MSE Trading Report for Week ending 11 March 2022

| MSE Equity Total Return Index: |

| Highlights: |

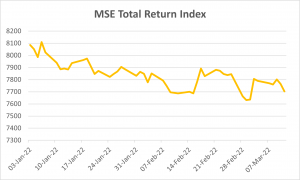

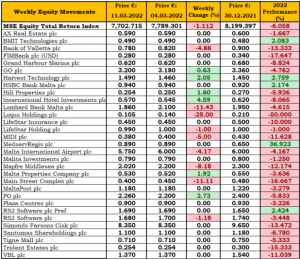

The MSE Equity Total Return Index (MSE) declined by a further 1.1% following last week’s 0.7% loss, as it closed the week at 7,702.715 points. A total of 17 equities were active, six of which registered gains while another nine lost ground. A total weekly turnover of €0.4m was generated across 68 transactions.

Bank of Valletta plc (BOV) was the most liquid equity, as 19 deals worth €0.1m were executed. The banking equity recorded a 4.9% decline, closing at €0.78, after trading at a weekly high of €0.80. BOV shares are down by 13.3% since the beginning of the year.

Malta International Airport plc joined the list of losers, as eight transactions involving 11,000 shares dragged the share price to the €5.75 level, and hence 4.2% lower on the week.

International Hotel Investments plc topped the list of gainers with a 4.6% gain to close at €0.57. This was the outcome of five transactions involving 36,815 shares.

The food and beverage company, Simonds Farsons Cisk plc, finished the week unchanged at €8.35, despite trading between a weekly high of €8.40 and a low of €8.20. Six trades of 8,412 shares were executed, generating a total turnover of €70,149.

RS2 Software plc Ordinary shares were active once, as 1,823 shares were traded. The equity finished the week lower by 1.2% to the €1.68 level. The company’s preference shares have not traded for the past six weeks.

On the other hand, the shares of retail conglomerate PG plc, advanced by 2.7% to the €2.26 price level. This was the result of just 1,000 shares executed across a single deal.

BMIT Technologies plc ended the week unchanged at €0.49. A total of 52,000 shares were traded between a weekly high of €0.492 and a low of €0.484 across three transactions.

The company’s board is scheduled to meet on March 29, 2022 to consider and approve the company’s audited financial statements for the financial year ended December 31, 2021 and to consider the declaration of a final dividend to be recommended to the company’s AGM.

Meanwhile, GO plc gained 0.6%, as turnover reached €15,360 over two transactions of 4,800 shares. The equity closed the week at €3.20.

The board is scheduled to meet on March 30, 2022 to consider and approve the company’s audited financial statements for the financial year ended December 31, 2021 and to consider the declaration of a final dividend to be recommended to the company’s AGM.

In the properties sector, seven deals involving 62,000 Hili Properties plc shares resulted in a 1.6% increase in price, as the equity closed at €0.254.

Malta Properties Company plc ended the week in the green, as 21,808 shares were spread across five transactions. The equity moved higher on Wednesday to finish at €0.545 but traded lower yesterday. However, the share price of the real estate company still ended the week 1.9% higher at €0.53.

Conversely, MIDI plc was down by 5% to €0.38, as 4,500 shares changed hands over two deals.

Mapfre Middlesea plc closed the week on a negative note, with an 8.2% fall in price, to close at €2.02. A single deal involving just 86 shares was executed.

Two deals on trivial volume moved the share price of LifeStar Holding plc lower by 1% to the €0.99 level.

A sole transaction of 1,700 Harvest Technology plc shares was executed, as the share price of the technology company closed 2.1% higher at €1.49. The equity has advanced by 2.8% since the beginning of the year.

The worst performing equity during the week was Loqus Holdings plc. The equity declined by 25% on Monday after trading once on trivial volume to close at €0.105.

Similarly, both Main Street Complex plc (MSC) and Lombard Bank Malta plc (LOM) experienced a double-digit decline of 11%. A total of 5,000 MSC shares were executed on one transaction whilst 13,071 LOM shares changed ownership over three deals.

In terms of upcoming board meetings, the board of FIMBank plc is scheduled to meet on April 13, 2022 to consider and approve the group’s and the bank’s audited accounts for the financial year ended December 31, 2021.

Malita Investments plc announced that its board is scheduled to meet on March 18, 2022 to consider and, if deemed appropriate, approve the company’s financial statements for the year ended December 31, 2021. The board will consider the payment of a final dividend during this meeting.

VBL plc announced that the discussion and approval of the company’s audited financial statements, as well as dividends is postponed to March 24, 2022 from the previously set date of March 10, 2022. This decision was taken in order to allow for the proper finalisation of the audited financial statements.

Meanwhile, yesterday M&Z plc was admitted to the official list of the MSE and trading is expected to commence on Monday.

In the Corporate Bond Market 56 issues were active, as 259 trades worth €3m were executed. The MSE Corporate Bonds Total Return Index declined by 0.2% to 1,139.185 points. The 3.5% GO plc € Unsecured 2031 was the most liquid, as turnover in this bond reached €0.8m to close the week at €101.50.

The MSE MGS Total Return Index closed the week 0.6% lower at 1,057.334 points. Turnover reached €1.7m across 31 transactions, as 16 issues were active. The 5.25% MGS 2030 (I) took the lion’s share of trading, as turnover in this bond reached over €1.2m. The bond closed the week at €133.22.

In the Prospects MTF market five issues were active. The 5% Busy Bee Finance plc Unsecured 2029 closed at 100, as nine transactions worth €59,900 were executed.

| Upcoming Events | ||||

| 16 March 2022 | MT: MaltaPost plc – Dividend Payment Date | Best Performers: | ||

| 23 March 2022 | MT: Mapfre Middlesea plc – Full Year Results | IHI | +4.59% | |

| 13 April 2022 | MT: HSBC Bank Malta plc – AGM | PG | +2.73% | |

| 20 April 2022 | MT: Lombard Bank Malta – Full Year Results | HRV | +2.05% | |

| 29 April 2022 | MT: Mapfre Middlesea plc – AGM | |||

| 26 May 2022 | MT: Lombard Bank Malta – AGM | Worst Performers: | ||

| LQS | -25.0% | |||

| LOM | -11.43% | |||

| MSC | -11.11% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]