MSE Trading Report for Week ending 18 March 2022

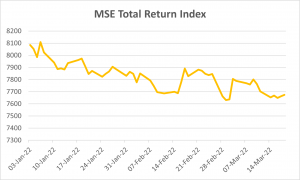

| MSE Equity Total Return Index: |

| Highlights: |

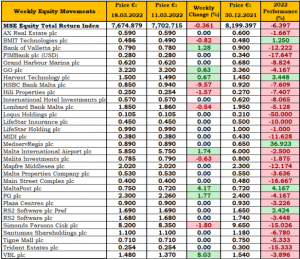

The MSE Equity Total Return Index extended its loss by a further 0.4% to 7,674.879 points, as 101 transactions were executed over 20 equities – as gainers and losers tallied to seven over a weekly turnover of €0.5 million.

Bank of Valletta plc locked a weekly gain of 1.3% to close at €0.79 in the final hours of trading yesterday, recording a volume of 97,486 shares across 23 trades. Total turnover stood at €76,043.

The board is scheduled to meet on March 22, 2022 to consider and approve the group’s and the bank’s audited financial statements for financial year ended December 31, 2021.

Its peer, HSBC Bank Malta plc headed the list of fallers. The share price fell to €0.88 on Monday and registered a further decline on Wednesday to close at €0.85, a 9.6% drop in price over the week. A total of 15,661 shares were executed over seven transactions.

Lombard Bank Malta plc shares added on its previous week’s decline, as a further 0.5% was wiped off its share value, following a single trade of just 24 shares. The equity closed the week at the €1.85 price level.

In the IT services sector, BMIT Technologies plc kicked off the week on a positive note as it reached €0.494 by Thursday but failed to sustain the gain as it closed at €0.486 yesterday. As a result, the equity finished the week down by 0.8% over 12 deals involving 142,900 shares.

RS2 Software plc Ordinary shares ended the week unchanged at €1.68, having recovered from a weekly low of €1.63. The equity was active across four transactions of 33,154 shares.

Malta International Airport plc (MIA) posted a 1.7% gain to its share price, as six deals of 7,700 shares were executed. The equity finished the week at €5.85. From a year-to-date perspective, the share price declined by 2.5%.

MIA registered a sevenfold increase in February passenger traffic over the same month in 2021. However, traffic, which totalled 196,895 passenger movements, remained 45.2% below 2019 levels.

Over the years, MIA’s traffic for the month of February has been consistently lower or marginally better than January traffic. Last February’s traffic bucked the trend, as it registered a significant increase of 24% over the previous month.

This double-digit growth indicates that the easing of travel restrictions, most of which had been introduced at the end of 2021, unleashed a pent-up demand for air travel.

February saw the United Kingdom claim the top spot in MIA’s market leaderboard. From among the most popular five markets, the United Kingdom had the strongest growth rate over February 2021. Back then, stringent travel restrictions between the two countries had limited traffic from this market to just 841 passenger movements. Italy, France, Poland and Germany made up the rest of the leaderboard, with a cumulative market share of 42.3%.

Airports Council International, of which Malta International Airport is a member, and the International Air Transport Association yesterday called for the removal of all remaining COVID-19 restrictions applying to intra-EU and Schengen area travel, including testing requirements, the need to present proof of vaccination and the need to complete a Passenger Locator Form (PLF).

Simonds Farsons Cisk plc was the most liquid security, as six deals of 16,017 shares worth €131,364 dragged the price lower by 1.8% to the €8.20 level.

Harvest Technology plc was active on the last trading day of the week, as two transactions worth €4,021 pushed the share price 0.7% higher to the €1.50 level.

GO plc added another 0.6% to the previous week’s significant gains, reaching €3.22. In total, just 2,330 shares changed ownership over seven transactions.

GO announced that it concluded a transaction that will result in the subscription of 76% shareholding in Sens Innovation Group Limited (SENS). The total consideration payable for the subscription of the shares is €1m, with the possibility of a further €1.85m earnout depending on the performance of SENS over a three-year period. It is expected that the aforementioned shares will be issued in favour of the company in the coming days.

SENS is an energy management company that leverages proprietary IOT-based technology to reduce energy consumption and associated costs for commercial buildings. SENS serves large hotels and commercial clients in Malta, UK, mainland Europe and Dubai.

Further to this strategic acquisition, the company anticipates that new opportunities will come its way, as it offers environmentally conscious energy-saving solutions to companies in Malta, Cyprus, and UK.

The retail conglomerate PG plc, joined this week’s positive movers, as the equity traded 1.8% higher to finish the week at €2.30. A total of 9,837 shares were executed across three transactions.

In the property sector, Trident Estates plc was the only positive performing equity during the week and the best performing equity overall. Trident advanced to the €1.48 price level, as two transactions of 2,028 shares pushed the share price higher by 8%.

On the other hand, despite the gains registered during the previous week, Hili Properties plc witnessed a 1.6% decline in its share price to €0.25, as a sole trade of 19,000 shares was executed.

VBL plc shares traded flat at €0.254, over one trade of 10,000 shares. Similarly, no movement was noted in the share price of International Hotel Investments plc shares having closed at €0.57, following two deals of 13,533 shares.

Last Monday, Malta Properties Company plc (MPC) saw a 1% drop in its share price which was quickly reversed on Thursday. The equity remained steady at €0.53 at the end of the week.

On Thursday, MPC announced that the AGM will be held remotely on May 19, 2022.

The company approved the annual report and consolidated financial statements for the year ended December 31, 2021. The total income for MPC amounted to €3.64m, 6% higher than that for 2020 as a result of the tenanted office building acquired in September 2020 and income generated from the photovoltaic panels installed late in 2020.

Operating profit of €2.1m remained in line with the previous year, with higher revenues offset by increases in various operating costs. In 2021, there were gains in fair value of €2.22m, and additional finance costs paid on refinancing a maturing loan and drawing down a new loan to finance the acquired office building, resulting in a profit before tax of €3.61m.

The board resolved to recommend that the AGM approves the payment of a final dividend of €0.012 net of taxation per share. The payment of this net dividend amounts to the sum of €1,215,726. The final dividend will be paid on May 24, 2022 to all shareholders on the register of members at the Central Securities Depository at close of business of April 19, 2022.

M&Z plc commenced trading last Monday, closing its first trading week in the green. Three trades worth €23,340 pushed the share price higher by 4.2% to the €0.75 level.

MaltaPost plc lost ground by 2.5%, as it closed the week at the €1.15 price level. Since the beginning of the year, the equity has dropped by 5.7% with no weekly advances, reaching a level last seen close to a year ago.

Malita Investments plc shares closed the week in the red, as two trades of 12,636 shares eased the share price by 0.6%. The equity finished the week at €0.785.

A single transaction involving 5,000 Mapfre Middlesea plc shares kept the share price at the €2.02 level. Meanwhile, Loqus Holdings plc traded twice on Wednesday over 4,860 shares. The equity’s previous week’s closing price of €0.105 was not altered.

In the corporate bond market, the MSE Corporate Bonds Total Return Index was down by 0.3% over the week, slipping to 1,136.305 points. A total of 51 issues were active, with total turnover reaching almost €1.6 million. The 3.25% APS Bank plc Unsecured Sub € 2025-2030 was the most liquid, as three trades worth €0.1m were recorded, and close the week at €100.50.

Mercury Projects Finance plc announced that it has submitted an application to the MFSA requesting the admissibility to listing of €50,000,000 secured bonds maturing in 2032, with a nominal value of €100 per bond, to be issued at par, and will pay interest at 4.30% per annum.

The MSE MGS Total Return Index declined by a further 1.5%, to close at 1,041.991 points on a turnover of €3.8m. A total of 17 government bonds were active during the week, with the 1.20% MGS 2037 (I) being the most liquid, as a single transaction worth a total of €1.8m was recorded. The bond closed the week at €93.17.

In the Prospects MTF market, four bonds were active. The 5% Busy Bee Finance plc Unsecured € 2029 was the most liquid issue, with total turnover tallying to €16,500 over three transactions to close the week at par.

| Upcoming Events | ||||

| 23 March 2022 | MT: Mapfre Middlesea plc – Full Year Results | Best Performers: | ||

| 13 April 2022 | MT: HSBC Bank Malta plc – AGM | LQS | +27.27% | |

| 20 April 2022 | MT: Lombard Bank Malta – Full Year Results | MDS | +18.67% | |

| 29 April 2022 | MT: Mapfre Middlesea plc – AGM | MLT | +5.33% | |

| 26 May 2022 | MT: Lombard Bank Malta – AGM | |||

| Worst Performers: | ||||

| IHI | -9.17% | |||

| HSB | -5.53% | |||

| FIM | -5.26% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]