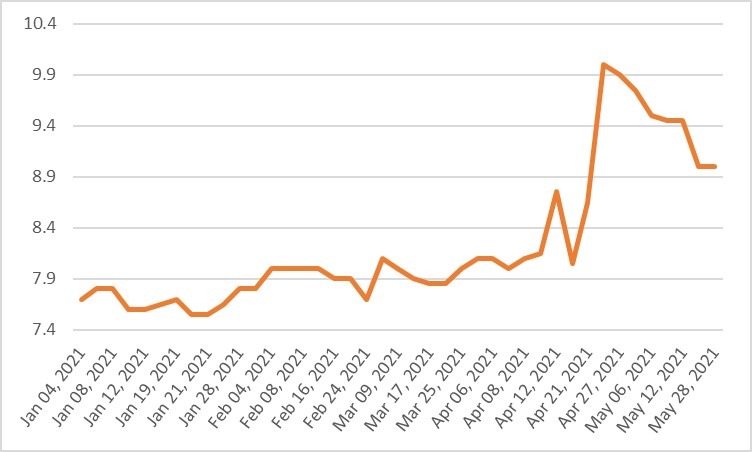

MSE Trading Report for Week ending 28 May 2021

| MSE Equity Total Return Index: |

| Chart of the Week: Simonds Farsons Cisk plc |

| Highlights: |

- The MSE Equity Total Return Index did not manage to sustain the previous week’s gain, as it lost 1.3%, reaching 8,202.788 points. A total of 16 issues were active, four of which registered gains while another eight traded lower. Total activity stood at €0.5m, as 112 transactions were recorded.

- Last Thursday, GO plc announced that the prospectus relating to the 3.5% unsecured bonds which mature in 2031 with an aggregate principal amount of up to €60m was approved by the Listing Authority.

- The proceeds from the bond issue, are earmarked to repay the borrowings outstanding with the European Investment Bank, for capital expenditure and a small balance will be used for general corporate funding purposes.

- The offer opens on June 3 and closes on to June 18, 2021. Application forms will be mailed to GO plc shareholders this Monday and the offer will be available through authorised financial intermediaries who will accept applications from the company’s shareholders and the general public.

- This week, the company also held its Annual General Meeting, during which the annual report and financial statements for the year ended December 31, 2020 comprising the financial statements and the directors’ and auditors’ reports thereon were approved. Moreover, the payment of a net dividend of €0.16 per share was also approved.

- Eight deals involving 14,661 shares were executed, dragging the price by 2.9% into the red. The equity ended the week €0.10 lower at €3.40.

- Its subsidiary, BMIT Technologies plc also held its Annual General Meeting.

- The annual report and financial statements for the year ended December 31, 2020 comprising the financial statements and the directors’ and auditors’ reports thereon were approved.

- Moreover, a net dividend of €0.02922 per share was also approved.

- The equity declined by 2% to €0.49, as 109,900 shares were spread across 14 transactions.

- Malta International Airport plc was the most liquid, as it registered a total turnover of circa €0.1m. This was the result of 18 deals involving 15,842 shares. The equity reached €6.45 during the week but closed flat at €6.40.

- Moving on to the property sector, MIDI plc announced that the Annual General Meeting is scheduled to be held on June 17, 2021. The equity ended the week 2.8% lower at €0.35, as 49,700 shares changed hands over four deals.

- Last Thursday, Simonds Farsons Cisk plc approved the annual report and consolidated financial statements for the financial year ended January 31, 2021 and resolved to propose same for the approval of the shareholders at the forthcoming Annual General Meeting to be held on June 24, 2021.

- The Group reported a total turnover of €73m compared to €103.5m for the previous year – a decrease of 29.4%.

- Similarly, profit before tax declined by 64% from €12.3m to €4.4m.

- The Group’s net borrowings decreased by €15.6m, while the gearing ratio reduced to 16.8%, as compared to 25.9% for 2020.

- The board feels that it is not prudent to declare a final dividend to the Annual General Meeting.

- Six deals involving 2,510 shares dragged the price to a five-week-low of €9.00. This translates into a 4.8% change in price. From a year-to-date perspective, the equity registered a 15.4% increase.

- Last Monday, Grand Harbour Marina plc announced that the shareholders approved the audited financial statements for the financial year ended December 31, 2020 and the directors’ and auditors’ report thereon. The equity was not active during the week.

- Similarly, MainStreet Complex plc held its Annual General Meeting. The audited financial statements for the financial year ended December 31, 2020 and the directors’ and auditors’ report thereon were approved. The equity was not active during the week.

- Last Thursday, Medserv plc published its interim report.

- Revenue for the first quarter of year was lower than that registered last year.

- This is expected to be recovered in the second half of the year, as offshore drilling projects postponed in the year 2020 due to the pandemic are scheduled to resume in the Mediterranean basin later this year.

- The Oil Country Tubular Goods segment is expected to register improved revenue.

- Reporting in the second half of the year will include the revenues and EBITDA of Regis Holdings Limited.

- The equity was not active during the week.

- The MSE MGS Total Return Index remained relatively flat at 1,118.93 points. A total of 19 issues were active, eight of which headed north while another five closed in the opposite direction. The 3% MGS 2040 (I) was the best performer, as it closed 0.8% higher at €135.00. On the other hand, the 2.4% MGS 2041 (I) ended the week 2.4% lower at €123.00.

- The MSE Corporate Bonds Total Return Index managed to recover, as it closed 0.6% higher at 1,123.82 points. Out of 45 active issues, 15 advanced while another 19 lost ground. The 3.75% AXI 2029 S2 headed the list of gainers, as it closed 4.9% higher at €108.00. Conversely, the 5% Mediterranean Investments Holding plc Unsecured € 2022 lost 5%, to close at €95.00.

- In the Prospects MTF market, five issues were active. The 5.5% Testa Finance plc € Bonds 2029 was the only positive performer, as it reached the €97.99 price level.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. TRI | +3.31% | |||

| 10 JUN 2021 | MT: International Hotel Investments plc – Annual General Meeting | 2. BOV | +1.12% | |

| 11 JUN 2021 | MT: Medserv plc – Annual General Meeting | 3. HRV | +0.65% | |

| 15 JUN 2021 | MT: Tigne’ Mall plc – Annual General Meeting | |||

| 17 JUN 2021 | MT: MIDI plc – Annual Results | Worst Performers: | ||

| 23 JUN 2021 | MT: Plaza Centres plc – Annual General Meeting | 1. MMS | -9.24% | |

| 2. SFC | -4.76% | |||

| 3. MLT | -4.44% | |||

|

|

Price (€): 28.05.2021 | Price (€): 21.05.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 8,202.788 | 8,309.976 | -1.29 | -3.17 |

| BMIT Technologies plc | 0.490 | 0.500 | -2.00 | 1.66 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.900 | 0.890 | 1.12 | -5.26 |

| FIMBank plc (USD) | 0.376 | 0.376 | 0.00 | -24.80 |

| Grand Harbour Marina plc | 0.660 | 0.660 | 0.00 | -5.71 |

| GO plc | 3.400 | 3.500 | -2.86 | -3.96 |

| Harvest Technology plc | 1.550 | 1.540 | 0.65 | 4.73 |

| HSBC Bank Malta plc | 0.840 | 0.840 | 0.00 | -6.67 |

| International Hotel Investments plc | 0.650 | 0.650 | 0.00 | -9.72 |

| Lombard Bank plc | 2.220 | 2.220 | 0.00 | -5.93 |

| Loqus Holdings plc | 0.097 | 0.097 | 0.00 | -2.02 |

| LifeStar Holding plc | 0.600 | 0.600 | 0.00 | 20.00 |

| MIDI plc | 0.350 | 0.360 | -2.78 | -21.88 |

| Medserv plc | 0.860 | 0.830 | 0.00 | 5.06 |

| Malta International Airport plc | 6.400 | 6.400 | 0.00 | 3.23 |

| Malita Investments plc | 0.860 | 0.900 | -4.44 | -4.44 |

| Mapfre Middlesea plc | 2.160 | 2.380 | -9.24 | -12.20 |

| Malta Properties Company plc | 0.540 | 0.555 | -2.70 | 8.00 |

| Main Street Complex plc | 0.488 | 0.488 | 0.00 | -2.40 |

| MaltaPost plc | 1.240 | 1.240 | 0.00 | -6.77 |

| PG plc | 2.100 | 2.100 | 0.00 | 5.00 |

| Plaza Centres plc | 0.900 | 0.900 | 0.00 | -8.16 |

| RS2 Software plc Preference Shares* | 1.860 | 1.850 | 0.54 | 6.29 |

| RS2 Software plc | 1.990 | 2.040 | -2.45 | -0.50 |

| Simonds Farsons Cisk plc | 9.000 | 9.450 | -4.76 | 15.39 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.750 | 0.750 | 0.00 | -11.77 |

| Trident Estates plc | 1.560 | 1.510 | 3.31 | -6.02 |

* Trading commenced on May 3, 2021.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]