MSE Trading Report for Week ending 5 November 2021

| MSE Equity Total Return Index: |

| Highlights: |

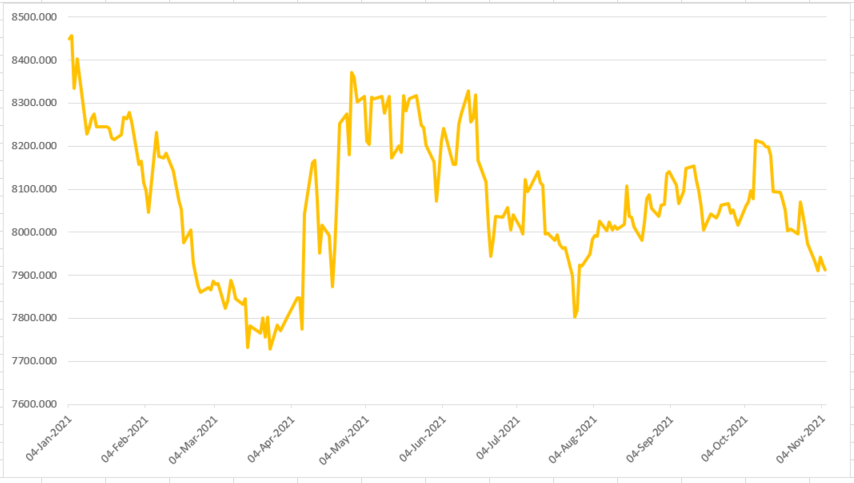

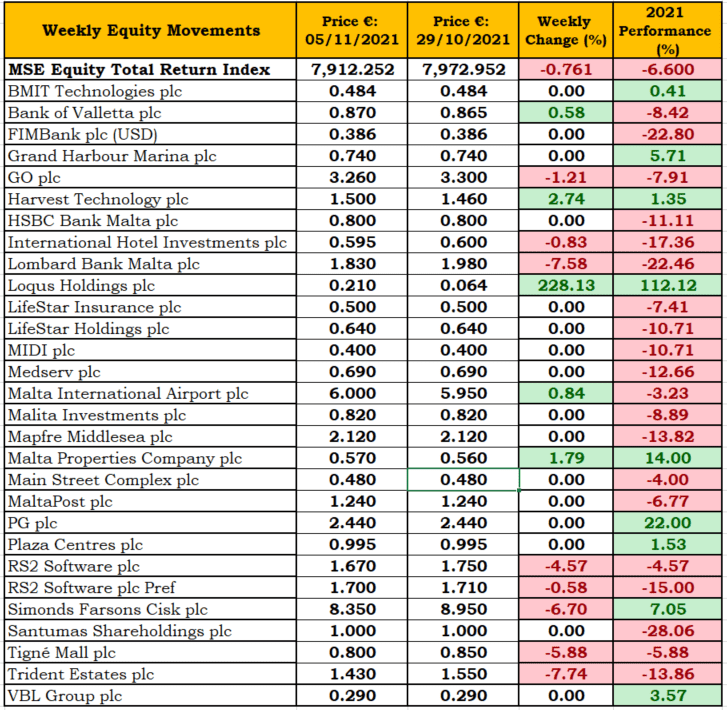

- The MSE Equity Total Return Index suffered a week-on-week decline of 0.8% to 7,912.252 points. As a result, on a year-to-date basis the local equities’ index is 6.6% lower. Five out of the 19 traded equities headed north, with Bank of Valletta plc, Malta International Airport plc and Loqus Holdings plc amongst the positive performers. On the flip side, eight equities fell in value, while six remained unchanged.

- In the banking industry, Bank of Valletta plc (BOV) advanced by 0.6% to capture the €0.87 price level. Activity in the bank’s shares was spread over 17 trades with a value of €69,572 across 80,351 shares. The equity’s price fluctuated between a weekly low of €0.86 and a high of €0.88. Since January, BOV shares are down 8.4%.

- Last Tuesday, the bank issued its interim directors’ statement. For the nine-month period to September 30, 2021 the bank’s profit before tax was €5.9 million higher than the same period in 2020.

- In addition, the third quarter results were better than those achieved in the third quarter of 2020, as the growth in overall interest-earning assets outweighed the reduction in net interest margin. The strength in profitability reflects the ongoing but as yet incomplete recovery from the COVID-19 pandemic.

- Commission income was up by 12%, compared to the previous quarter, hence making the third quarter the strongest in 2021. In addition, the number of new requests for supportive measures have decreased during the quarter, whilst 97% of business customers are repaying as planned.

- The bank added that 85,000 less cheques were encashed, indicating a shift to digital and other alternative channels, as well as a 33% increase in mobile banking transactions.

- Circa €1m on fair value gains on equity holdings contributed to higher revenues, while during the first nine months of 2021, the net interest income was €111.6m, up by 2% compared to the same period last year.

- Operating expenses were higher by 1% than the same period in 2020. This increase reflects the cost of refunding customers targeted in fraud scams (circa €1.2m), higher employee compensation and increased regulatory costs, mainly contribution to the Deposit Guarantee Scheme.

- Loans and advances to consumers increased by €248m from the fourth quarter of 2020, with home loans accounting for 70% of overall growth. MDB COVID-19 Assist Loans have also been steadily declining at the bank. Customer deposits have overall increased by 4.3% or €482m since December 2020, with an increase of 8.3% and 0.4% in retail and business clients respectively, whilst a decline of 11.3% was recorded for international clients.

- HSBC Bank Malta plc (HSBC) closed unchanged at €0.80 on weaker than usual volumes, as 8,434 shares exchanged ownership over 3 trades. Similar to BOV, HSBC shares are below their January price level by 11.1%.

- In the telecommunications sector, GO plc eased by 1.2%, as nine trades involving 7,680 shares were recorded. The share price at the end of yesterday’s session read €3.26.

- BMIT Technologies plc (BMIT) held on to the €0.484 price level, as it was involved in a sole trade across 6,381 shares. On a year-to-date basis, BMIT shares are up 0.4%.

- Loqus Holdings plc increased from €0.064 last week to €0.21 on the back of positive financial results, announced last week. Despite the price increase, trading activity was spread over five trades with a total turnover of €3,608. The equity closed the week at an 11-year high.

- Harvest Technology plc moved 2.7% higher to the €1.50 level on a volume of 8,916 shares with a value of €13,374. Last Thursday, the company announced that it will be distributing an interim net dividend of €364,490, equivalent to €0.016 per share to shareholders appearing on the company’s register of members as of November 10, 2021. Payment of the dividend shall be affected by not later than November 26, 2021.

- The company added that the unaudited consolidated net profit before tax of the company and its subsidiaries as at end of September 2021 amounted to €3.1m. This marks an improvement of 9% over the consolidated net profit before tax of the Harvest Group for the same period in 2020. The board reiterates its target of the group achieving annual projected consolidated net profit before tax of €4m for the financial year ending December 31, 2021.

- Following last week’s negative performance, Malta International Airport plc shares recovered 0.8% to regain the €6 level. During the week, six transactions worth €42,459 were recorded.

- On the back of a substantial increase in its equity price last week, Simonds Farsons Cisk plc retracted back to the €8.35 price level, a week-on-week decline of 6.7%. Trading activity included seven transactions with turnover tallying to €12,351.

- The MSE MGS Total Return Index was the only positive performing index this week, as it gained 0.6% to close at 1,098.329 points. The 2.1% MGS 2039 closed the week with an increase of 4.4% at the price of €118.50, while on the downside the 5.1% MGS 2029 suffered the biggest decline, as it dropped by 0.8% to end the week at €136.82.

- The MSE Corporate Bonds Total Return Index ended the week 0.6% lower at 1,145.607 points. The 6% International Hotel Investments plc € 2024 registered the best performance, as it closed 4% higher at €105. Conversely, the 4% Stivala Group Finance plc Secured € 2027 closed 2.4% lower at €101.

- In the Prospects MTF market, activity was spread across four issues, as turnover amounted to €33,446. The 5% Busy Bee Finance plc Unsecured € 2029 was the most liquid, as weekly turnover reached €13,805 as a result of two transactions and closed the week at €101.51.

| Upcoming Events | ||||

| 09 November 2021 | MT: LifeStart Holding plc Annual General Meeting | Best Performers: | ||

| 16 December 2021 | MT: Shares for Hili Properties plc to go public on the MSE | 1. LQS | 228.13% | |

| 17 December 2021 | MT: Bonds for International Hotel Investments plc to go public on the MSE | 2. HRV | 2.74% | |

| 3. MPC | 1.79% | |||

| Worst Performers: | ||||

| 1. TRI | 7.74% | |||

| 2. LBM | 7.58% | |||

| 3. SFC | 6.70% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]