MSE Trading Report for Week ending 08 January 2021

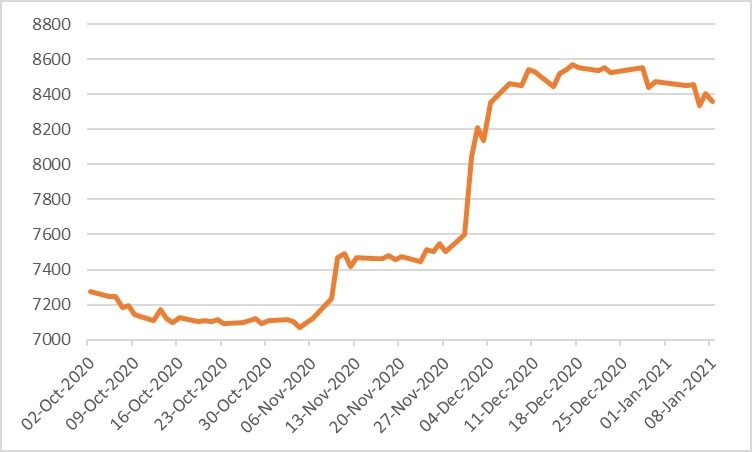

| MSE Equity Total Return Index: |

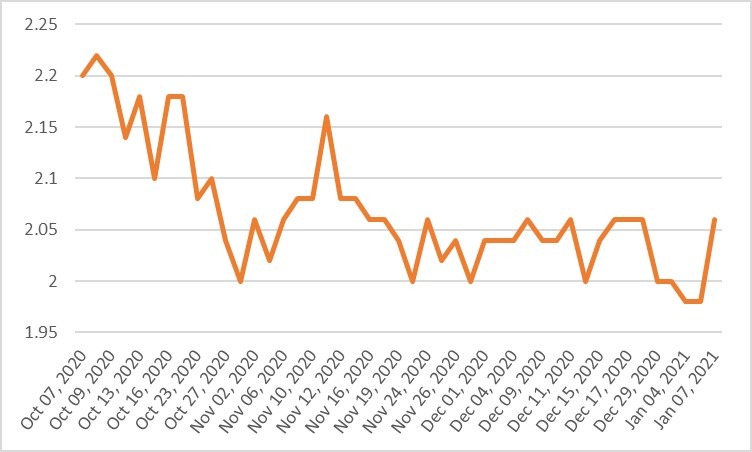

| Chart of the Week: RS2 Software plc |

| Highlights: |

- The MSE Equity Total Return Index kicked off the year on a negative note, as it lost 1.3% to close at 8,358.498 points. Out of 17 equities, two headed north while another 10 closed in the opposite direction. A total turnover of €0.8 million was generated across 121 transactions.

- The best performer was RS2 Software plc, as it registered a 3% increase in price, reaching €2.06. The equity started off the week in the red, but managed to close higher after a thin trade was executed on Thursday. During the week a total of nine deals involving 24,456 shares were executed.

- Lombard Bank Malta plc was the most liquid equity, as it generated a total turnover of €154,725. The equity was also the worst performer, registering a double-digit decline of 16.1%. Two deals involving 78,144 shares were executed, dragging the price to a six-week low price of €1.98.

- Meanwhile, Bank of Valletta plc (BOV) and HSBC Bank Malta plc (HSBC) were both active but finished the week flat. BOV saw 86,568 shares exchange hands across 19 deals worth €82,179. The banking equity’s price remained at €0.95, after trading at a weekly high of €0.97 and a low of €0.93.

- Its peer, HSBC, traded 10 times over a spread of 27,489 shares. The equity started off the week in the green at €0.91, declined to €0.86 mid-week, but managed to offset the loss yesterday, as it closed flat at €0.90.

- Malta International Airport plc declined by 0.8%, as it ended the week €0.05 lower at €6.15. A total of 21 deals involving 13,268 shares generated a total turnover of €81,790.

- Retail conglomerate, PG plc, closed at a 10-month high of €2.02, translating into a 1% increase. On Wednesday, the equity declined to €1.90 but managed to recover the following day. A total of 14 deals involving 26,270 shares were executed.

- In the property sector, Malta Properties Company plc registered the highest liquidity, as total turnover reached €144,427. Eight deals involving 288,900 shares were executed, leaving no impact on the equity’s previous closing price of €0.50.

- The MSE MGS Total Return Index declined by 0.7%, as it closed at 1,146.73 points. Out of 16 active issues, five registered gains while another six lost ground. The 4.3% MGS 2033 (I) headed the list of gainers, as it closed 1.2% higher at €148.00. On the other hand, the 5.25% MGS 2030 (I) lost 3.9%, ending the week at €147.00.

- The MSE Corporate Bonds Total Return Index was up by 0.5%, as it reached 1,099.16 points. A total of 48 issues were active, 22 of which gained ground while another 10 closed in the red. The best performance of 3.1% was recorded by the 6% Medserv plc Secured & Guaranteed € Notes 2020-2023 S1 T1, as it ended the week at par. Conversely, the 5.8% International Hotel Investments plc 2021 and the 4% Shoreline Mall plc Secured € Bonds 2026 both closed 1% lower at €99.01 and €100.00, respectively.

- In the Prospects MTF market, seven issues were active. The 5% Busy Bee Finance Company plc Unsecured € 2029 was the most liquid, as it generated a total turnover of €23,467 over three deals.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. RS2 | +3.00% | |||

| 2. PG | +1.00% | |||

| 14 JAN 2021 | MT: Loqus Holdings plc – Annual General Meeting | |||

| 12 FEB 2021 | MT: MaltaPost plc – Annual General Meeting | |||

| Worst Performers: | ||||

| 1. LOM | -16.10% | |||

| 2. MMS | -13.01% | |||

| 3. TRI | -9.64% | |||

|

|

Price (€): 08.01.2021 | Price (€): 30.12.2020 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 8,358.498 | 8,471.334 | -1.33 | -1.33 |

| BMIT Technologies plc | 0.480 | 0.482 | -0.41 | -0.41 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.950 | 0.950 | 0.00 | 0.00 |

| FIMBank plc (USD) | 0.500 | 0.500 | 0.00 | 0.00 |

| Grand Harbour Marina plc | 0.700 | 0.700 | 0.00 | 0.00 |

| GO plc | 3.500 | 3.540 | -1.13 | -1.13 |

| Harvest Technology plc | 1.460 | 1.480 | -1.35 | -1.35 |

| HSBC Bank Malta plc | 0.900 | 0.900 | 0.00 | 0.00 |

| International Hotel Investments plc | 0.720 | 0.720 | 0.00 | 0.00 |

| Lombard Bank plc | 1.980 | 2.360 | -16.10 | -16.10 |

| Loqus Holdings plc | 0.099 | 0.099 | 0.00 | 0.00 |

| LifeStar Holding plc | 0.500 | 0.500 | 0.00 | 0.00 |

| MIDI plc | 0.448 | 0.448 | 0.00 | 0.00 |

| Medserv plc | 0.775 | 0.790 | -1.90 | -1.90 |

| Malta International Airport plc | 6.150 | 6.200 | -0.81 | -0.81 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Mapfre Middlesea plc | 2.140 | 2.460 | -13.01 | -13.01 |

| Malta Properties Company plc | 0.500 | 0.500 | 0.00 | 0.00 |

| Main Street Complex plc | 0.498 | 0.500 | -0.40 | -0.40 |

| MaltaPost plc | 1.320 | 1.330 | -0.75 | -0.75 |

| PG plc | 2.020 | 2.000 | 1.00 | 1.00 |

| Plaza Centres plc | 0.980 | 0.980 | 0.00 | 0.00 |

| RS2 Software plc | 2.060 | 2.000 | 3.00 | 3.00 |

| Simonds Farsons Cisk plc | 7.800 | 7.800 | 0.00 | 0.00 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.850 | 0.850 | 0.00 | 0.00 |

| Trident Estates plc | 1.500 | 1.660 | -9.64 | -9.64 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]