MSE Trading Report for Week ending 17 June 2022

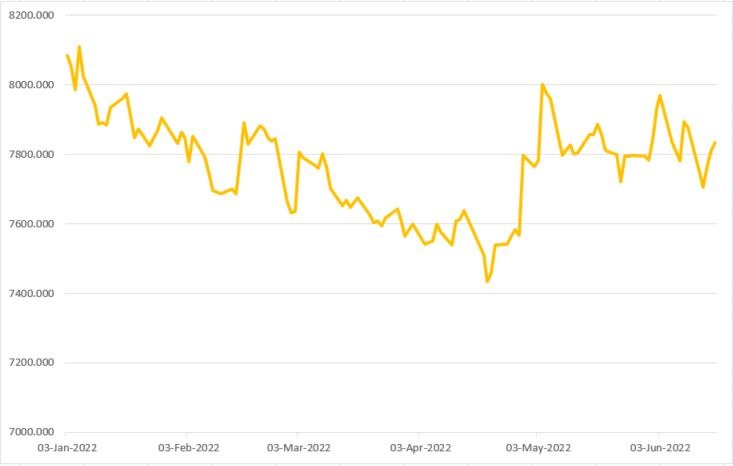

| MSE Equity Total Return Index: |

| Highlights: |

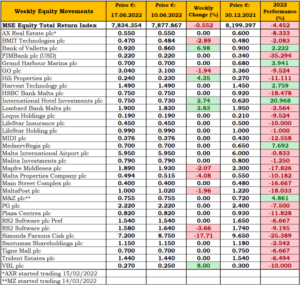

- The MSE Equity Total Return Index shed 0.6% to 7,834.354 points. A total of 18 equities were active, seven of which registered a loss, while another five traded higher. A total weekly turnover of €0.8m was generated over 140 deals.

- In the banking sector, Bank of Valletta plc (BOV) reversed the previous weeks’ decline, after closing significantly higher at €0.92. This increase translated to a 7% gain in the share price, generating a total turnover of €171,735 over 34 transactions.

- Likewise, Lombard Bank Malta plc rallied 3.8%, ending the week at €1.90 across eight deals involving 38,676 shares.

- On the other hand, two contrasting sessions in HSBC Bank Malta plc kept the share price at the €0.75 level. A total of 112,925 shares changed hands over 17 transactions.

- Malta International Airport plc (MIA) maintained the previous week’s closing price of €5.95, after being active on slim volume when compared to previous weeks. Five deals worth €26,634 were recorded.

- MIA continued to observe signs of a comeback in air travel, with May becoming the second consecutive month to surpass the half-a-million passenger mark. A total of 554,820 passengers travelled through MIA last month, translating in a recovery of 82.3% of pre-pandemic figures, as more travel requirements were lifted by the Maltese authorities. Additionally, the majority of the countries that are directly connected to MIA have now completely removed their travel requirements for passengers coming from a European Union or Schengen country.

- Last month’s seat occupancy was the highest MIA has registered in the past two years, indicating a further release of the pent-up demand for air travel.

- Italy continued to lead the way in terms of market popularity, accounting for 121,120 passengers out of May’s total traffic. The United Kingdom, France, Germany and Poland too retained their rankings from the previous month.

- Simonds Farsons Cisk plc was the worst performing equity as it suffered a 17.7% decline in its share price, ending the week at €7.20.

- GO plc continued to slip as it declined a further 2% to close at €3.04. A turnover of €78,043 was generated across 14 trades.

- In the IT services sector, RS2 Software plc reached a weekly low of €1.53, which was partially recovered on Friday. The equity closed at €1.58, a week-on-week decline of 3.7%. Ten trades involving 9,305 shares were transacted.

- The share price of BMIT Technologies plc fell by 2.9% or €0.014, ending the week at €0.47. The equity generated a total turnover of €40,146 as result of nine transactions.

- Harvest Technology plc remained at the €1.49 price level, as three transactions worth €1,555 were executed.

- A sole transaction involving 55 Mapfre Middlesea plc saw the equity price trend 2.1% lower, ending the week at €1.89.

- International Hotel Investments plc traded three times over 34,250 shares. The equity advanced by 2.7% as it closed at €0.75.

- Hili Properties plc and VBL plc were the only positive movers in the property sector. Three transactions of 4,100 Hili Properties plc shares pushed the share price 4.4% higher to reach the €0.24 level. VBL plc was the best performing equity with an 8% increase to its share price, as 33,500 shares exchanged hands across three transactions. The equity closed at €0.27.

- AX Real Estate plc was active but ended the week flat at €0.55. A total of 93,500 shares exchanged ownership across three deals.

- Malta Properties Company plc closed the week 4.1% lower at €0.494 despite trading at an intra-week high of €0.545. This was the outcome of 10 transactions worth €12,449.

- Tigne Mall plc was active on trivial volume, closing the week unchanged at €0.70.

- MaltaPost plc returned to the €1.00 price level as a result of two deals involving 3,172 shares. This translated to a 2% decline in the share price.

- A sole transaction of 5,660 Main Street Complex plc shares kept the share price unchanged at €0.40.

- FIMBank plc announced that the bank’s AGM was held on June 14, 2022. All resolutions on the agenda were approved.

- The board of Malita Investments plc announced that the AGM was held on June 16, 2022 wherein all the resolutions were approved.

- The AGM of MIDI plc was held last Thursday and all resolutions on the agenda were approved.

- The board of MedservRegis plc announced the approval of the audit consolidated financial statements of the Company for the year ended December 31, 2021. The board resolved that the annual report be submitted for the approval of the shareholders at the forthcoming AGM on July 28, 2022.

- The group registered a total revenue of €30m for 2021, up by €18.8m when compared to the previous year. Adjusted EBITDA amounted to €5.3m for the year as compared to a negative €4m in financial year 2021. The group recorded a smaller loss after tax of €7.2m versus the €12.7m loss declared in 2020.

- Following the publication of its annual audited financial statements for the period ending December 31, 2021 the suspension of trading for MedservRegis plc’s listed securities has been terminated.

- In relation to the new share issue, APS Bank Malta plc announced that 72.86% of the total amount applied for by preferred applicants, and 33.67% of the total amount applied for by the general public, will be satisfied and allocated. Trading is expected to commence on June 20, 2022.

- The MSE MGS Total Return Index declined by a further 3% to 935.209 points. A total of 17 issues were active, one of which traded higher while another 13 closed in the red. The 2.5% MGS 2036 (I) registered a 0.03% gain, as it closed at €98.50.

- The MSE Corporate Bonds Total Return Index lost ground, as it closed 0.23% lower at 1,140.866 points. Out of 49 active issues, 12 headed north while another 20 closed in the opposite direction. The 6% AX Investments Plc € 2024 was the top performing corporate bond as it gained 2.5% to €102.49.

- In the Prospects MTF market, five issues were active. The 5% HH Finance Plc Unsecured Euro Bonds 2023-2028 was the most liquid equity, generating a total trading turnover of €9,950. The bond closed the week at €99.50.

| Upcoming Events | ||||

| 22 June 2022 | MT: Plaza Centres plc – AGM | Best Performers: | ||

| 23 June 2022 | MT: Simonds Farsons Cisk plc – AGM | VBL | +8.00% | |

| 23 June 2022 | MT: Malita Investments plc – Dividend Payment Date | BOV | +6.98% | |

| 23 June 2022 | MT: Lombard Bank Malta plc – Bonus Share Allotment Date | HLI | +4.35% | |

| 24 June 2022 | MT: LifeStar Insurance plc – AGM | |||

| 24 June 2022 | MT: LifeStar Holding plc – AGM | Worst Performers: | ||

| 24 June 2022 | MT: Trident Estates plc – AGM | SFC | -17.71% | |

| 24 June 2022 | MT: M&Z plc – AGM | RS2 | -3.66% | |

| 24 June 2022 | MT: Simonds Farsons Cisk plc – Dividend Payment Date | BMIT | -2.89% | |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]