Market behaviour during US elections

Markets tend to be more volitle during a presidential election and the increase in Covid-19 cases is not helping the situation as the path back to normality remains unclear. One thing is clear, the market can’t stand uncertainty and if there isn’t a clear winner or if the result will be contested by the time you are reading this article, then you can expect some short-term volatility.

Markets tend to be more volitle during a presidential election and the increase in Covid-19 cases is not helping the situation as the path back to normality remains unclear. One thing is clear, the market can’t stand uncertainty and if there isn’t a clear winner or if the result will be contested by the time you are reading this article, then you can expect some short-term volatility.

In the current political environment, if the opposing party holds majority in the Senate and House, the Presidential candidate will be limited to introduce significant economic changes. The chief investment strategist at BlackRock, Russ Koesterich argues that “divided power saves both parties from their worst instincts. With neither party in control, government is somewhat neutered, leaving markets free to flourish”. On the other hand, a complete sweep meaning that the President and both houses (the Senate and the House of Representatives) are from the same party, increases the possibility of significant market impacts.

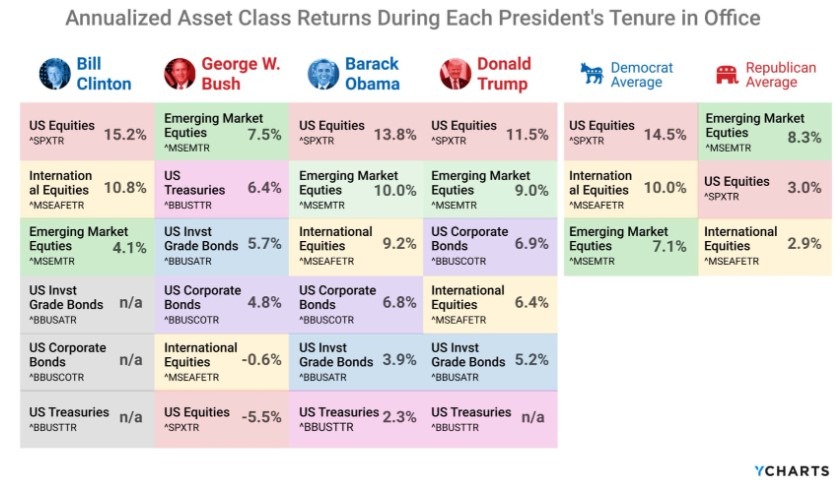

In general, there is the perception that the stock market would perform better if the Republicans, who are considered to be more business friendly than the Democrats, had to be elected. However, according to YCharts data below, when the Democrats were in control of the White House, since Bill Clinton’s appointment in 1993, US equities have increased by 14.5% on average as opposed to 3% when the Republicans are in government.One can also note a similar trend in international equities, whilst the Republicans also referred to as the ‘Grand Old Party’ (GOP) have that slight edge with regards to emerging market stocks.

I will now focus the rest of my article on some key measures that will affect the market depending on whether Donald Trump or Joe Biden are elected. Without any doubt, the most debatable factor which was one of the main causes why the market fluctuated so much during the current legislation is international trade. Trump was the first president that attacked China’s trade policies since China became one of the leading exporting countries by imposing $350 billion in tariffs. He is also confirming that further negotiations will take place if he will be re-elected, in order to reduce the trade deficit and for America to become more independent. Biden tends to agree with Trump’s approach on China, but it is not clear whether he will be assertive and determined as much. The difference between the two lies more on how they will manage relations with the other trade partners Canada, Mexico, Europe and Japan of which Trump had also introduced tariffs in certain cases. It seems that more actions will take place if he is back in government which will have a negative effect on the US dollar as foreign countries will be constrained to use their currencies for trade. Conversely, Biden tends to adopt a friendlier approach and any trade agreements which are in place will most likely remain as they are.

Another factor which is very much debatable and which will affect the stock market is taxes. Trump has temporarily reduced taxes in 2018 and is allowing the deferral of payroll taxes for low and middle-class wage earners. If Trump will be re-elected such measures will be implemented permanently and he will reduce taxes further for both individuals and corporations. Biden, on the other hand has promised not to raise taxes on individuals earning less than €400,000 annually, but will most likely raise taxes for the wealthy people and increase the minimum wage. In fact, JP Morgan believes that stockholders might experience an increase in their tax burden if Biden is elected whilst the increase in minimum wage could have a negative impact towards labour-intensive industries and a positive effect in the consumer sector.

Another important element which would affect the stock market is regulation. During the current legislation, Trump has withdrew a number of regulations which include those in agriculture, education, environmental, finance, health, housing, labour and transportation. If he is re-elected, such deregulation is expected to continue in the second term. This will favour corporate earnings. The democrats are more in favour of renewable energy products, so Biden will focus more on reducing carbon emissions, investing in green energy including electric vehicle eco-system, more efficient infrastructures and increase spending in education and healthcare. He also has the intention of expanding the Obamacare healthcare programme to a bigger part of the population which may have a negative impact on pharmaceutical companies. Trump’s agenda, on the other hand, is more pro domestic carbon energy and could be more positive for those carbon-intensive parts of the economy such as energy and utilities.

It is evident that presidential elections will affect the market’s various sectors and indices depending on which party is in government and how much that party is in control. Thus, one has to ensure that your portfolio is well diversified and rebalanced when necessary, without trying to time the market. When investing for the long-term, it is recommended that you stick to your strategy which is longer than one presidential term and ride any short-term volatility that market conditions may bring.

Matthew Magro,B.Com (Hons) Banking & Finance, is an Investment Advisor at Jesmond Mizzi Financial Advisors Limited. This article does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Investors should remember that past performance is no guide to future performance and that the value of investments may go down as well as up. For further information contact Jesmond Mizzi Financial Advisors Limited of 67, Level 3, South Street, Valletta, on Tel: 2122 4410, or email [email protected]