MSE Trading Report for Week ending 22 January 2021

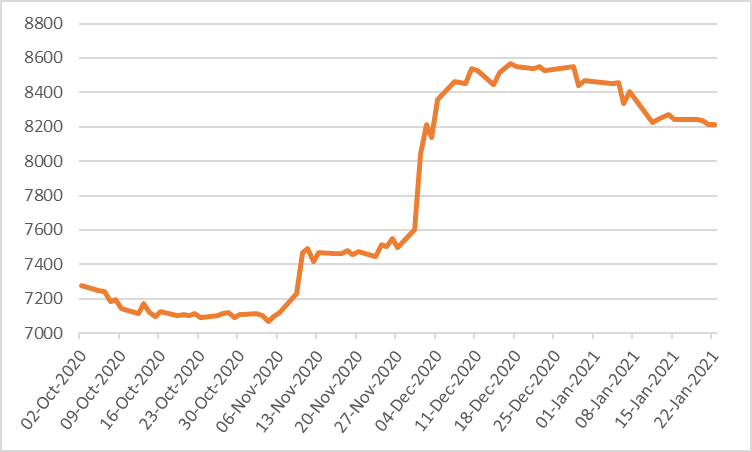

| MSE Equity Total Return Index: |

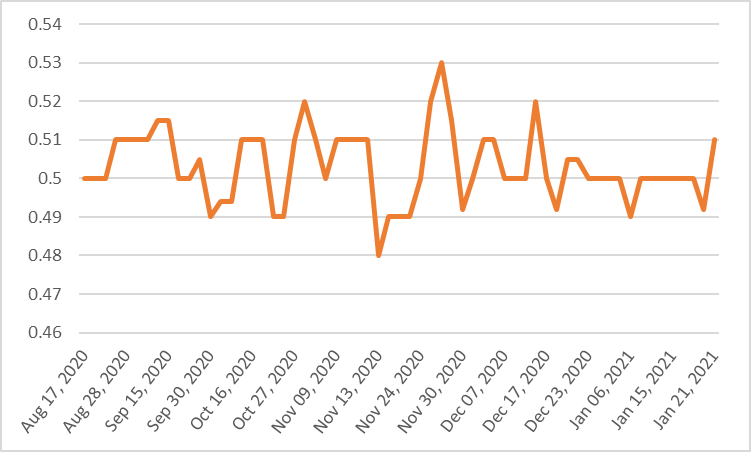

| Chart of the Week: Malta Properties Company plc |

| Highlights: |

- The MSE Equity Total Return Index ended the week with a further 0.3% decline, as it reached 8,213.12 points. A total of 15 equities were active, four of which advanced while another six closed in the red. Total weekly turnover more than doubled, as it amounted to €1.6 million, generated across 151 transactions.

- In the banking industry, only Bank of Valletta plc (BOV) and HSBC Bank Malta plc (HSBC) were active. BOV registered a total turnover of €157,492 as a result of 24 deals involving 167,110 shares. During the week, the banking equity traded at a low of €0.93 but closed at €0.948 – equivalent to a 0.2% decline when compared to the previous week.

- Similarly, HSBC shares lost 3.5%, as 91,854 shares changed hands over 11 deals. The banking equity ended the week €0.03 lower at €0.84, as trading in the equity only took place on Monday and Thursday.

- In the aviation industry, Malta International Airport plc (MIA) shares closed flat at €6.10 after trading at €6.15 on Wednesday and Thursday. Nine deals involving 4,817 shares were executed.

- Last Thursday, the company announced the full-year traffic results for 2020. The airport operator recorded a 76.1% drop in passenger movements when compared to the previous year. This is the lowest traffic result to be reported by the company since it assumed management of the air terminal in 2002, when full-year traffic amounted to 2.6 million passenger movements.

- Traffic for December 2020 stood at just 10% of what was reported within the same month in 2019, as only 46,475 passenger movements were recorded. Data provided by Airports Council International (ACI) shows that European airports in general suffered the same plight last year, with this airport group registering an overall contraction in passenger traffic of 79.6% and reporting the cumulative loss of over 6,000 routes.

- Several international industry organisations are predicting that, following an extremely rocky first quarter of 2021, the tourism industry may expect to start seeing signs of recovery with the onset of the summer season.

- MIA’s CEO welcomed the International Air Transport Association’s recent appeal to key EU policymakers to agree on a common digital European Covid-19 vaccination certificate, which would constitute a huge stride towards the safe re-opening of borders without the need for testing and quarantines.

- Despite the current uncertainty and shorter-term planning, MIA and the Malta Tourism Authority have remained in active discussions with partner airlines to work on rebuilding Malta’s connectivity. Stakeholder collaboration in this regard is essential for the Maltese islands to be able to enjoy connections with Europe and beyond offered by a mix of low-cost and flag carriers.

- Given that the first quarter of 2021 is expected to be as challenging as 2020, Malta International Airport will work actively towards the preservation of the company’s liquidity through any cost-cutting measures deemed necessary.

- The board is scheduled to meet on February 24, 2021, to conduct an assessment of the current situation, which continues to evolve. During this meeting, the board will be approving the company’s financial statements for the year ended December 31, 2020, and discussing other items on the agenda, including shareholder dividend.

- While MIA generally publishes a forecast for the year ahead in January, given the fluidity of the current situation and limited visibility of the way ahead, the company confirmed that it will not provide guidance to the market, as it does not have sufficient data to rely on.

- BMIT Technologies plc was the most liquid, as it generated a total weekly turnover of €420,993. A total of 39 deals involving 876,851 shares were executed, leaving no impact on the equity’s previous week’s closing price of €0.48.

- In the property sector, Malta Properties Company plc was the most liquid, as it recorded a total turnover of €250,863. The equity was also the best performing equity, as it closed 2% higher at €0.51. This was the outcome of 19 deals involving 500,764 shares.

- The board of Mapfre Middlesea plc is scheduled to meet on March 25, 2021, to consider and approve the audited financial statements for the financial year ended December 31, 2020.

- The declaration of a dividend, if any, shall also be considered and recommended to the shareholders’ Annual General Meeting.

- The equity traded three times over a spread of 3,932 shares, pushing the price 1.9% higher to €2.10.

- Last Thursday, Maltapost plc announced that the Annual General Meeting will be held on February 12, 2021.

- The audited financial statements, for the year ended September 30, 2020 shall be received and approved, while the report of the directors and auditors will be considered.

- The board shall also consider the declaration of a final ordinary net dividend of €0.04 per nominal €0.25 share, representing a final net payment of €1,506,189 in cash.

- A sole deal of 5,172 shares dragged the price by 12.1% into the red. The equity ended the week at the €1.16 price level.

- The MSE MGS Total Return Index gained ground, as it closed 0.8% higher at 1,149.30 points. A total of 17 issues were active, nine of which headed north while another six closed in the opposite direction. The best performer was the 3% MGS 2040 (I), as it closed 3% higher at €142.50. Conversely, the 4.65% MGS 2032 (I) closed 0.7% lower at €148.00.

- The MSE Corporate Bonds Total Return Index remained relatively flat at 1,099.70 points. Out of 50 active issues, 23 traded higher while another 18 lost ground. The 6% International Hotel Investments plc € 2024 headed the list of gainers, as it closed 2.6% higher at €105.00. On the other hand, the 3.5% Bank of Valletta plc € Notes 2030 S2 T1 lost 2.9%, ending the week at €99.00.

- In the Prospects MTF market, eights issues were active. The 4.75% Orion Finance plc € Unsecured 2027 was the most liquid, as it generated a total weekly turnover of €32,000.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. MPC | +2.00% | |||

| 2. MMS | +1.94% | |||

| 3. RS2 | +1.01% | |||

| 12 FEB 2021 | MT: MaltaPost plc – Annual General Meeting | |||

| 24 FEB 2021 | MT: Malta International Airport plc – Annual Results | Worst Performers: | ||

| 1. MTP | -12.12% | |||

| 2. PZC | -4.08% | |||

| 3. HSBC | -3.45% | |||

|

|

Price (€): 22.01.2021 | Price (€): 15.01.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 8,213.120 | 8,241.788 | -0.35 | -3.05 |

| BMIT Technologies plc | 0.480 | 0.480 | 0.00 | -0.42 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.948 | 0.950 | -0.21 | -0.21 |

| FIMBank plc (USD) | 0.500 | 0.500 | 0.00 | 0.00 |

| Grand Harbour Marina plc | 0.650 | 0.650 | 0.00 | -7.14 |

| GO plc | 3.460 | 3.460 | 0.00 | -2.26 |

| Harvest Technology plc | 1.480 | 1.470 | 0.68 | 0.00 |

| HSBC Bank Malta plc | 0.840 | 0.870 | -3.45 | -6.67 |

| International Hotel Investments plc | 0.720 | 0.720 | 0.00 | 0.00 |

| Lombard Bank plc | 1.980 | 1.980 | 0.00 | -16.10 |

| Loqus Holdings plc | 0.099 | 0.099 | 0.00 | 0.00 |

| LifeStar Holding plc | 0.550 | 0.550 | 0.00 | 10.00 |

| MIDI plc | 0.388 | 0.388 | 0.00 | -13.39 |

| Medserv plc | 0.745 | 0.745 | 0.00 | -5.70 |

| Malta International Airport plc | 6.100 | 6.100 | 0.00 | -1.61 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Mapfre Middlesea plc | 2.100 | 2.060 | 1.94 | -14.63 |

| Malta Properties Company plc | 0.510 | 0.500 | 2.00 | 2.00 |

| Main Street Complex plc | 0.498 | 0.498 | 0.00 | -0.40 |

| MaltaPost plc | 1.160 | 1.320 | -12.12 | -12.78 |

| PG plc | 2.060 | 2.060 | 0.00 | 3.00 |

| Plaza Centres plc | 0.940 | 0.980 | -4.08 | -4.08 |

| RS2 Software plc | 2.000 | 1.980 | 1.01 | 0.00 |

| Simonds Farsons Cisk plc | 7.550 | 7.650 | -1.31 | -3.21 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.820 | 0.820 | 0.00 | -3.53 |

| Trident Estates plc | 1.480 | 1.500 | -1.33 | -10.84 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]