When debt is a necessity

Now that many of us might feel relieved that 2020 is behind us, it might be interesting to analyse the aftermath brought about by the COVID-19 pandemic on the global debt burden and its implications going forward. As the situation on the ground is yet to get worse before it starts getting better, investor sentiment has roared over the past few months, fuelling equity markets with positive “unstoppable” momentum. Sentiment which would not have been revived had there not been a complementary increase in debt accumulation.

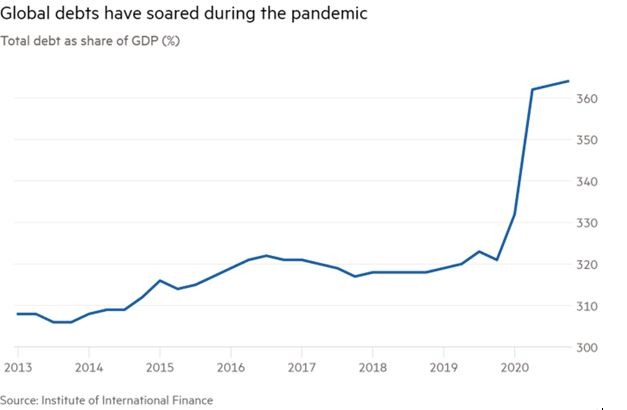

While debt build-up has been on a significant rise in absolute terms since 2016, studies carried out by the Institute of International Finance (IIF) highlight that out of the circa $52 trillion increase, $15 trillion was recorded in the first nine months of 2020. This happened as global GDP figures took a nose-dive as lockdowns and other travel restrictions kicked in. In fact, as a percentage of world GDP, global debt is estimated by economists to surpass the 365% mark, or circa $275 trillion – refer to Figure 1 below. Here I am referring to global total debt, in which case, less than half of that would be available via the traditional fixed-income tradeable public and corporate debt.

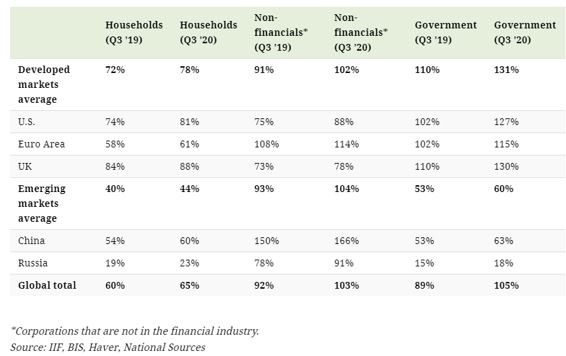

This is happening as the divergence in debt-to-GDP ratios that exists between developed and developing countries continues to widen as support from governments in developed countries came into place more heavily than in less developed regions. In fact, the same study by the IIF highlights that around half of the 50-percentage point increase in debt across developed nations – standing at 432% of GDP as at Q3 2020 – was accounted for by the US alone. Closer to home, public debt in the euro zone area has also increased substantially and will continue to increase, particularly following the historic €1.8 trillion budget and stimulus package agreed upon across EU leader states. As one may expect, government debt across developed economies represented the largest share of the overall debt accumulation, followed by corporate debt (excluding companies in the financial industry) and household debt.

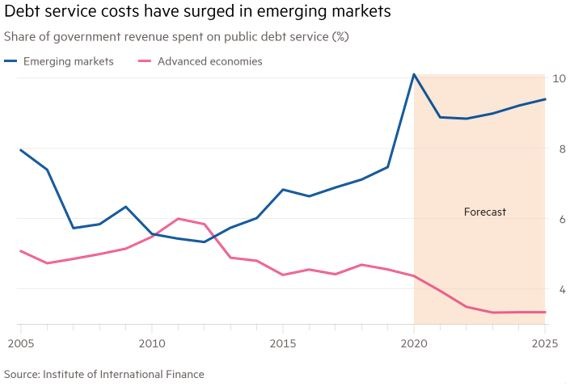

Albeit it might be easier for advanced economies to continue servicing such debt, as monetary policy measures will most probably remain in place for an extended period – thus, keeping yields lower, it might come as no surprise that the same rationale is not applied across emerging economies – refer to Figure 2 below. Although the debt burden as a percentage of GDP in developing countries is less than 250%, the inherent risks coupled with other risk factors exacerbated at times of uncertainty, such as that brought about by a pandemic, will maintain pressure on the serviceability of such debt on the high side for an extended period of time. Moreover, corporate debt has not only registered the highest percentage point increase across emerging markets, but is equivalent to the size of government and household debt combined – refer to Table 1 below.

As the increase in debt levels has been pivotal in boosting investors’ sentiment once again, one ought not to forget the long-term implications all this will have on the future of economies and the various investment asset classes. Most probably, we will continue to experience aggressive fiscal and monetary policy measures for the foreseeable future, leading to further increases in debts as the COVID-19 strain is making everyone’s expectations to normality somewhat blurry. However, debt, at the end of the day need not only be serviced (i.e. interest payments), but also paid back. And a higher debt burden cannot be considered sustainable unless there is (eventually) a corresponding and higher economic growth linked to it. The truth of the matter is that we will most probably continue to experience some form of financial distress across the hardest hit economies.

Debt restructuring and relief, in collaboration with international bodies like the IMF and the World Bank will continue to be present across the world’s poorest countries; whereas a continued era of aggressive monetary policies, globally and across developed economies in particular, will maintain some form of capping in any potential interest rate reversals as economies eventually revive from the pandemic. Meanwhile, as highlighted in a research note by chief economic advisor to Allianz, Mohammed El-Erian earlier this week, growth dispersions will continue to persist, as the inequality in many countries worsens. El-Erian also highlights the risk factors linked to central banks’ responses at times of heighted volatility and economic vulnerability we are currently experiencing. In the sense of putting your faith in central banks’ ability to protect financial markets from all kinds of corporate and economic shocks.

Linking all this to the context of portfolio construction, in my opinion, this is why I believe that investors should not just chase income return at all costs – underscoring the inherent risks and sustainability of the investment or particular asset class. Rather, an individual should put more weight on the long-term viability of the investment, even if it means choosing low-income generating asset classes, such as equities, over fixed-income. Nevertheless, diversification remains key, and the balance between the two broad asset classes in one’s portfolio remains subject to an individual’s risk profile and long-term investment objective.

Colin Vella, CFA is the Head of Wealth Management at Jesmond Mizzi Financial Advisors Limited. This article does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Investors should remember that past performance is no guide to future performance and that the value of investments may go down as well as up. For further information contact Jesmond Mizzi Financial Advisors Limited of 67, Level 3, South Street, Valletta, on Tel: 2122 4410, or email [email protected]