MSE Trading Report for Week ending 13 November 2020

| MSE Equity Total Return Index: |

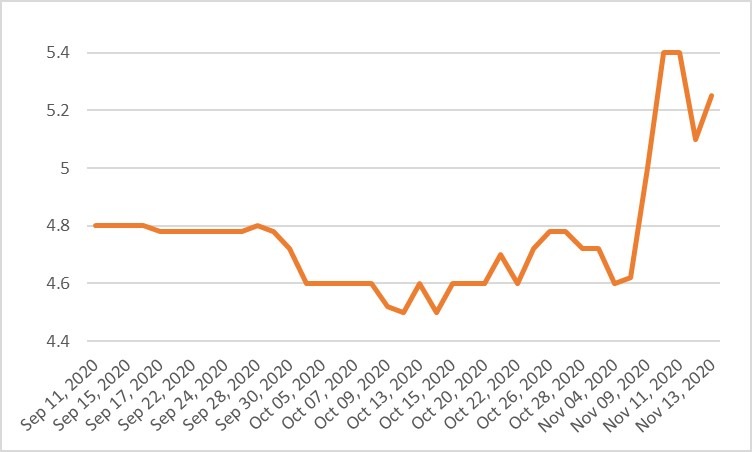

| Chart of the Week: Malta International Airport plc |

| Highlights: |

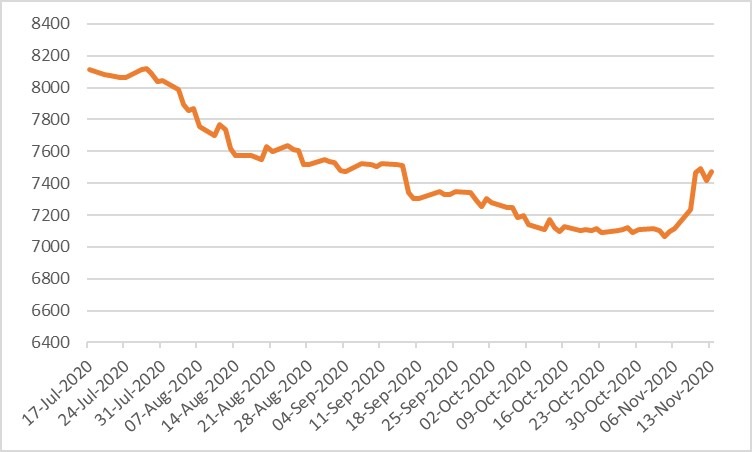

- The MSE Equity Total Return Index closed higher for the third consecutive week, as it closed 5% higher at 7,470.616. A total of 18 equities were active, 11 of which headed north while another five closed in the opposite direction. Total weekly turnover amounted to €1.2 million, generated across 207 transactions.

- Malta International Airport plc (MIA) shares jumped by a whopping 14% as the equity closed the week at €5.25. During the week the equity traded at a three-month-high of €5.40 and a weekly low of €4.80. MIA shares were the most liquid, as increased hopes of a possible vaccine in the coming months, improved investors’ sentiment towards tourism and hospitality related equities. A total of 41 deals involving 53,973 shares generated a total weekly turnover of €275,952.

- On Wednesday, MIA announced October’s traffic results and the financial results for the first nine months of 2020.

- In October, the airport welcomed 110,346 passengers, bringing the year-to-date traffic up to 1,661,700 passenger movements. This translates into a drop of 73.8% when compared to the same period of the last year.

- Total revenue generated between January and September 2020 amounted to €24.9 million, equivalent to a 67.7% drop from the previous year’s figure over the same comparable period.

- Profit before tax stood at a negative €1.4 million versus a €42 million profit recorded during the same period of 2019.

- In April 2020, MIA implemented a cost-cutting and liquidity preservation programme. Staff costs declined by 24.1% for the first three quarters of 2020 as a result of a reduction in management and employee wages from April until July 2020, together with contributions from the government Covid-19 wage scheme.

- Similarly, operating costs were down by 38.4% as several measures were taken, including revision of its maintenance programme, to focus solely on essential works.

- The aviation industry has now entered the winter period, which is expected to be more challenging.

- MIA is confident that the financial resilience amassed over the past decade, together with the right team of employees, has put it in a good position to continue facing Covid-related challenges and eventually emerge from this crisis.

- MIA also held its 28th Annual General Meeting on Wednesday. The financial statements for the financial year ended December 31, 2019 and the directors’ and auditors’ report thereon as set out in the annual report, were approved.

- During the meeting, a final gross dividend of €0.046 per share (net €0.03) which represents a payment of €4,059,000 was also considered and approved.

- The banking sector also enjoyed a strong week, as all three active equities closed in the green. HSBC Bank Malta plc registered a total turnover of €270,033 as 369,650 shares were spread over 35 deals. The banking equity reached a weekly high of €0.79 on Tuesday but closed at €0.75 – equivalent to a positive 5.6% change in price.

- Its peer, Bank of Valletta plc, was up by nearly 9%, as it reached the €0.93 price level. During the week the banking equity traded between a low of €0.86 and a high of €0.94. This was the result of 31 deals involving 119,946 shares.

- On Wednesday, Lombard Bank Malta plc announced that the Annual General Meeting shall be held on December 2, 2020. The audited financial statements for the financial year ended December 31, 2019 and the directors’ and auditors’ reports thereon shall be received and, if thought fit, approved. No trading activity was recorded during the week.

- Turnover in RS2 Software plc doubled to €145,775 when compared to the previous week. The equity traded at a weekly high of €2.16 but ended the week at €2.08 – translating into a 1% increase. A total of 71,534 shares changed hands over 18 deals.

- The best performance was recorded by Simonds Farsons Cisk plc, as it reached the €8.30 level during yesterday’s final trading minutes. During the week a total of 12 deals involving 4,157 shares pushed the price up by 23% to a 24-week-high-price.

- Malta Properties Company plc lost 4%, as 205,630 shares change ownership over 19 deals, to close at €0.48.

- On Monday, Plaza Centres plc announced that the company shall once again be offering its shareholders the opportunity to tender their shares to the company, if they so desire, at any price within a range of €0.90 to €0.95. This price range has been reduced, in line with bids made in the last exercise, where the winning bid was closed at €0.92.5.

- The maximum number of shares that it will acquire from shareholders as part of the auction process already announced is 1,000,000 shares.

- Once accepted any shares tendered shall be traded on the Malta Stock Exchange for value on November 19, 2020.

- The equity was not active during the week.

- The MSE MGS Total Return Index declined by a further 0.2%, as it reached 1,128.75 points. A total of 16 issues were active, six of which closed higher while nine declined. The top performer was the 2.5% MGS 2036 (I), as it traded 1.6% higher at €128.00. On the other hand, the 2.1% MGS 2039 (I) closed 5.3% lower at €125.00.

- The MSE Corporate Bonds Total Return Index lost ground as it closed 0.3% lower at 1,078.94 points. Out of 49 active issues, 17 advanced while another 19 traded lower. The 4% International Hotel Investments plc Unsecured € 2026 was the best performer, as it closed 4.2% higher at €98.95. Conversely, the 6% Mediterranean Investments Holding plc Euro 2021 lost 5%, ending the week at €95.00.

- In the Prospects MTF market, five issues were active. The 5.5% Testa Finance plc € Bonds 2029 was the most liquid and closed flat at €98.70.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. SFC | +22.96% | |||

| 26 NOV 2020 | MT: Bank of Valletta plc – Annual General Meeting | 2. MIA | +13.64% | |

| 27 NOV 2020 | MT: HSBC Bank Malta plc – Annual General Meeting | 3. BOV | +8.90% | |

| 30 NOV 2020 | MT: FIMBank plc – Annual General Meeting | |||

| 02 DEC 2020 | MT: Lombard Bank Malta plc – Annual General Meeting | Worst Performers: | ||

| 15 DEC 2020 | MT: RS2 Software plc – Extraordinary General Meeting | 1. MTP | -11.02% | |

| 2. TML | -5.66% | |||

| 3. MDI | -5.29% | |||

|

|

Price (€): 13.11.2020 | Price (€): 06.11.2020 | Weekly Change (%) | 2020 Performance (%) |

| MSE Equity Total Return Index | 7,470.616 | 7,117.922 | 4.96 | -22.31 |

| BMIT Technologies plc | 0.484 | 0.464 | 4.31 | -6.92 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.930 | 0.854 | 8.90 | -12.26 |

| FIMBank plc (USD) | 0.300 | 0.290 | 3.45 | -50.00 |

| Grand Harbour Marina plc | 0.700 | 0.700 | 0.00 | 27.27 |

| GO plc | 3.000 | 2.900 | 3.45 | -29.58 |

| Harvest Technology plc | 1.480 | 1.460 | 1.37 | -1.33 |

| HSBC Bank Malta plc | 0.750 | 0.710 | 5.63 | -42.31 |

| International Hotel Investments plc | 0.575 | 0.560 | 2.68 | -30.72 |

| Lombard Bank plc | 1.940 | 1.940 | 0.00 | -14.91 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | 0.78 |

| LifeStar Holding plc | 0.500 | 0.500 | 0.00 | 78.57 |

| MIDI plc | 0.322 | 0.340 | -5.29 | -40.37 |

| Medserv plc | 0.480 | 0.480 | 0.00 | -56.36 |

| Malta International Airport plc | 5.250 | 4.620 | 13.64 | -23.91 |

| Malita Investments plc | 0.900 | 0.890 | 1.12 | 0.00 |

| Mapfre Middlesea plc | 1.970 | 1.970 | 0.00 | -8.80 |

| Malta Properties Company plc | 0.480 | 0.500 | -4.00 | -23.81 |

| Main Street Complex plc | 0.450 | 0.450 | 0.00 | -25.00 |

| MaltaPost plc | 1.050 | 1.180 | -11.02 | -19.85 |

| PG plc | 1.880 | 1.900 | -1.05 | 2.17 |

| Plaza Centres plc | 0.925 | 0.925 | 0.00 | -8.42 |

| RS2 Software plc | 2.080 | 2.060 | 0.97 | -2.80 |

| Simonds Farsons Cisk plc | 8.300 | 6.750 | 22.96 | -27.83 |

| Santumas Shareholdings plc | 1.490 | 1.490 | 0.00 | 5.67 |

| Tigné Mall plc | 0.750 | 0.795 | -5.66 | -16.67 |

| Trident Estates plc | 1.510 | 1.510 | 0.00 | -2.58 |

* Trading commenced on January 7, 2020

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]