MSE Trading Report for Week ending 30 June 2023

| Movement in Equity and Bond Indices: |

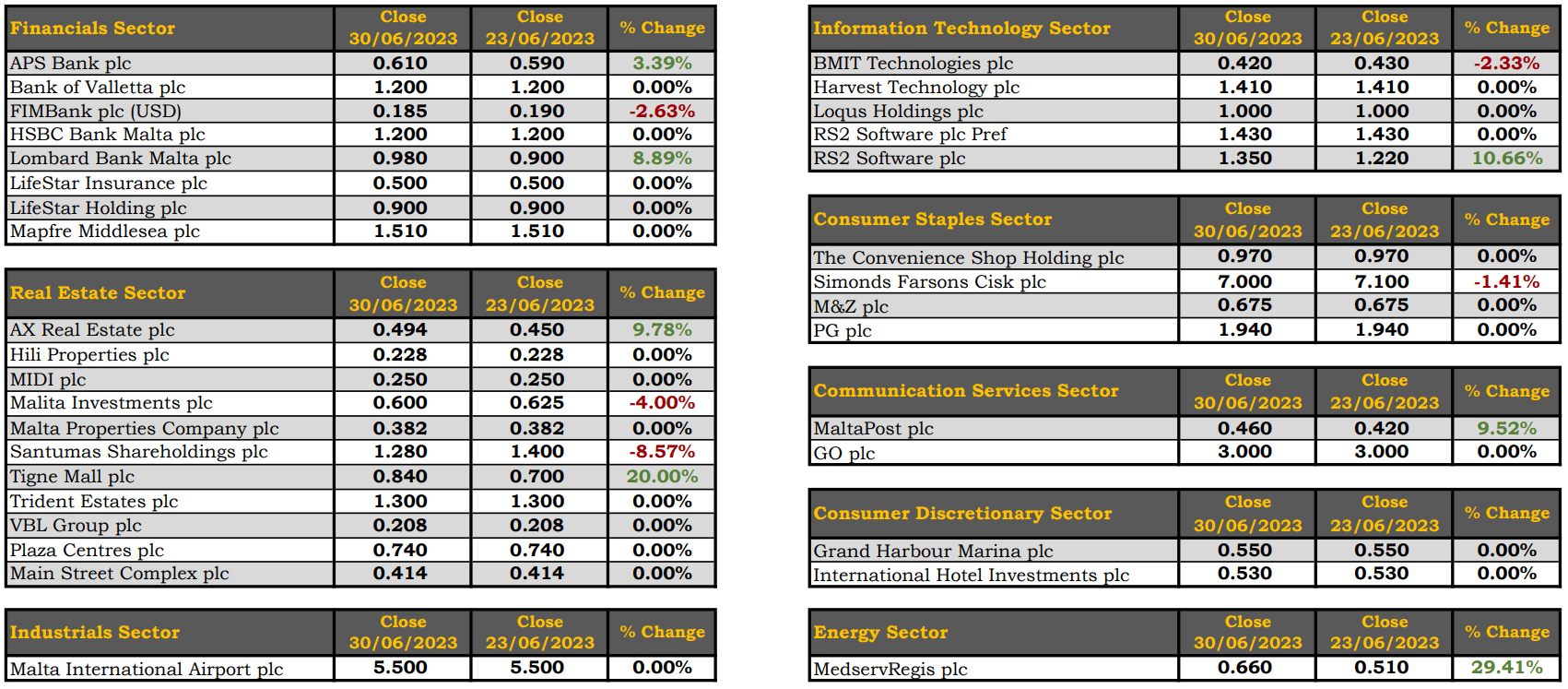

The MSE Equity Total Return Index returned to positive territory, as it closed 1.6% higher, at 7,917.909 points. A total of 23 equities were active, seven of which headed north while another five closed in the opposite direction. Total weekly turnover increased by €0.6m to €1.5m, generated across 108 transactions.

The MSE Corporate Bonds Total Return Index closed marginally lower, down by 0.06% to 1,147.061 points. A total of 47 issues were active, 16 of which advanced, while another 17 lost ground. The 6% Pharmacare Finance plc Unsecured € 2033 headed the list of gainers, as it closed 2.4% higher at €103.00. On the other hand, the 3.5% Simonds Farsons Cisk plc Unsecured € 2027 closed 3.2% lower at €98.75.

The MSE MGS Total Return Index advanced by just 0.04%, as it closed at 875.842 points. Out of nine active issues, six closed higher while another three closed in the red. The best performance was recorded by the 4.1% MGS 2034 (I), as it ended the week 0.7% higher at €103.68. Conversely, the 3.4% MGS 2027 (VI) lost 0.5%, to close at €101.00.

| Market Highlights: |

RS2 Software plc Ordinary (RS2) shares generated the highest weekly turnover, as 16 deals worth €390,580 were executed. The equity gained 10.7%, to finish the week at its eight-month high of €1.35.

MedservRegis plc was the best performing equity, having recovered almost all of the previous week’s €0.16 decline, as its share price bounced back by 29%, – closing at a weekly high of €0.66. Five deals of 85,000 shares were executed.

Tigne Mall plc was active on Friday, as 50,000 shares traded over five transactions and pushing the share price 20% up. The equity closed the week at the €0.84 price level – a six-month high.

APS Bank plc traded 3.4% higher, as 11,000 shares were spread across two transactions. The equity ended the week at €0.61– which translates into a positive 1.9% year-to-date change.

FIMBank plc declined by 2.6%, as it ended the week at $0.185. A single transaction involving 15,362 shares was executed. The equity has lost over 80% of its value since the beginning of the year.

Albeit active over a combined turnover of just over €284,000, shares of HSBC Bank Malta plc and Bank of Valletta plc failed to register any movement in price by Friday’s closing session – both maintaining the €1.20 price point.

On Wednesday, a total of 50,000 AX Real Estate plc shares changed hands in a single transaction. The equity closed at €0.494 – a 9.8% week-on-week gain.

A single deal of just 40 MaltaPost plc shares pushed the share price 9.5% higher to €0.46.

Nine deals involving 4,699 Simonds Farsons Cisk plc shares dragged the price 1.4% lower, to close at €7.00.

On a similar note, BMIT Technologies plc lost 2.3%, as it closed at €0.42. Seven deals involving 109,975 shares were executed.

Shares of Malita Investments plc were active across four deals worth €85,620 at the €0.60 – marking a 4% decline in price over the previous week’s closing price.

| Announcements: |

The Government of Malta will be launching a new issue of Malta Government Stocks as detailed hereunder:

(a) 3.55% Malta Government Stock 2026 (V);

(b) 3.75% Malta Government Stock 2033 (III); and

(c) 4.00% Malta Government Stock 2038 (I).

The fixed prices and the pricing guidelines will be published by a press release to be issued by the Department of Information of the Government of Malta as well as on the Treasury’s website on July 6, 2023.

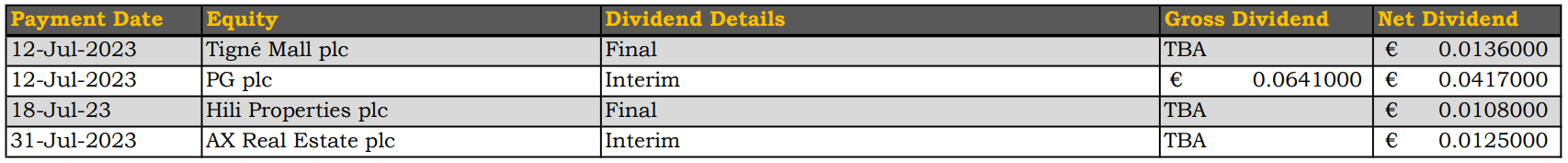

The board of AX Real Estate plc approved the company’s half yearly financial report for the six-month period ended April 30, 2023. The board declared a net interim dividend of €0.0125 net per ordinary share, which shall be paid on July 31, 2023 to shareholders on the company’s share register as at July 17, 2023.

The board of Harvest Technology plc announced that its AGM was held on June 27, 2023 and all resolutions on the agenda were approved. The board approved an aggregate net dividend of EUR0.035 per share for the financial year ended December 31, 2023.

On Tuesday, the board of Grand Harbour Marina plc approved all resolutions on the agenda at the company’s AGM held on June 27, 2023.

Hili Properties plc also held its AGM on Tuesday, during which all resolutions on the agenda were approved. The company will distribute a dividend of €0.0108 per share.

| Market Movers by Sector: |

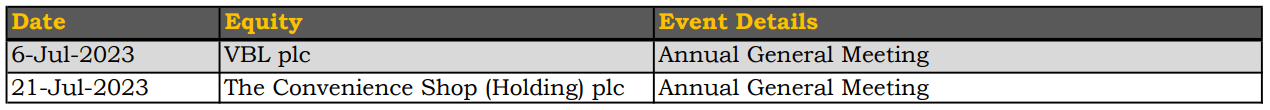

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]