MSE Trading Report for Week ending 05 February 2021

| MSE Equity Total Return Index: |

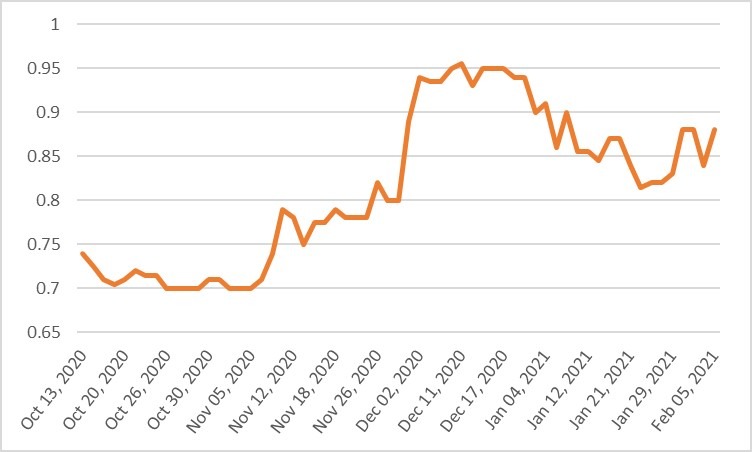

| Chart of the Week: HSBC Bank Malta plc |

| Highlights: |

- The MSE Equity Total Return Index closed the first week of February 2.5% lower at 8,045.256 points. A total of 20 equities were active, four of which headed north while another 14 closed in the opposite direction. A total weekly turnover of €1.7 million was generated across 153 transactions.

- In the banking sector, HSBC Bank Malta plc gained 6% to close the week as the top performing equity. A total of 187,077 shares were executed across 19 transactions, pushing the price €0.05 higher to €0.88 after trading at a weekly low of €0.82.

- Meanwhile, Bank of Valletta plc (BOV) shares started off the week on a positive note, as the equity traded at a high of €0.95 but did not manage to sustain the gain, as it closed at €0.93. On the week, a 1.1% loss was recorded, as 225,129 shares were spread across 28 transactions.

- Last Tuesday, the bank referred to a previous announcement published in April 2019, where it had filed proceedings against Italy before the European Court of Human Rights (ECHR) in which the Bank complained that Italian law does not provide a remedy for its fair hearing concerns in respect of the claim made against the Bank by the curators in the bankruptcy of the Deiulemar Group before the courts of Torre Annunziata, in Italy.

- The ECHR has decided that the Bank’s application is, at this stage of the proceedings, inadmissible. The basis of the ECHR’s decision is that the Bank still has remedies to exhaust in Italy regarding its fair hearing concerns, and not because it considered the Bank’s complaint unmeritorious.

- BOV confirmed that it will continue to pursue its defence vigorously, including its fair hearing concerns before the Italian courts and, if those prove unsuccessful, it will petition the ECHR again once the Italian remedies will have been fully exhausted.

- Retail conglomerate, PG plc recorded the highest liquidity, as it generated a total turnover of €301,416. Six deals involving 149,660 shares dragged the price €0.06 lower to €2.00. This decline is equivalent to a 2.9% movement in price.

- Malta International Airport plc reached €6.15 during the week but did not manage to sustain the gain, as it closed flat at €6.10. A total of 14,123 shares were spread over 19 deals.

- FIMBank plc headed the list of fallers with a 28% change in price. Four deals involving 72,800 shares, during the week’s opening trading session, dragged the price to $0.36 – equivalent to a $0.14 fall in price.

- The board of Malta Properties Company plc (MPC) is scheduled to meet on February 25, 2021 to consider and approve the company’s audited financial statements for the financial year ended December 31, 2020.

- The declaration of a final dividend to be recommended to the Annual General Meeting shall also be considered.

- This week MPC shares fell by 5.5%, as 82,030 shares change hands across 10 transactions.

- The equity ended the week at €0.52. From a year-to-date perspective, the equity is up by 4%.

- Last Thursday, MaltaPost plc announced that regulatory approval has been granted for the registration of IVALIFE Limited to carry out the business of life insurance. IVALIFE Ltd, is equally owned by MaltaPost plc, APS Bank plc, Atlas Insurance PCC Ltd and Gasan Mamo Insurance Limited.

- The Company considers its involvement in this venture as a significant development which stands to benefit its stakeholders and the community at large.

- No trading activity was recorded during the week.

- The MSE MGS Total Return Index managed to recover its previous loss, as it closed 0.7% higher at 1,152.45 points. A total of 18 issues were active, three of which advanced while another 11 lost ground. The 2.3% MGS 2029 (II) headed the list of gainers, as it closed 6.2% higher at €128.50. On the other hand, the 4.1% MGS 2034 (I) traded 2% lower at €146.00.

- The MSE Corporate Bonds Total Return Index declined by 0.3%, as it reached 1,098.07 points. Out of 51 active issues, 19 traded higher while another 20 closed in the red. The best performer was the 5% Tumas Investments plc Unsecured € 2024, as it closed 2.5% higher at €103.50. Conversely, the 6% International Hotel Investments plc € 2024 lost 4.7%, to close at €100.11.

- In the Prospects MTF market, seven issues were active. The 4.75% Orion Finance plc € Unsecured 2027 was the most liquid as it generated a total weekly turnover of €172,000.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. HSB | +6.02% | |||

| 2. SFC | +2.56% | |||

| 12 FEB 2021 | MT: MaltaPost plc – Annual General Meeting | 3. BMIT | +2.08% | |

| 23 FEB 2021 | MT: HSBC Bank Malta plc – Annual Results | |||

| 24 FEB 2021 | MT: Malta International Airport plc – Annual Results | Worst Performers: | ||

| 1. FIM | -28.00% | |||

| 2. LQS | -19.19% | |||

| 3. IHI | -9.35% | |||

|

|

Price (€): 05.02.2021 | Price (€): 29.01.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 8,045.256 | 8,255.308 | -2.54 | -5.03 |

| BMIT Technologies plc | 0.490 | 0.480 | 2.08 | -1.66 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.930 | 0.940 | -1.06 | -2.11 |

| FIMBank plc (USD) | 0.360 | 0.500 | -28.00 | -28.00 |

| Grand Harbour Marina plc | 0.650 | 0.650 | 0.00 | -7.14 |

| GO plc | 3.440 | 3.460 | -0.58 | -2.83 |

| Harvest Technology plc | 1.480 | 1.490 | -0.67 | 0.00 |

| HSBC Bank Malta plc | 0.880 | 0.830 | 6.02 | -2.22 |

| International Hotel Investments plc | 0.630 | 0.695 | -9.35 | -12.50 |

| Lombard Bank plc | 1.980 | 1.980 | 0.00 | -16.10 |

| Loqus Holdings plc | 0.080 | 0.099 | -19.19 | -19.19 |

| LifeStar Holding plc | 0.550 | 0.550 | 0.00 | 10.00 |

| MIDI plc | 0.390 | 0.388 | 0.52 | -12.95 |

| Medserv plc | 0.735 | 0.735 | 0.00 | -6.96 |

| Malta International Airport plc | 6.100 | 6.100 | 0.00 | -1.61 |

| Malita Investments plc | 0.880 | 0.900 | -2.22 | -2.22 |

| Mapfre Middlesea plc | 2.280 | 2.360 | -3.39 | -7.32 |

| Malta Properties Company plc | 0.520 | 0.550 | -5.45 | 4.00 |

| Main Street Complex plc | 0.490 | 0.498 | -1.61 | -2.00 |

| MaltaPost plc | 1.160 | 1.160 | 0.00 | -12.78 |

| PG plc | 2.000 | 2.060 | -2.91 | 0.00 |

| Plaza Centres plc | 0.920 | 0.940 | -2.13 | -6.122 |

| RS2 Software plc | 2.040 | 2.040 | 0.00 | 2.00 |

| Simonds Farsons Cisk plc | 8.000 | 7.800 | 2.56 | 2.56 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.770 | 0.820 | -6.10 | -9.41 |

| Trident Estates plc | 1.470 | 1.480 | -0.68 | -11.45 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]