MSE Trading Report for Week ending 17 September 2021

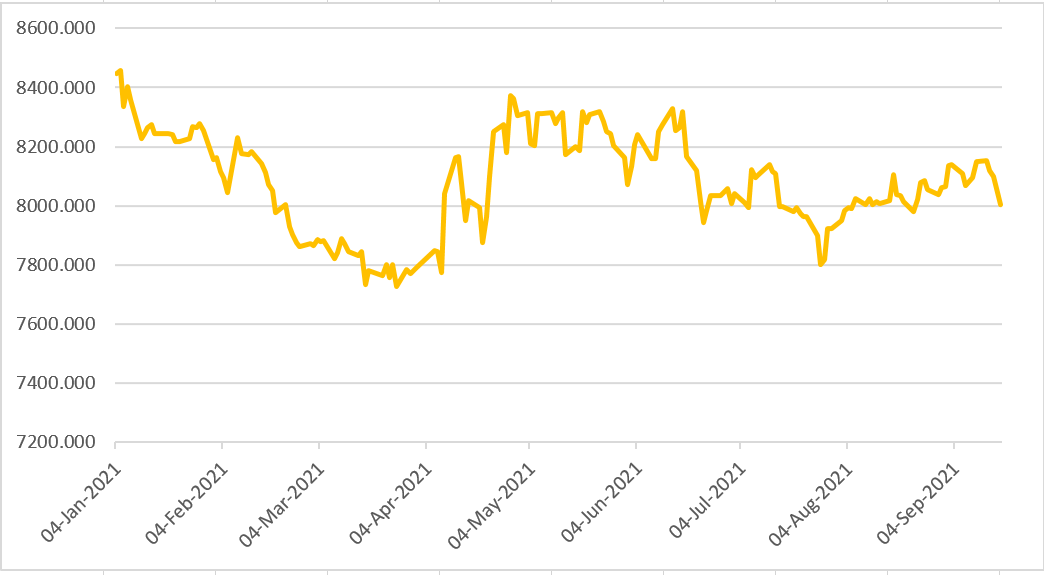

| MSE Equity Total Return Index: |

| Highlights: |

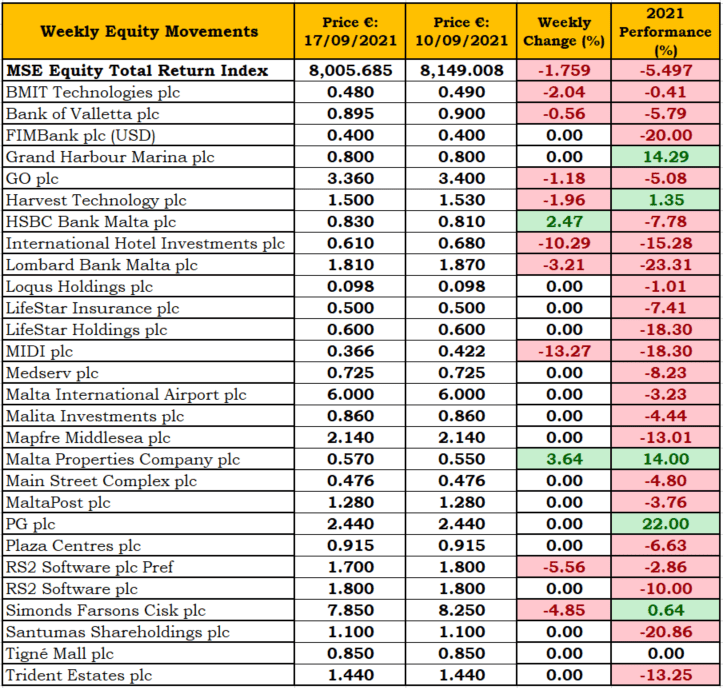

- The MSE Equity Total Return Index lost 1.8% during this week’s trading and ended at 8,005.685 points. Thirteen equities were active, as nine were in the red, two gained, while another two equities remained unchanged. The equity index was dragged down mostly by the large declines experienced by MIDI plc, International Hotel Investments plc and Simonds Farsons Cisk plc.

- MIDI plc was this week’s worst performer, as the equity plummeted 13.3%, as a result of one trade which took place on Thursday involving 13,661 shares with a trading value of €5,000. The company’s share price closed the week at the €0.366 price level.

- During this week, MIDI plc announced that the board of the Planning Authority approved the revised masterplan and the revised outline development permit for the restoration and redevelopment of Manoel Island.

- International Hotel Investments plc fell by 10.3% to the €0.61 price level, as one trade was recorded late during Friday’s trading session involving 24,500 shares with a value of €14,945. The share price of the hotels’ operator dropped 15.3% since the beginning of the year.

- In the banking industry, Bank of Valletta plc (BOV) shares shed 0.6% during the week. The equity was active over 11 trades, with 60,986 shares changing ownership. BOV’s share price ended the week at €0.895 and is currently trading 5.8% lower on a year-to-date basis.

- On the flip side, the shares of HSBC Bank Malta plc jumped 2.5%, as 16 trades with a total trading value of €105,371 were recorded. The bank’s equity closed at the €0.83 price level and from a year-to-date perspective it is trading 7.8% lower.

- In the telecommunications sector, GO plc trended 1.2% lower, as five trades across 14,950 shares were recorded and closed at the €3.36 price level.

- Furthermore, Harvest Technology plc dropped by 2%, because of two trades with a total trading value of €6,353 which were recorded on Tuesday. The equity ended the week at €1.50.

- BMIT Technologies plc (BMIT) saw its shares decline by 2%. This drop resulted due to seven trades across 83,007 shares recorded during Monday and Thursday’s trading sessions. BMIT shares closed at the €0.48 price level.

- Malta International Airport plc (MIA) held onto the €6 price level, as eight trades across 1,770 shares were recorded and ensured that the equity closed the week unchanged. MIA is currently trading 3.2% lower on a year-to-date basis.

- The equity of Simonds Farsons Cisk plc eased by 4.9% to the €7.85 price level on activity totalling 3,763 shares. The company’s shares are trading 0.6% higher year-to-date.

- The MSE MGS Total Return Index increased by 0.4%, to end the week at 1,103.593 points. The best performing government stock was the 5.25% MGS 2030 (I) which experienced an increase of 1.6% in its price over the past week, to end the week at €144. On the downside, the 4.5% MGS 2028 (II) suffered the biggest decline, as it dropped by 1.2% to end the week at €130.42.

- The MSE Corporate Bonds Total Return Index ended the week 0.3% higher at 1,150.027 points. The 5.75% Central Business Centres plc Unsecured € 2021 S1T1 ended the week as the best performer with a gain of 2.5% at €101.99. On the other hand, the 4% SP Finance plc Secured 2029 suffered the biggest drop, as it declined by 4.3% to close at €100.51.

- In the Prospects MTF market, activity was spread across six issues, as turnover amounted to €56,565. The 4.875% AgriHoldings Plc Senior Secured € 2024 was the most liquid, as weekly turnover reached €19,095 because of one transaction and closed the week at €100.50.

| Upcoming Events | ||||

| Best Performers: | ||||

| 22 SEP 2021 | MT: Trident Estates plc – Half Yearly Results | 1. MPC | +3.64% | |

| 2. HSB | +2.47% | |||

| 29 SEP 2021 | MT: Simonds Farsons Cisk plc – Half Yearly Results | |||

| Worst Performers: | ||||

| 1. MDI | -13.27% | |||

| 2. IHI | -10.29% | |||

| 3. RS2P | -5.56% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]