliance activities of the Bank.

- The share price of the bank lost 3%, as 102,197 shares changed hands over 16 deals, ending the week at €0.854.

- FIMBank plc was only active yesterday, as five deals involving 52,022 shares were executed. As a result, the price declined to $0.29 – equivalent to a 3.3% change in price.

- The bank announced that during the Annual General Meeting, to be held on November 30, 2020 the audited accounts for the financial year ended December 31, 2019 together with the report of the directors, the corporate government statement, the remuneration report and the report of the auditors thereon, shall be received and approved.

- Last Friday October 30, Lombard Bank plc announced that it has been informed by the FIAU that the latter has imposed an administrative penalty on the bank for what were considered as breaches in certain AML/CFT obligations.

- On Monday, the bank informed the market with its intentions to contest each and every finding at the appeal stage.

- During the week no trading activity was recorded in the banking equity.

- On Thursday, GO plc entered into a Share Purchase Agreement with Newco United Group Hellas S.A.R.L. for the sale of its 24,887,737 shares in Hellenic Telecommunication and Telematic Applications S.A. (“Forthnet S.A.”) at a total price of €3,235,405.

- Completion of the transfer of the shares is scheduled to take place by not later than November 11, 2020.

- The proceeds from the sale of the shares will be redeployed in GO’s local operations.

- Three deals involving 6,082 shares were executed, leaving no impact on the equity’s previous week’s closing price of €2.90, despite trading at a weekly high of €2.92.

- On Wednesday, Plaza Centres plc announced that as part of the share buy-back it has received 16 different offers from shareholders, for an aggregate of 3,822,632 shares, who expressed an interest in selling back their shares in the company.

- The best offers received by the company was for a total of 1,000,000 shares at the price of €0.92c5.

- In line with the terms announced, these shares will be traded on the Malta Stock Exchange for value on November 10, 2020.

- The equity ended the week at €0.925 – translating into a negative 3.7% change in price. Two deals involving 12,802 shares were executed.

- On Wednesday, the board of Harvest Technology plc announced that, having considered the position of the company, it has resolved to distribute an interim net dividend of €364,490 (subject to rounding), equivalent to €0.016 per share (having a nominal value of €0.50 per share).

- This was considered by reference to the interim financial statements for the financial period ended June 30, 2020, approved and published on July 28, 2020 as well as the management accounts of the Company as at September 30, 2020.

- Shareholders appearing on the company’s register as at close of business yesterday, shall be entitled to receive the dividend, payment of which shall be effected by not later than November 18, 2020.

- The board also announced that the unaudited consolidated net profit before tax of the company and its subsidiaries (the Harvest Group) as at end of September 2020 amounted to €2,876,309.

- This marks an improvement of 22% over the projected consolidated net profit before tax of the Harvest Group for the period.

- The equity closed 0.7% higher at €1.46, as 8,500 shares were spread over two deals.

- The MSE MGS Total Return Index declined marginally once again to 1,131.08 points. Out of 19 active issues, gainers and losers tallied to nine-a-piece. The 2.5% MGS 2036 (I) headed the list of gainers, as it closed 2.4% higher at €126.00. On the other hand, the 2.3% MGS 2029 (II) traded 5.5% lower at €121.00.

- The MSE Corporate Bonds Total Return Index closed 0.1% higher at 1,081.82 points. A total of 50 issues were active, 14 of which advanced while another 20 declined. The best performer was the 5% Dizz Finance plc Unsecured € 2026 as it ended the week at €98.99 – translating into a 1.6% movement. Conversely, the 6% Pendergardens Developments plc Secured € 2022 Series II lost 4.2%, to close at €100.61.

- In the Prospects MTF market, six issues were active. The 5% JD Capital plc Unsecured € Bonds 2028 was the most liquid and the only positive performer, as it closed the week at €98.70.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. IHI | +12.00% | |||

| 11 NOV 2020 | MT: Malta International Airport plc – Annual General Meeting | 2. RS2 | +3.00% | |

| 26 NOV 2020 | MT: Bank of Valletta plc – Annual General Meeting | 3. MLT | +2.30% | |

| 27 NOV 2020 | MT: HSBC Bank Malta plc – Annual General Meeting | |||

| 30 NOV 2020 | MT: FIMBank plc – Annual General Meeting | Worst Performers: | ||

| 02 DEC 2020 | MT: Lombard Bank Malta plc – Annual General Meeting | 1. GCL | -7.41% | |

| 2. BMIT | -4.92% | |||

| 3. MDE | -4.00% | |||

|

|

Price (€): 06.11.2020 | Price (€): 30.10.2020 | Weekly Change (%) | 2020 Performance (%) |

| MSE Equity Total Return Index | 7,117.922 | 7,107.928 | 0.14 | -25.98 |

| BMIT Technologies plc | 0.464 | 0.488 | -4.92 | -10.77 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.854 | 0.880 | -2.95 | -16.43 |

| FIMBank plc (USD) | 0.290 | 0.300 | -3.33 | -51.67 |

| GlobalCapital plc | 0.500 | 0.540 | -7.41 | 78.57 |

| Grand Harbour Marina plc | 0.700 | 0.700 | 0.00 | 27.27 |

| GO plc | 2.900 | 2.900 | 0.00 | -31.92 |

| Harvest Technology plc | 1.460 | 1.450 | 0.69 | -2.67 |

| HSBC Bank Malta plc | 0.710 | 0.710 | 0.00 | -45.38 |

| International Hotel Investments plc | 0.560 | 0.500 | 12.00 | -32.53 |

| Lombard Bank plc | 1.940 | 1.940 | 0.00 | -14.91 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | 0.78 |

| MIDI plc | 0.340 | 0.340 | 0.00 | -37.04 |

| Medserv plc | 0.480 | 0.500 | -4.00 | -56.36 |

| Malta International Airport plc | 4.620 | 4.720 | -2.12 | -33.04 |

| Malita Investments plc | 0.890 | 0.870 | 2.30 | -1.11 |

| Mapfre Middlesea plc | 1.970 | 1.970 | 0.00 | -8.80 |

| Malta Properties Company plc | 0.500 | 0.520 | -3.85 | -20.63 |

| Main Street Complex plc | 0.450 | 0.450 | 0.00 | -25.00 |

| MaltaPost plc | 1.180 | 1.180 | 0.00 | -9.92 |

| PG plc | 1.900 | 1.910 | -0.52 | 3.26 |

| Plaza Centres plc | 0.925 | 0.960 | -3.65 | -8.42 |

| RS2 Software plc | 2.060 | 2.000 | 3.00 | -3.74 |

| Simonds Farsons Cisk plc | 6.750 | 6.950 | -2.88 | -41.30 |

| Santumas Shareholdings plc | 1.490 | 1.490 | 0.00 | 5.67 |

| Tigné Mall plc | 0.795 | 0.795 | 0.00 | -11.67 |

| Trident Estates plc | 1.510 | 1.510 | 0.00 | -2.58 |

* Trading commenced on January 7, 2020

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]