MSE Trading Report for Week ending 09 April 2021

| MSE Equity Total Return Index: |

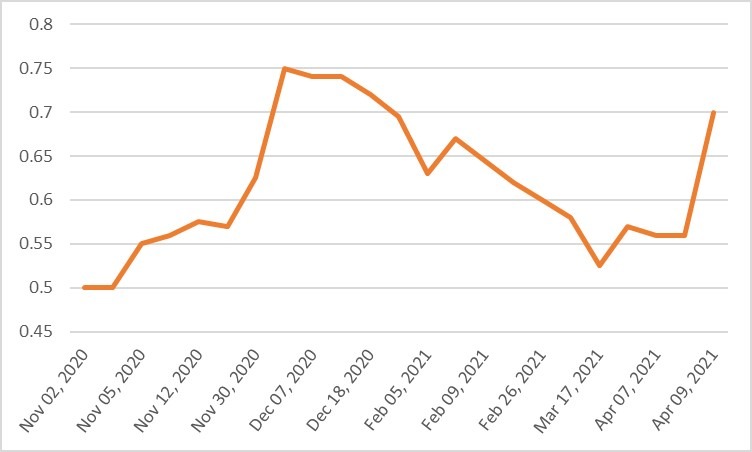

| Chart of the Week: International Hotel Investments plc |

| Highlights: |

- The MSE Equity Total Return Index registered a further 3.2% increase, as investors’ sentiment improved possibly on the back of the relaxation of some Covid-19 measures. Some of these measures are expected to come into force as from Monday. Most large caps gained, as hotels operator International Hotel Investments plc (IHI) jumped by 33%. On the other hand, technology companies declined. The local equities index finished the week at 8,042.663 points. Following the gains in the past two trading weeks, the MSE Index has recovered some of the lost ground since the beginning of the year and is now down by 5%.

- A total of 19 equities were active, nine of which traded higher while another six closed in the red. During this four-day trading week, total turnover was €0.7 million.

- IHI headed the list of gainers with a double-digit gain to finish at a 10-week high of €0.70. A €0.175 change in price was generated, as 59,367 shares changed hands across 11 transactions. Yesterday, IHI announced that the Annual General Meeting (AGM) shall be held on June 10, 2021.

- Last Thursday, Malta International Airport plc published the traffic results for the month of March. Passenger traffic totalled 32,033 movements last March – a drop of 93% compared to the same month in 2019. This traffic result reflects the hurdles still being faced by the aviation industry a year into the COVID-19 pandemic.

- A rapid vaccination roll-out among the local population together with government’s recently announced plan for the restart of tourism on June 1, bode well for the second half of the year. However, the successful revival of air travel is also highly dependent on the restoration of consumer confidence in the industry in the build-up to summer.

- The equity of the airport operator was the most liquid, as it generated a total weekly turnover of €0.13 million – more than double last week’s figure. This was the result of 21,597 shares spread over 21 deals, pushing the price 1.6% higher to €6.20.

- Telecommunications company, GO plc registered a weekly turnover of €0.1 million, as 10 transactions involving 29,273 shares were executed. The equity’s price was up by 1.7% to €3.70 – the highest in 48-weeks. Meanwhile, from a year-to-date perspective, the equity is up by 4.5%.

- Yesterday, BMIT Technologies plc announced that the AGM shall be held on May 26, 2021.

- The annual report and financial statements for the year ended December 31, 2020 comprising the financial statements and the directors’ and auditors’ reports thereon, shall be received and approved.

- Moreover, a net dividend of €0.02922 per share shall be paid to all shareholders on the register as at April 26, 2021.

- The payment of this net dividend amounts to the sum of nearly €6 million.

- The equity lost 1%, as 163,790 shares changed ownership across 19 transactions. The equity closed the week at €0.525 and is up by 9% since the beginning of the year.

- Last Monday, RS2 Software plc announced that its Managed Services subsidiary RS2 Smart Processing Ltd has concluded a major processing outsourcing agreement with one of the largest European Fintech companies, enabling them to provide acquiring services in Latin America.

- The agreement has been signed for an initial term of 3 years with the option to extend yearly. Moreover, the subsidiary has signed a processing agreement in the Nordic with Landesbankinn in Iceland to provide Omni-channel Acquiring Services to the bank.

- The company pointed out that the projected revenue from the above client has been taken into consideration and are reflected in the projections contained in the Prospectus dated February 19, 2021 relating to the issue of Preference Shares.

- A 0.6% fall in price was recorded, as six deals involving 23,500 shares were executed. The equity ended the week at €1.79.

- Yesterday, HSBC Bank Malta plc announced that all shareholders registered on March 23, 2021 have the right to participate and vote in the meeting.

- The AGM shall be held on April 22, 2021. The audited accounts for the year ended December 31, 2020 and the reports of the directors and auditors shall be received and approved.

- Moreover, the shareholders shall also consider the final gross dividend of €0.016 per share, representing a final gross payment of nearly €4.2 million as recommended by the board.

- The equity was trading at a low of €0.785 but managed to recover, as it closed 0.6% higher at €0.815. A total of 87,751 shares were spread across 15 transactions.

- The board of FIMBank plc approved the bank’s annual report and financial statements for the financial year ended December 31, 2020. These shall be submitted for approval by the shareholders at the forthcoming AGM.

- A loss before tax of $35.8 million was recorded for 2020, following a profit before tax of $7.3 million in 2019. As the pandemic unfolded, the Group retracted from certain business activities to safeguard its capital and liquidity, which remain strong and well above regulatory minima. This came at the cost of revenue generation. As a result, net operating income dropped by 23% to $39.3 million.

- Total consolidated assets stood at $1.83 billion, down by $59.0 million from end-2019. The Group’s consolidated liabilities amounted to $1.6 billion, a drop of USD11.1 million from prior year. Throughout this period, the Group increased its available liquidity with ratios well above the regulatory guidelines.

- As at December 31, 2020, CET1 ratio and total capital ratio stood at 18.5%.

- As none of the reserves are available for distribution, the board will not be recommending the payment of a dividend to the AGM of Shareholders.

- The equity recorded the worst performance, as it declined by 15% to $0.314. A total of 112,240 shares changed hands over 11 deals.

- Last Monday, MIDI plc announced that the forthcoming AGM shall be held on June 17, 2021. The equity traded once at €0.40 over 10,000 shares and remained flat.

- Last Tuesday, Mapfre Middlesea plc announced that it shall be convening the 40th AGM which shall be held on April 30, 2021.

- The financial statements for the year ended December 31, 2020 and the reports of the directors and auditors thereon shall be considered and approved.

- A final gross dividend of €0.052434 per share shall also be considered.

- A sole deal of 1,690 shares dragged the price by 0.9% into the red. The equity ended the week at the €2.36 price level.

- Last Tuesday, Medserv plc announced that its subsidiary, Medserv Operations Limited, has successfully been awarded a new contract with one of its existing major clients.

- This contract is for a period of one year with an option to extend for a further three-year period under the same terms and conditions.

- The contract relates to the development of offshore projects at the Bahr Essalm offshore gas fields in the central Mediterranean. This major natural gas field project includes the drilling a of significant number of offshore wells and the installation of structures.

- Medserv Operations Limited will provide fully integrated logistics shore-base services from its Freeport base in Malta and is expected to manage a considerable volume of oil country tubular goods and related equipment. Additionally, a range of vessels will call at its Malta shore-base for the completion of this four-year major project.

- The equity traded once across 1,129 shares, leaving no impact on the previous week’s closing price of €0.63.

- The MSE MGS Total Return Index advanced by 0.2%, as it reached 1,125.92 points. Out of 17 active issues, four registered gains while another 12 lost ground. The best performer was the 2.3% MGS 2029 (II), as it closed 3.7% higher at €125. Conversely, the 5.1% MGS 2029 (I) traded 2.7% lower at €142.

- The MSE Corporate Bonds Total Return Index registered a further 0.24% increase, as it closed at 1,111.35 points. A total of 44 issues were active, 21 of which headed north while another nine closed in the opposite direction. The 3.65% Stivala Group Finance plc Secured 2029 registered the best performance with a 3% increase, as it closed at €102.99. On the other hand, the 6% AX Investments Plc € 2024 closed 10.6% lower at €105.00.

- In the Prospects MTF market, nine issues were active. The 5% Horizon Finance plc Secured Callable € Bonds 2026-2029 was the most liquid, as it generated a total weekly turnover of €24,240 over two deals.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. IHI | +33.33% | |||

| 2. MTP | +11.86% | |||

| 22 APR 2021 | MT: HSBC Bank Malta plc – Annual General Meeting | 3. MPC | +5.77% | |

| 22 APR 2021 | MT: Tigne’ Mall plc – Annual Results | |||

| 23 APR 2021 | MT: MIDI plc – Annual Results | Worst Performers: | ||

| 1. FIM | -15.14% | |||

| 2. MLT | -3.91% | |||

| 3. HRV | -2.03% | |||

|

|

Price (€): 09.04.2021 | Price (€): 01.04.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 8,042.663 | 7,792.985 | 3.20 | -5.06 |

| BMIT Technologies plc | 0.525 | 0.530 | -0.94 | 8.92 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.900 | 0.870 | 3.45 | -5.26 |

| FIMBank plc (USD) | 0.314 | 0.370 | -15.14 | -37.20 |

| Grand Harbour Marina plc | 0.660 | 0.660 | 0.00 | -5.71 |

| GO plc | 3.700 | 3.640 | 1.65 | 4.52 |

| Harvest Technology plc | 1.450 | 1.480 | -2.03 | -2.03 |

| HSBC Bank Malta plc | 0.815 | 0.810 | 0.62 | -9.44 |

| International Hotel Investments plc | 0.700 | 0.525 | 33.33 | -2.78 |

| Lombard Bank plc | 1.900 | 1.900 | 0.00 | -19.49 |

| Loqus Holdings plc | 0.090 | 0.090 | 0.00 | -9.09 |

| LifeStar Holding plc | 0.600 | 0.600 | 0.00 | 20.00 |

| MIDI plc | 0.400 | 0.400 | 0.00 | -10.71 |

| Medserv plc | 0.630 | 0.630 | 0.00 | -20.25 |

| Malta International Airport plc | 6.200 | 6.100 | 1.64 | 0.00 |

| Malita Investments plc | 0.860 | 0.895 | -3.91 | -4.44 |

| Mapfre Middlesea plc | 2.360 | 2.380 | -0.84 | -4.07 |

| Malta Properties Company plc | 0.550 | 0.520 | 5.77 | 10.00 |

| Main Street Complex plc | 0.498 | 0.498 | 0.00 | -0.40 |

| MaltaPost plc | 1.320 | 1.180 | 11.86 | -0.75 |

| PG plc | 2.040 | 2.040 | 0.00 | 2.00 |

| Plaza Centres plc | 0.880 | 0.880 | 0.00 | -10.20 |

| RS2 Software plc | 1.790 | 1.800 | -0.56 | -10.50 |

| Simonds Farsons Cisk plc | 8.150 | 8.100 | 0.62 | 4.49 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.720 | 0.720 | 0.00 | -15.29 |

| Trident Estates plc | 1.500 | 1.450 | 3.45 | -9.64 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]