MSE Trading Report for Week ending 23 December 2022

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index gained 0.5%, reaching 7,386.966 points. Total weekly turnover stood at €349,305 as a result of 101 transactions. A total of 16 equities were active, seven of which headed north, while four closed in the opposite direction.

The MSE MGS Total Return Index lost ground, as it closed 0.9% lower at 886.201 points. A total of 9 issues were active. The best performance was recorded by the 2.6% MGS 2028 (V) issue, as it closed 0.3% higher at €99. On the other hand, the 4.3% MGS 2033 (I) closed 3.5% lower at €104.70.

The MSE Corporate Bonds Total Return Index notched 0.4% higher, to close at 1,122.741 points. There were 43 active issues during the week, as the 4.35% SD Finance plc Unsecured € 2027 headed the list of gainers, closing 4.6% higher at €98.80. Conversely, the 4.25% CPHCL Finance plc Unsecured € 2026 closed 11.5% lower at €85.01.

| Top 10 Market Movers: |

The equity of MedservRegis plc was this week’s best performing equity, as it rallied by 33.1%, to close at €0.785, as a result of six trades during Tuesday’s trading session. Total trading turnover stood at €8,743 on a volume of 13,870 shares. The increase in price means that, since January, the share price increased by 20.7%.

Bank of Valletta plc shares slid 1.8%, to close at €0.825, as 16 trades involving the exchange of 101,736 shares were recorded. The bank’s equity price fluctuated between a high of €0.845 and a low of €0.80.

On the other hand, APS Bank plc gained 1.7%, to close at €0.61. Trading activity included 17 trades, with total trading turnover reaching €67,939.

Similarly, Simonds Farsons Cisk plc saw its shares trend 2.9% lower, to end the week at the €6.80 price level. Trading activity included five deals worth €7,660. On a year-to-date basis, the beverage manufacturing company is down 29.5%.

The price per share of Lombard Bank Malta plc (Lombard) plummeted by 7.4% to €1. Two trades across 6,000 Lombard shares were recorded during Monday and Tuesday’s trading sessions, while no further activity was witnessed during the rest of the week.

The share value of Tigne Mall plc jumped by 10.5% to €0.84, as 4,500 shares spread over two transactions were exchanged.

Harvest Technology plc shares followed a similar path, as the Company’s share value rose by 15.2%, to close at €1.44. This increase came as a result of two small trades worth a mere €747.

The equity of RS2 Software plc was also active during the week, as the share price gained 0.8%, to close at €1.20. Although the equity ended in positive territory, during Monday’s trading session it shed 14.3% as a result of three trades, but quickly regained 17.6% on Tuesday, following five trades worth €16,811.

The share price of the postal services company, MaltaPost plc, slid 1% to end at €0.97, as six trades across 16,992 shares were recorded.

The equity price of telecommunications company GO plc increased by 3.6%, to close at €2.86. Twelve trades across 13,886 shares were recorded with trading turnover reaching €38,595.

| Company Announcements: |

During the week, the Board of Directors of MaltaPost plc approved the financial statements for the financial year ended September 30, 2022.

Group profit before tax for the period under review decreased to €0.64m from €2.4m recorded last year. This resulted in earnings per share of €0.01. Total revenue fell by 17% to €31.5m, when compared to €37.9m last year, while total expenses decreased to €30.8m versus €35.8m for 2021. The Board of Directors resolved to recommend for approval the payment of a final net dividend of €0.04 per nominal share.

On Friday, Hili Properties plc announced that following the acquisition earlier this year of 75% of the issued share capital of Baneasa Real Estate SRL, it has now entered into an agreement for the acquisition of the remaining 25%, which is expected to take place in August 2024.

The Board of Directors of Santumas Shareholdings plc is scheduled to meet on December 28, 2022 to consider and, if deemed appropriate, approve the company’s interim financial statements for the six months ended October 31, 2022.

GAP Group plc announced that its latest €23m GAP Group plc 4.75% secured bonds 2025-2027 has been subscribed in full. The secured bonds are expected to be admitted to listing on the official list of the MSE on December 29, 2022 and trading is expected to commence thereafter.

Mariner Finance plc announced that all applications for their latest bond issue of 5% unsecured bonds 2032, were allocated in full. The new bonds are expected to be admitted to listing on the official list of the MSE by latest January 3, 2023 and trading is expected to commence the day after.

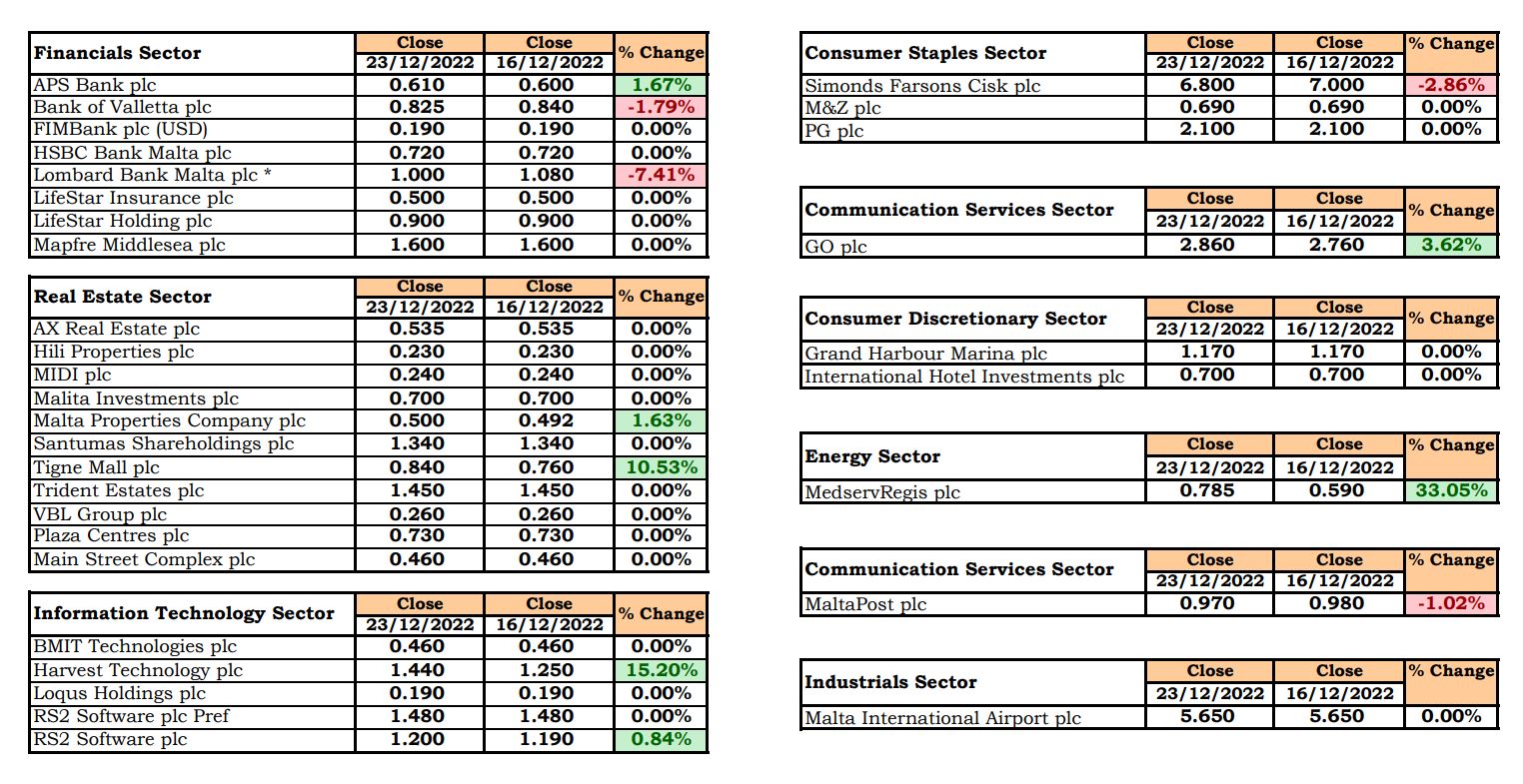

| Market Movers by Sector: |

| Upcoming Events: |

| 28 December 2022 | MT: Santumas Shareholdings plc – Approval of Interim Financial Statements |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]