MSE Trading Report for Week ending 8 October 2021

| MSE Equity Total Return Index: |

| Highlights: |

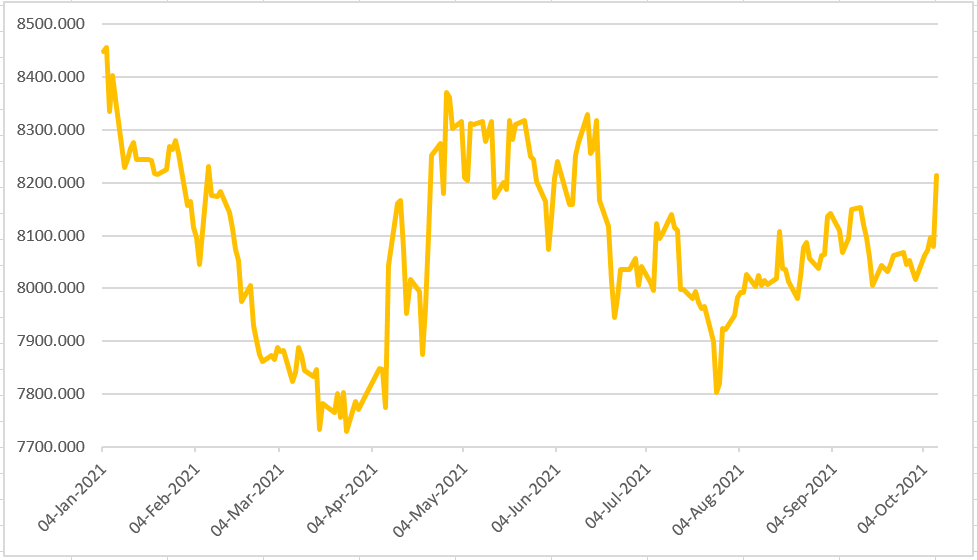

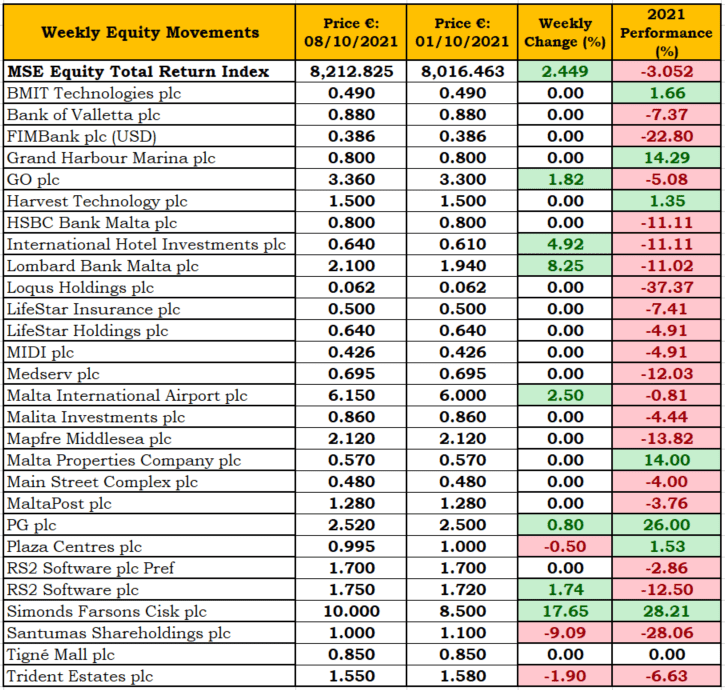

- The MSE Equity Total Return Index (MSE) advanced 2.5% during the week and closed at 8,212.825 points. Seventeen equities were active, as seven increased, three declined, while another seven closed unchanged. This significant increase in the index was mainly a result of gains in Simonds Farsons Cisk plc, International Hotel Investments plc and GO plc.

- The equity of Simonds Farsons Cisk plc was this week’s best performing equity, as the equity rallied a staggering 17.7% to regain the €10 price level, a level last seen in late April. This price increase was a result of six trades across 11,144 shares. Since the beginning of the year the equity is up by 28%.

- The shares of the hotel operator, International Hotel Investments plc saw an increase of 4.9%, as three trades on a volume of 18,000 shares were recorded. The company’s equity closed at €0.64.

- Following last week’s negative performance, GO plc closed at the €3.36 price level and subsequently saw its shares regain some of the losses – up by 1.8% on 35,629 shares with a total trading value of €117,564.

- It’s subsidiary, BMIT Technologies plc was also active during the week, and although 64,000 shares changed ownership over five trades, the price closed unchanged at €0.49. On a year-to-date basis the equity is trading 1.7% higher.

- In the banking industry, Bank of Valletta plc (BOV) kept hold of the €0.88 level. The equity traded 19 times on a volume of 72,513 shares, as the price fluctuated between a weekly low of €0.87 and a high of €0.885.

- Similarly, the share price of HSBC Bank Malta plc (HSBC) closed unchanged at €0.80, as three trades with a market value of €5,062 were recorded. HSBC shares traded at a weekly high of €0.82.

- Malta International Airport plc (MIA) trended 2.5% higher to regain the €6.15 price level on 12,810 shares over 13 transactions. During the week, MIA published the September traffic results. The report indicated that MIA recorded its strongest month in terms of passenger volumes since the outbreak of the coronavirus pandemic, welcoming a total of 418,473 passengers in September. When compared to pre-pandemic levels, airport traffic is still significantly lower (45.1% less than September 2019). The United Kingdom retained its spot as Malta International Airport’s top driver of passenger traffic, followed by Italy, Germany, France and Spain. MIA also published its winter schedule, featuring new flight connections, adding services to unserved markets including Croatia, North Macedonia and the United Arab Emirates, as well as a number of route extensions from summer into winter.

- PG plc shares were this week’s most liquid, as 55,322 shares with a value of €138,325 were traded, closing at €2.52, an increase of 0.8%.

- Santumas Shareholdings plc plummeted 9.1% to the €1 price level on a volume of 5,155 shares.

- Meanwhile, during an Extraordinary General Meeting, Hili Properties plc announced that the company considered and approved a number of resolutions. These include, the issuance and allotment of 18,408,000 Ordinary Shares at €1each from the unissued share capital of the company, to increase the company’s authorised share capital to €120,000,000 and to re-designate authorised share capital into 600,000,000 Ordinary Shares of a nominal value of €0.20 each, and issued share capital into 300,000,000 Ordinary Shares of a nominal value of €0.20.

- The MSE MGS Total Return Index declined by 0.4%, to end the week at 1,087.947 points. The only positive performing government bond was the 4.45% MGS 2032 (II) which experienced an increase of 0.5% in its price over the past week, to end at €139. On the downside, the 2.2% MGS 2035 (I) suffered the biggest decline, as it dropped by 6.8% to end the week at €113.92.

- The MSE Corporate Bonds Total Return Index ended the week 0.05% lower at 1,151.196 points. The 3.75% Bortex Group Finance plc Unsecured € 2027 ended the week as the best performer, gaining 4% to close at the €104 price level. On the other hand, the 4.65% Smartcare Finance plc Secured Bonds 2031 suffered the biggest drop, as it declined by 2.6% to close at €103.01.

- In the Prospects MTF market, activity was spread across six issues, as turnover amounted to €114,595. The 5% Luxury Living Finance plc € Secured Bonds 2028 was the most liquid, as weekly turnover reached €73,240 as a result of six transactions and closed the week at €100.20.

| Upcoming Events | ||||

| Best Performers: | ||||

| 20 October 2021 | MT: Simonds Farsons Cisk Dividend Distribution | 1. SFC | +17.7% | |

| 2. LOM | +8.25% | |||

| 3. IHI | +4.92% | |||

| Worst Performers: | ||||

| 1. STS | -9.09% | |||

| 2. TRI | -1.90% | |||

| 3. PZC | -0.50% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]