Bond Market Resurgence Brings Positive End To Year Of Unprecedented Market Volatility

By Gabriel Mansueto, Head of Institutional Investors at Jesmond Mizzi Financial Advisors

After years of very low or negative interest rates – and correspondingly low bond returns – investors have reason to be optimistic again, with bond yields starting 2023 at their highest levels in years.

2022 has been the year of runaway inflation and unprecedented volatility. The year started off with interest rates near the zero mark in the United States and in negative territory in the Euro Area.

With low inflation characterising the best part of the last ten years, central banks’ priority was keeping short-term interest rates low to stimulate economic activity through investment and spending.

Inflation started to increase slowly in 2021 but this was dismissed as a transitory phenomenon resulting from the disruption brought about by the COVID-19 pandemic.

Central banks were therefore hesitant to increase interest rates to reign inflation in, all while governments across the globe were pumping trillions of dollars in stimulus packages into their economies out of fear of them falling into recession.

This failure to act as early as 2021 was, in hindsight, a mistake. Rather than seeing inflation decline during 2022 as was predicted, inflation shot up, in part due to the uncertainty and market disruption brought about by the Ukraine war.

The result was a sell-off across financial markets as investors fears that inaction by central banks would see inflation spiral out of control.

In reality, central banks did eventually start to raise interest rates, though not at a pace fast enough to tame inflation, which continued its relentless increase well into the first half of the year.

Central banks were forced into a more aggressive stance during the second half of the year and over the span of weeks interest rates increased by margins which would normally have been spread across a two-year cycle.

This fast-paced interest rate hiking coupled with the expectation of more inflation to come had a severe impact on every segment of the bond market, which experienced what can only be described as an anomalous year. Both highly rated corporate bonds and government bonds experienced heavy declines, recording equity-like returns in the process.

The fact that bond yields were ultra-low at the start of the year meant bonds had a limited, if any, cushioning to protect investors from the negative impact of higher interest rates. This was the primary reason behind the decline in the bond market which cancelled many of the benefits of diversification.

Light at the end of tunnel for bond investors

With markets assuming that the bulk of monetary tightening is behind us, and that inflation will start to decline sooner rather than later, returns from bonds are looking up.

Both the European Central Bank and the US Federal Reserve plan to continue with interest rate hikes during the start of 2023, though at smaller increments than 2022.

So, financial markets are starting 2023 with yields at the highest levels in years, which is positive news on two fronts. First, it means that if volatility persists, bonds will have a good cushion to withstand it. Secondly, the return of healthy bond returns for the foreseeable future means investors looking for income have more opportunities to consider.

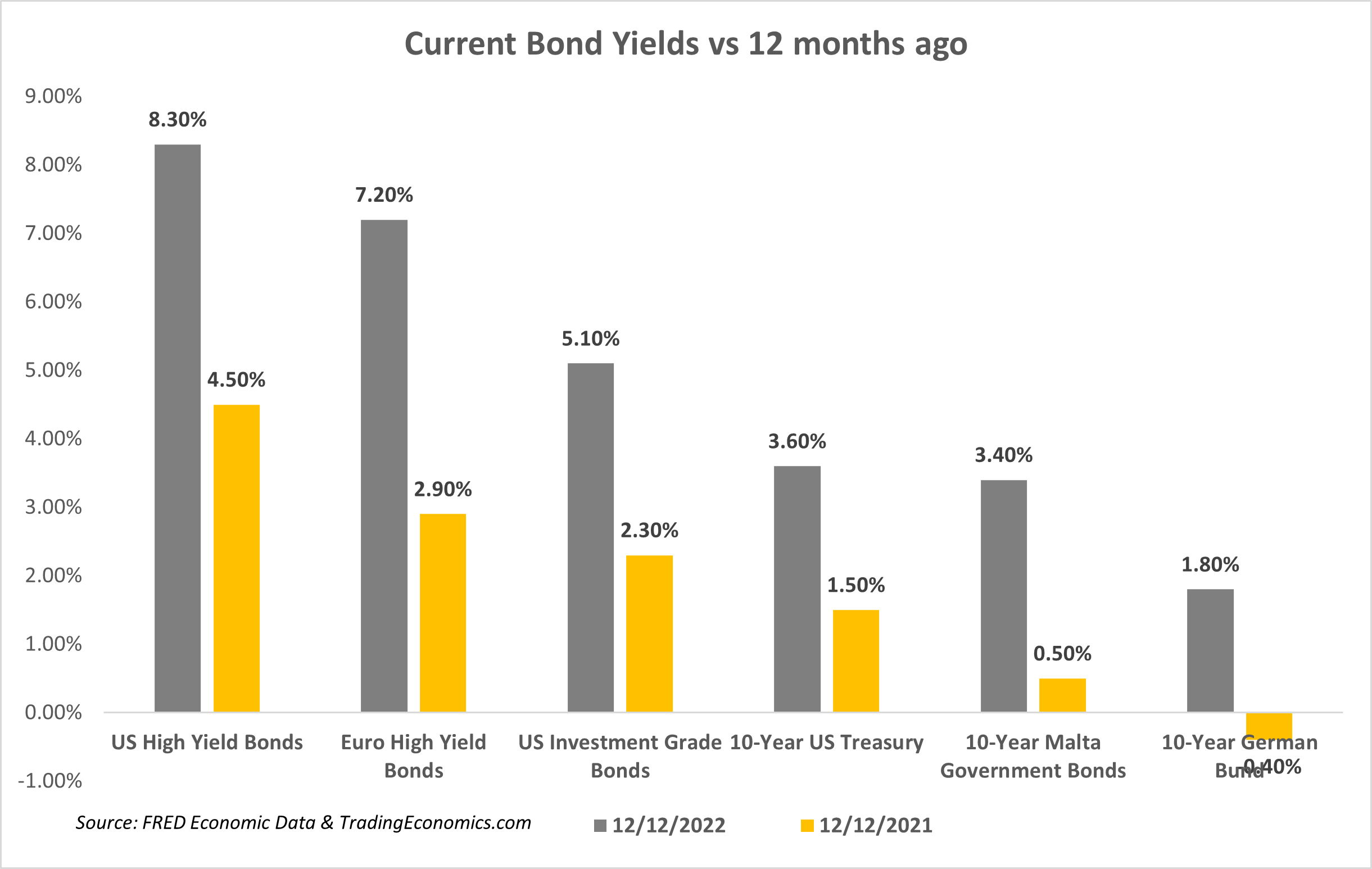

Highly rated sovereign bonds are today rewarding investors with much more attractive yields than was the case just a few months ago. A 5-year Maltese government bond will give a yield of roughly 3% compared to 0% a year ago while 10-year bonds are yielding roughly 3.4% against 50 basis points 12 months ago. US treasuries are similarly yielding 3.6% compared to just 1.5% last year.

Bond investors can therefore add quality to their portfolios while also using the increased yields on short-term bonds to reduce their portfolio’s average maturity and shield it from potential interest rate changes further down the line.

Investing in bonds might not generate the same excitement as equities do, but it is nonetheless an effective way to generate a mix of income and capital growth if portfolios are retained for the medium to long-term and assuming no investment grade bond default.

New bonds are also coming to market which are rewarding investors with more attractive coupons than they have become accustomed to in recent years.

On the credit side yields have increased considerably both in the investment grade and high yield space. Bond investors who are willing and able to take the volatility of high yield bonds will likely see yields in general more than double.

Both European and US high yield bonds are currently generating high single digit returns and make a good investment for those with the necessary risk tolerance.

Diversified and flexible bond portfolios

Despite some pickup in bond prices over the last weeks, we at Jesmond Mizzi Financial Advisors remain optimistic about bond returns in the years ahead.

Yields are starting the year at the highest levels we’ve experienced in a long time and with the bulk of the bond mayhem seemingly behind us, the outlook is looking more positive going into the new year.

Economies across the developed world are slowing down while inflation, both in Europe and to a larger extent the US, is starting to decline as tighter monetary policy appears to be having the desired impact, the bond market is once again an attractive option for investors.

Recent years have seen those looking mainly for income shying away from the bond market’s low yields and opting instead to accumulate positions in illiquid assets such as private assets, high risk bonds and property.

The resurgence in the market means that today, retail investors, high net worth individuals and corporate investors with surplus liquidity can generate steady and attractive returns through a diversified and flexile bond portfolio that reflects one’s risk profile and investment goals.

A flexible bond mandate in today’s yield environment is expected to generate attractive returns for the foreseeable future while keeping portfolio risk in check.

This article is issued by Jesmond Mizzi Financial Advisors Limited (JMFA) and was prepared by Gabriel Mansueto – Head of Institutional Client at JMFA. This article does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA, under the Investment Services Act. Investors should remember that past performance is no guide to future performance and that the value of investments may go down as well as up. For further information contact Jesmond Mizzi Financial Advisors Limited of 67, Level 3, South Street, Valletta, on Tel: 2122 4410, or email [email protected]