MSE Trading Report for Week ending 18 November 2022

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index (MSE) closed the week in the red, with a 0.1% decline to finish at 7,545.346 points. Total weekly turnover stood at €0.5m, as nineteen equities were active, seven of which gained and four declined.

The MSE MGS Total Return Index ended the week 1.3% higher at 890.860 points. Out of 17 active issues, 14 posted gains while two slipped. The 3% MGS 2040 (I) gained 8.8%, to close at €98, consequently ending the week as the best performer. On the other hand, the 5.5% MGS 2023 (I) suffered the biggest drop, as it declined by 0.9%, to close at €101.25.

The MSE Corporate Bonds Total Return Index declined by 1.2%, to end the week at 1,116.235 points. A total of 44 bonds were active, as 10 bonds advanced while 22 declined. The 4.65% Smartcare Finance plc Secured € 2032 was the best performer, as it gained 2%, to close at €101.99. On the other hand, the 4% International Hotel Investments plc Unsecured € 2026 suffered the biggest decline, as it dropped by 4.5%, to €95.

| Top 10 Market Movers: |

HSBC Bank Malta plc shares gained 4.2% during the week, to close at €0.75. Nine deals worth €42,873 were executed.

Bank of Valletta plc (BOV) was amongst the best performing equities, as it recorded a week-on-week increase of 1.7%. The equity closed at €0.90, after trading at an intra-week low of €0.87. BOV was the most liquid equity, as 305,595 shares worth €273,421 exchanged ownership over 24 transactions.

Lombard Bank Malta plc jumped 12.8%, to finish the week as the best performing equity. The bank’s shares closed at the €1.10 price level. Trading activity included 11 trades involving 21,860 shares. Last Thursday the Company’s share price adjusted to reflect the recently announced 2:1 share split.

LifeStar Insurance plc followed suit, as two transactions over 7,500 shares pushed the share price up by 11.1%. The equity closed the week €0.05 higher at €0.50.

Two transactions involving 23,209 MIDI plc shares added 3.7% to its share price, finishing the week at €0.282.

PG plc gained 1%, as 1,897 shares changed hands over two trades. Since January, the Company’s shares are down 11.7%, as it closed at €2.12.

The share price of International Hotel Investments plc ended the week 7.1% lower, at €0.65. This decline resulted from two trades involving 16,601 shares.

Simonds Farsons Cisk plc retracted by 2.6%, erasing last week’s gains. The Company saw its shares fall to the €7.50 price level. The equity is down 22.3% year-to-date.

Three deals involving the exchange of 3,345 GO plc shares dragged the share price 1.4% lower, as the equity closed at €2.88.

MaltaPost plc shares fell by 0.9% on low volumes during Wednesday’s session. A sole transaction worth €725 was recorded. The equity closed at €1.10.

| Company Announcements: |

The board of GAP Group plc announced that it has submitted an application to the MFSA requesting the admissibility to listing of €23m 4.75% Gap Group plc Secured Bonds 2025 – 2027.

HSBC Bank Malta plc announced its results for the nine-month period ended September 30, 2022. Reported profit before tax amounted to €33.5m, an increase of €8.3m over the same period last year. Adjusted profits, which represent reported profits excluding significant items, amounted to €34.8m compared to €28.6m reported last year. Significant items incurred in 2021 and 2022 mainly consist of restructuring provisions and related transformation costs.

The board of Lombard Bank Malta plc approved that the Authorised Share Capital of the Bank is €37,500,000 divided into 300,000,000 Ordinary Shares, whilst the issued and fully paid-up share capital of the bank is €11,340,966.75 divided into 90,727,734 Ordinary Shares, both of a nominal value of €0.125 each.

LifeStar Holdings plc announced that the board shall be convening an Extraordinary General Meeting remotely on December, 5 2022.

MedservRegis plc announced that its subsidiary, Middle East Tubular Services (Iraq) Ltd (METS) has been awarded a contract term of three years by Kuwait Energy Basra Limited (KEBL), being the operator of the Block-9 Contract Area located in the Basra Governate, Southern Iraq.

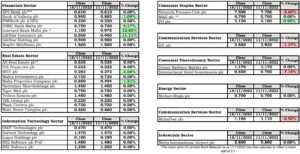

| Market Movers by Sector: |

| Upcoming Events: |

| 19 December 2022 | MT: MaltaPost plc – Full-Year Results |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]