MSE Trading Report for Week ending 03 September 2021

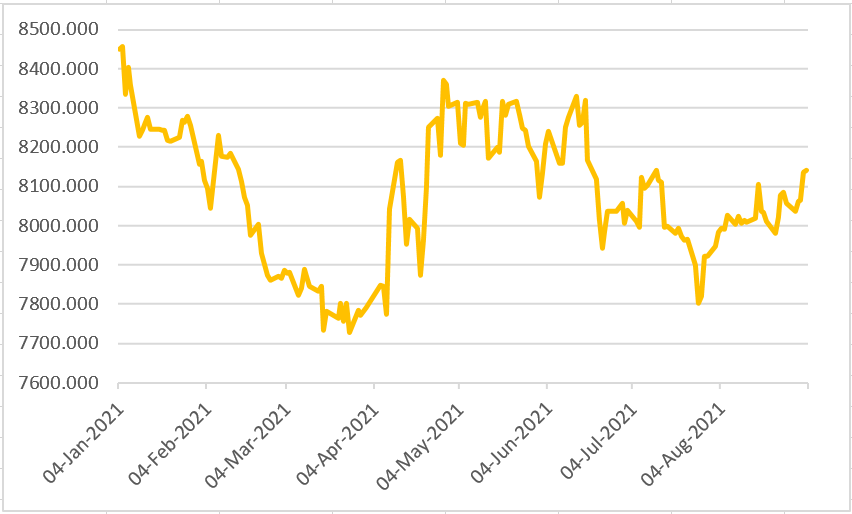

| MSE Equity Total Return Index: |

| Highlights: |

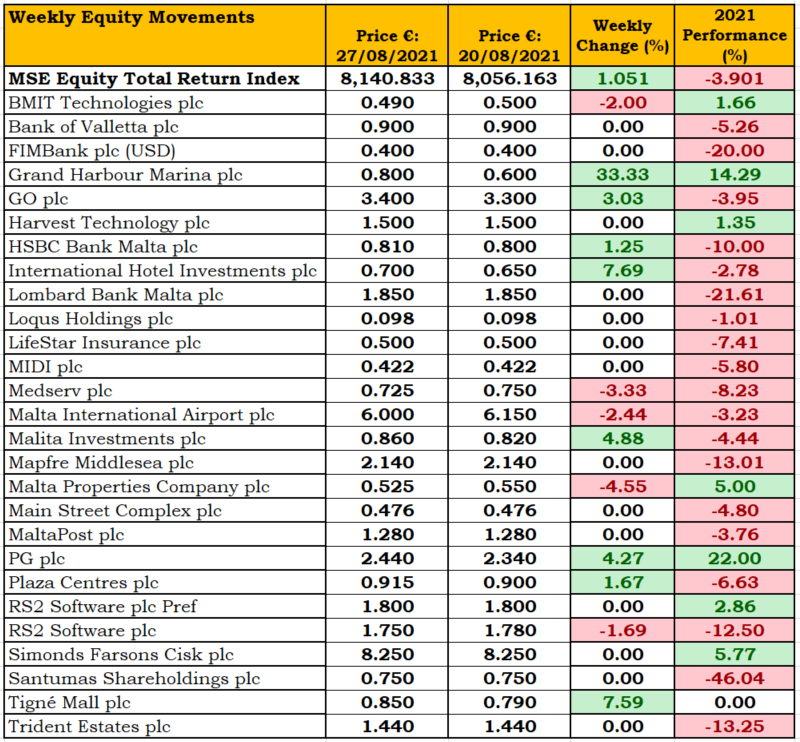

- The MSE Equity Total Return Index (MSE) climbed 1.05%, to end the first week of September at 8,140.833 points. This week’s trading sessions saw 18 active equites, eight of which gained ground, five declined, while a further five remained unchanged. Gains in Grand Harbour Marina plc, International Hotel Investments plc, PG plc, GO plc and HSBC Bank Malta plc pushed the equity index higher.

- In the banking industry, Bank of Valletta plc was the most liquid equity during this week’s trading sessions. The bank’s share price closed unchanged at the €0.90 price level, as 21 trades with a value of €340,782 were recorded. The equity’s price traded between a weekly low of €0.895 and a high of €0.900.

- HSBC Bank Malta plc advanced by a further 1.2%, as the bank’s equity ended the week at €0.81. This price increase was a result of five trades across 48,057 shares. The bank’s equity is trading 10% lower on a year-to-date basis.

- In the telecommunications sector, GO plc gained 3% during the week, as the equity marched higher from Monday through Wednesday, while trading unchanged on Thursday and Friday. Sixteen deals worth €101,846 were executed. The share price closed at €3.40.

- Compared to the previous week’s gain, BMIT Technologies plc shares shed 2% over the past week. The equity price fluctuated between a weekly low of €0.48 and a weekly high of €0.49. Total trading value tallied up to €117,246. The equity closed at the €0.49 price level.

- Harvest Technology plc traded flat during the week and closed unchanged at the €1.50 price level. Two small trades across 1,700 shares during Monday and Wednesday’s trading sessions were recorded.

- The equity of International Hotel Investments plc (IHI)trended 7.7% higher during this week’s trading sessions. Six trades during Thursday’s trading session with a trading value of €23,196 ensured that the hotel chain operator’s share price ended the week in the green. During the week the board of IHI approved the half-yearly financial report for the period ended June 30, 2021. The group registered revenue of €34.6m in the first six months of 2021 of which approximately 30% is not hotel-related. The company posted a negative EBITDA of €0.8m for the period under review. This compares to revenue of €51.7m and a negative EBITDA of €2.1m in the corresponding period last year. During the period under review, the group registered a loss after tax of €26.4m compared to a loss of €30.1 million reported in the same period last year. The board has also submitted an application to the Malta Financial Services Authority to approve the listing and trading on the Malta Stock Exchange of the Unsecured Bonds redeemable in 2031. Part of the proceeds will be used to redeem the existing 5.8% unsecured bonds 2021 (ISIN: MT0000111279) due on 21 December 2021.

In a separate announcement, IHI informed the market that Corinthia Hotels and Dubai-based developer Meydan have also agreed a settlement to exit from their respective positions of hotel operator and investor on a beachfront hotel and residential project in the Jumeirah Beach Residence area of Dubai.

- Malta International Airport plc share price eased by 2.4% to end the week at the €6 price level, as 22,919 shares changed ownership across 14 trades. The airport’s shares are trading 3.2% lower since January.

- The share price of PG plc rose 4.3% during the week to a four-month high of €2.44, as 29,531 shares changed hands.

- Following the publication of MedservRegis plc half year report, the equity lost 3.3%, as 15,000 shares changed hands over four trades. MedservRegis plc approved their half-yearly financial report for the period ended June 30, 2021. Turnover for the first six months stood at €6m compared to €6.3m in the same period last year, a decrease equivalent to 4.6%. The group’s EBIDTA was a negative €56,604, which is a significant jump from last year’s negative €1.3m. This negative figure was a result of an impairment allowance on a trade receivable balance. After all deductions were made, the group registered an operating loss of €503,214, a significant improvement from last year’s €2.6m loss. After accounting for the profit from discontinued operation, profit for the period amounted to €1.9m compared to last year’s €3.2 loss.On a year-to-date basis, the company’s shares are trading 8.2% lower at the €0.725 price level.

- The MSE Corporate Bonds Total Return Index ended the week 0.01% lower at 1,149.777 points. The 5.9% Together Gaming Solutions plc Unsecured € 2024-2026gained 2.98% and ended the week as the best performer at the €102.99 price level. On the other hand, the 4.25% GAP Group plc Secured € 2023 suffered the biggest drop, as it declined by 2.9% to close at €101.

- In the Prospects MTF market, activity was spread across two issues, as turnover amounted to €15,000. The 5% Luxury Living Finance plc € Secured Bonds 2028 was the most liquid, as weekly turnover reached €10,000 over two transactions and closed the week at €100.

- The MSE MGS Total Return Index declined by 0.3%, to end the week at 1,098.744 points. Only the 4.65% MGS 2032 (I) experienced an increase of 0.1% in its price over the past week, to end the week at the €142.20 price level. On the downside, the 2.5% MGS 2036 (I) suffered the biggest decline, as it dropped by 1.7% to end the week at €119.50.

| Upcoming Events | ||||

| Best Performers: | ||||

| 22 SEP 2021 | MT: Trident Estates plc – Half Yearly Results | 1. GHM | +33.33% | |

| 2. IHI | +7.69% | |||

| 29 SEP 2021 | MT: Simonds Farsons Cisk plc – Half Yearly Results | 3. TML | +7.59% | |

| Worst Performers: | ||||

| 1. MPC | -4.55% | |||

| 2. MDS | -3.33% | |||

| 3. MPC | -2.44% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]