MSE Trading Report for Week ending 14 May 2021

| MSE Equity Total Return Index: |

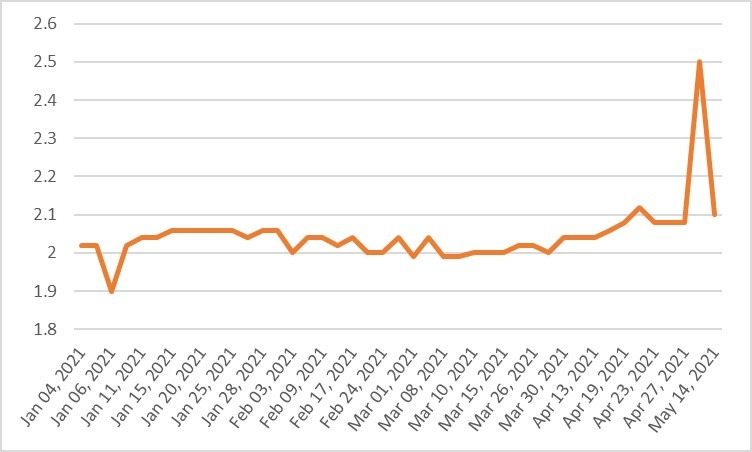

| Chart of the Week: PG plc |

| Highlights: |

- The MSE Index shed 1.7%, as losses in five equities outweighed gains elsewhere to close the week at 8,172.64 points. Total turnover reached €0.5m, as 119 deals were executed. Double digit losses on slim volumes in International Hotel Investments plc (IHI) and PG plc weighted heavily on performance, as gains in several large caps were not enough to make up for these losses. Since the beginning of the year, the local equities index is down by 3.5%.

- BMIT Technologies plc (BMIT) closed the week higher by 2%, as the equity finished at €0.51. BMIT shares were the most liquid, as turnover totalled €78,000 across 15 deals. On a year-to-date basis, BMIT shares are up by 6%.

- Last Thursday, the company announced the performance for the first quarter of 2021. The company continued the same trend of 2020, as it recorded good performance across all business lines. Despite the unprecedented times, one year after the pandemic outbreak, the financial results achieved by the Company during the first quarter of the year were positive.

- As at end of the first quarter, the unaudited accounts show that the Company generated revenues of €6.6 million, against €5.8 million during the same period last year.

- The trend experienced in prior months persisted, whereby revenue from cloud and connectivity services continued growing steadily.

- Revenue derived from managed services showed encouraging signs, thus this segment is successfully overcoming the challenges brought about by the pandemic.

- Cost of sales and administrative expenses amounted to €3.6 million, slightly up from €3.4 million in 2020. The slight increase is mainly the result of more hardware and software sales, which has driven up the cost of goods sold.

- Administrative expenses were lower during the quarter. This resulted in an EBITDA of just below €3 million up to quarter one, which is €0.5 million more than that recorded during the same period last year.

- In its announcement, the Company added that whilst economic recovery post pandemic, both locally and globally, is yet uncertain and may have an unexpected adverse impact on performance, the results are encouraging, and the Company remains cautiously optimistic for the rest of the year.

- During the first quarter, the Company also increased its liquidity in preparation for the payment of dividend towards the end of May.

- Go plc ended a volatile week higher at €3.56, after trading at a weekly low of €3.50 and a high of €3.68. Total turnover stood at just over €16,000 across 18 trades, with the number of trades jumping during yesterday session, as investors acquired shares in the company to be able to gain preference for the upcoming bond issue, for which the company is awaiting approval.

- In fact, on Thursday the company announced that it has applied for the authorisation for admissibility to listing to the Listing Authority, requesting the approval of a prospectus in relation to the issue of €60m in a 3.5% unsecured bond.

- The company will be allocating a portion of the bond to shareholders and employees. For shareholders to gain preference they should hold Go plc shares by close of business on May 21, 2021 which includes trades which take place up to May 19, 2021.

- In the hospitality sector, IHI declined by 11% or €0.075 to end the week at €0.605, as one trade of a mere 370 shares was executed. Since the beginning the year, the share price of IHI is down by 16%.

- PG plc shares headed the list of fallers with a 16% or €0.40 decline. The equity succumbed to selling pressure, as during the week one single deal worth €2,000 was executed. PG plc shares finished the week at €2.10. Since the beginning of the year the equity is still up by 5%.

- In the same sector, the Board of Directors of Malita Investments plc announced that the annual general meeting of the Company was held on May 11, 2021 and that all resolutions put forward for the shareholders’ approval were approved. No trading activity took place in the company’s shares.

- Last Wednesday, Trident Estates plc announced that the Board of Directors approved the annual reports and consolidated financial statements for the financial year ended January 31, 2021.

- During its financial year, the Group registered profit before tax of €741,000 compared to €328,000 in 2020. The results include net fair value gains on investment property of €562,000. This was primarily driven by the increase in the market value of the Trident House property in Marsa.

- As at end of the financial year, shareholders’ equity amounted to €53 million, up from €52.5m in the previous financial year.

- The board of directors believe that it is not prudent to recommend the declaration of a final dividend to the forthcoming Annual General Meeting. No trades were executed during the week.

- In the sovereign debt market 18 issues were active. Two issues gained and ten closed lower, as the Central Bank of Malta revised lower its bid prices in line with the increasing yields in international markets. Activity was mainly concentrated across the long-dated issues. The 2.1% MGS 2039 (I) shed 4.7% to close at €122.

- In the corporate bond market, the 4.85% Melite Finance plc Unsecured 2028 declined by 12.5% to finish at €70, while the 10-year 4.25% Mercury Projects Finance plc Secured 2031 headed the list of gainers with a 3.2% movement in price.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. FIM | +5.03% | |||

| 20 MAY 2021 | MT: Bank of Valletta plc – Annual General Meeting | 2. MIA | +3.23% | |

| 24 MAY 2021 | MT: Grand Harbour Marina plc – Annual General Meeting | 3. GO | +2.89% | |

| 26 MAY 2021 | MT: Main Street Complex plc – Annual General Meeting | |||

| 26 MAY 2021 | MT: BMIT Technologies plc – Annual General Meeting | Worst Performers: | ||

| 26 MAY 2021 | MT: Simonds Farsons Cisk plc – Annual Results | 1. PG | -16.00% | |

| 2. IHI | -11.03% | |||

| 3. RS2 | -5.26% | |||

|

|

Price (€): 14.05.2021 | Price (€): 07.05.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 8,172.640 | 8,310.761 | -1.66 | -3.53 |

| BMIT Technologies plc | 0.510 | 0.500 | 2.00 | 5.81 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.915 | 0.900 | 1.67 | -3.68 |

| FIMBank plc (USD) | 0.376 | 0.358 | 5.03 | -24.80 |

| Grand Harbour Marina plc | 0.660 | 0.660 | 0.00 | -5.71 |

| GO plc | 3.560 | 3.460 | 2.89 | 0.57 |

| Harvest Technology plc | 1.520 | 1.500 | 1.33 | 2.70 |

| HSBC Bank Malta plc | 0.820 | 0.830 | -1.20 | -8.89 |

| International Hotel Investments plc | 0.605 | 0.680 | -11.03 | -15.97 |

| Lombard Bank plc | 2.000 | 2.000 | 0.00 | -15.25 |

| Loqus Holdings plc | 0.097 | 0.097 | 0.00 | -2.02 |

| LifeStar Holding plc | 0.600 | 0.600 | 0.00 | 20.00 |

| MIDI plc | 0.360 | 0.380 | -5.26 | -19.64 |

| Medserv plc | 0.830 | 0.830 | 0.00 | 5.06 |

| Malta International Airport plc | 6.400 | 6.200 | 3.23 | 3.23 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Mapfre Middlesea plc | 2.380 | 2.380 | 0.00 | -3.25 |

| Malta Properties Company plc | 0.545 | 0.545 | 0.00 | 9.00 |

| Main Street Complex plc | 0.498 | 0.498 | 0.00 | -0.40 |

| MaltaPost plc | 1.240 | 1.240 | 0.00 | -6.77 |

| PG plc | 2.100 | 2.500 | -16.00 | 5.00 |

| Plaza Centres plc | 0.900 | 0.880 | 2.27 | -8.16 |

| RS2 Software plc | 1.800 | 1.900 | -5.26 | 0.00 |

| RS2 Software plc Preference Shares* | 1.780 | 1.750 | 1.71 | -10.00 |

| Simonds Farsons Cisk plc | 9.450 | 9.450 | 0.00 | 21.15 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.750 | 0.750 | 0.00 | -11.77 |

| Trident Estates plc | 1.600 | 1.600 | 0.00 | -3.61 |

* Trading commenced on May 3, 2021.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]