MSE Trading Report for Week ending 17 December 2021

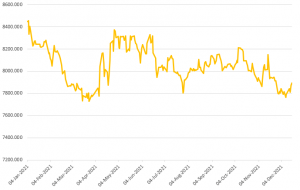

| MSE Equity Total Return Index: |

| Highlights: |

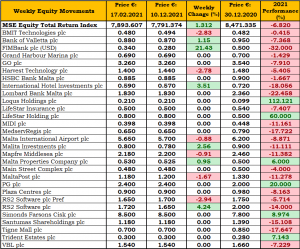

The Malta Stock Exchange (MSE) Equity Total Return Index closed the four-day trading week higher by 1.3% to finish at 7,893.607 points. FIMBank plc was the main contributor to this week’s gain, as the share price of the trade finance bank soared, while RS2 Software plc (RS2) Ordinary shares and International Hotel Investments plc (IHI) followed. Turnover increased marginally to nearly €0.5m, as 14 equities were active across 90 deals.

Fimbank plc registered a double-digit gain of 21.4%. The equity was only active on Tuesday, as the first trade was executed at a weekly low of $0.28 but managed to close at the $0.34 level. Four deals involving 64,000 shares were executed.

Bank of Valletta plc managed to gain 1.2% after turning negative on Wednesday following a positive start to the week. The equity’s price traded between a weekly low of €0.84 and a high of €0.88, this week’s closing price.

On the other hand, HSBC Bank Malta plc (HSBC) closed flat at €0.885 after touching a weekly low of €0.815 on Tuesday. The equity saw 46,216 shares change hands across 13 transactions. This week the bank announced that it has entered into a €60m loan agreement with HSBC Bank plc. The purpose of the loan is to enable the Bank to meet the interim targets for minimum requirement for own funds and eligible liabilities as set by the Single Resolution Board.

Two trades in RS2’s Ordinary shares pushed the price up by 4.2%, to close the week at €1.72. On the other hand, one transaction of 2,000 RS2 Preference shares resulted into a negative 2.9% movement in price. The equity closed €0.05 lower at €1.65.

IHI shares gained 3.5% to end the week at €0.59. Six transactions worth nearly €16,000 were executed.

In the IT sector, two transactions dragged the price of Harvest Technology plc by 2.8% to close at the €1.40 level. The equity was only active on Wednesday.

Malta International Airport plc (MIA) registered the highest liquidity, as it generated a total weekly turnover of €147,229. The equity started off the week in the red, as it traded at €5.65, the price at which it closed the week. As a result, MIA shares declined by almost 1%. A total of 26,056 shares were spread across 12 transactions. On a year-to-date perspective, the equity is down by 9%.

Telecommunications company, GO plc closed flat at the €3.26 level after trading at a high of €3.34. A total of 8,280 shares changed ownership over six deals. The equity generated a total turnover of €27,079.

Meanwhile, its subsidiary, BMIT Technologies plc was active and closed the week in negative territory at €0.48, hence down by nearly 3%. Sixteen deals involving 109,650 shares were executed.

On Thursday, PG plc approved the company’s interim financial statements for the six-month period ended October 31, 2021. The group registered a turnover of €71m compared to €60.9m in the same period last year. This represents a growth of 16.5%.

The overall gross profit earned by the Group from May 1, 2021 to October 31, 2021, amounted to €11.3m as compared to €9.6m in October 2020. The operating profit registered was €9.3m when compared to €7.9m in 2020, an improvement of 17.4%.

Profit before tax increased by 20% to €8.6m. After deducting finance costs and taxation, the Group registered a profit after tax of €6.2m compared to €5.1m the previous year. This resulted in an increase of 20.7%.

The cash generated from operating activities amounted to €11.3m, which is 21% higher than the equivalent amount registered last year. As at October 31, 2021 the Group’s bank borrowings, net of cash in hand, stood at €0.89m. The company added that it has a strong liquidity position and remains well placed to pursue new growth opportunities in its core line of business. A net interim dividend of €2.25m was paid on December 10, 2021 to all ordinary shareholders on the books of the group as at December 2, 2021.

On Thursday, VBL plc announced that it sold 100% of the shares of Casa Rooms Limited. The sale of Casa Rooms Limited happens after integration of its core-Valletta related business into the VBL Group thus keeping the focus and main activity of the VBL Group, which is exclusively focused on the capital city of Valletta. This transaction only concerns the sale of the operations outside of Valletta and therefore, VBL Group will retain any and all rights to the management contracts of Casa Rooms Limited related to Valletta which have been already re-contracted by the Group.

In terms of IPO announcements, Hili Properties plc announced that all applications were allocated in full, as a total amount of 100,892,700 shares were submitted by authorised financial intermediaries representing 25.2% of the total issued share capital of the Company. Trading in the equity is expected to commence on December 22, 2021.

The MSE MGS Total Return Index advanced by 0.1% to 1,102.05 points. A total of 10 issues were active. The most traded issue was the 1.85% MGS 2029 (III), as €4.5m was traded.

The MSE Corporate Bonds Total Return Index closed in positive territory, as it increased by 0.3% to 1,146.55 points. A total of 36 issues, were active. The 3.25% AX Group plc 2026 returned to the €100 level. The 4% Exalco Finance plc Secured € 2028 was the most liquid issue, as six trades worth just over €139,000 were executed.

In the Prospects MTF market, the 5% Busy Bee Finance plc Unsecured € 2029 was the only active security, as it closed at the €101.50 level as a result of three trades.

| Upcoming Events | ||||

| 20 December 2021 | MT: Loqus Holdings plc – Annual General Meeting | Best Performers: | ||

| 21 December 2021 | MT: MaltaPost Full Year Results | FIM | +21.43% | |

| 10 January 2022 | MT: AX Real Estate plc – Opening of offer period | RS2 | +4.24% | |

| IHI | +3.51% | |||

| Worst Performers: | ||||

| RS2P | -2.94% | |||

| BMIT | -2.83% | |||

| HRV | -2.78% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]