MSE Trading Report for Week ending 23 February 2024

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index headed north, increasing by 0.8%, to close at 8,126.460 points. A total of 17 equities were active, as five headed north while another eight closed in the opposite direction. Turnover was just above €1.5m, an increase of €0.9m when compared to the previous week. A total of 166 transactions were executed.

The MSE MGS Total Return Index continued to decline, as it settled at 896.882 points, equivalent to a 0.7% drop. A total of 20 issues were active, with three heading north while 15 drifted lower. The best performer was the 3.40% MGS 2042 (I) as it gained 2.6% to €99. The worst performer was the 2.2% MGS 2035 (I), as it eased by 4%, to close at €85.94.

The MSE Corporate Bonds Total Return Index returned to positive territory, as it closed 0.1% higher at 1,173.322 points. A total of 52 issues were active, 13 of which advanced while another 20 closed in the red. The 4% Malta Properties Company Plc Sec € 2032 S1/22 T1 headed the list of gainers, as it closed 3.7% higher at €99.50. On the other hand, the 3.65% Stivala Group Finance plc Secured € 2029 lost 4%, ending the week at €95.01.

| Market Highlights: |

HSBC Bank Malta plc was the week’s best performing equity, adding 6.2% to its share price, closing at €1.37. HSBC was one of the most liquid equities, generating a total of €395,664 as a result of 31 trades involving 293,640 shares.

Its peer, Bank of Valletta plc recorded a gain of 1.5%, closing at a weekly high of €1.32. This was the outcome of 49 deals executed across 241,906 shares, generating total turnover of €316,928.

The share price of APS Bank plc advanced by 0.9%, to close at a weekly high of €0.55. A total of 29,305 shares worth €15,990 changed hands across 10 deals.

International Hotel Investments plc observed a 1.3% decrease, as it closed at a weekly low of €0.456. This was the outcome of eight deals of 118,070 shares worth €54,098.

Malta International Airport plc observed a 0.9% increase in its share price, closing at €5.70. A total of 14,342 shares worth €79,716 were spread across 21 trades.

Malta Properties Company plc experienced a significant decline in its share price as it dropped by 11.8%. The equity ended the week at €0.30, as four deals of just 2,315 shares were executed.

Four deals of 30,100 Malita Investments plc dragged the share price 2% lower. The equity ended the week at the €0.49 price level.

Plaza Centres plc registered a negative 4.8% movement, closing the week at €0.59. Three deals generated a total of €65,278 across 108,914 shares.

Hili Properties plc ended the week in positive territory, registering a 1.9% gain. Five deals of 58,900 shares generated €11,634 in turnover. The equity closed the week at a weekly high of €0.214.

A sole deal of 2,900 M&Z plc shares saw the equity move into the red. The equity witnessed a 6.3% decrease in its share price, closing at €0.60.

| Company Announcements |

During a meeting held on February 21, 2024, the board of HSBC Bank Malta plc approved the annual report and accounts as at December 31, 2023. The group reported a profit after tax of €86.8m for the year, an increase of €50.6m or 140% over the previous year. The bank is recommending a final net dividend of 5.85 cents per share, which brings the total net dividend for 2023 to 9.75 cents.

The board of AX Real Estates plc approved the audited financial statements for the year ending October 31, 2023. The group generated €11.8m in revenue which consists of €11.7m in rental income from the lease of the Group’s investment properties and the rest from sales of property. Profit after tax for 2023 was at €0.4m, lower by €3.2m when compared to 2022. The directors do not recommend payment of a final dividend.

Hili Properties plc has successfully concluded the sale of a retail complex in Dzelzavas Street, Riga, Latvia. This property, acquired in 2015 and transformed into a modern shopping destination, has been sold to align with Hili Properties’ strategy of optimizing its portfolio and enhancing capital efficiency. The sale valued at €7m and the overall terms of the transaction are considered customary for a transaction of this nature.

Loqus Holdings plc announced that the board will meet on February 26, 2024, to consider and approve the half-yearly report of the company for the six-month ended December 31, 2023.

Mapfre Middlesea plc announced that the company’s AGM will be held on April 30, 2024.

The Convenience Shop Holding plc announced that its forthcoming AGM shall be held on April 29, 2024.

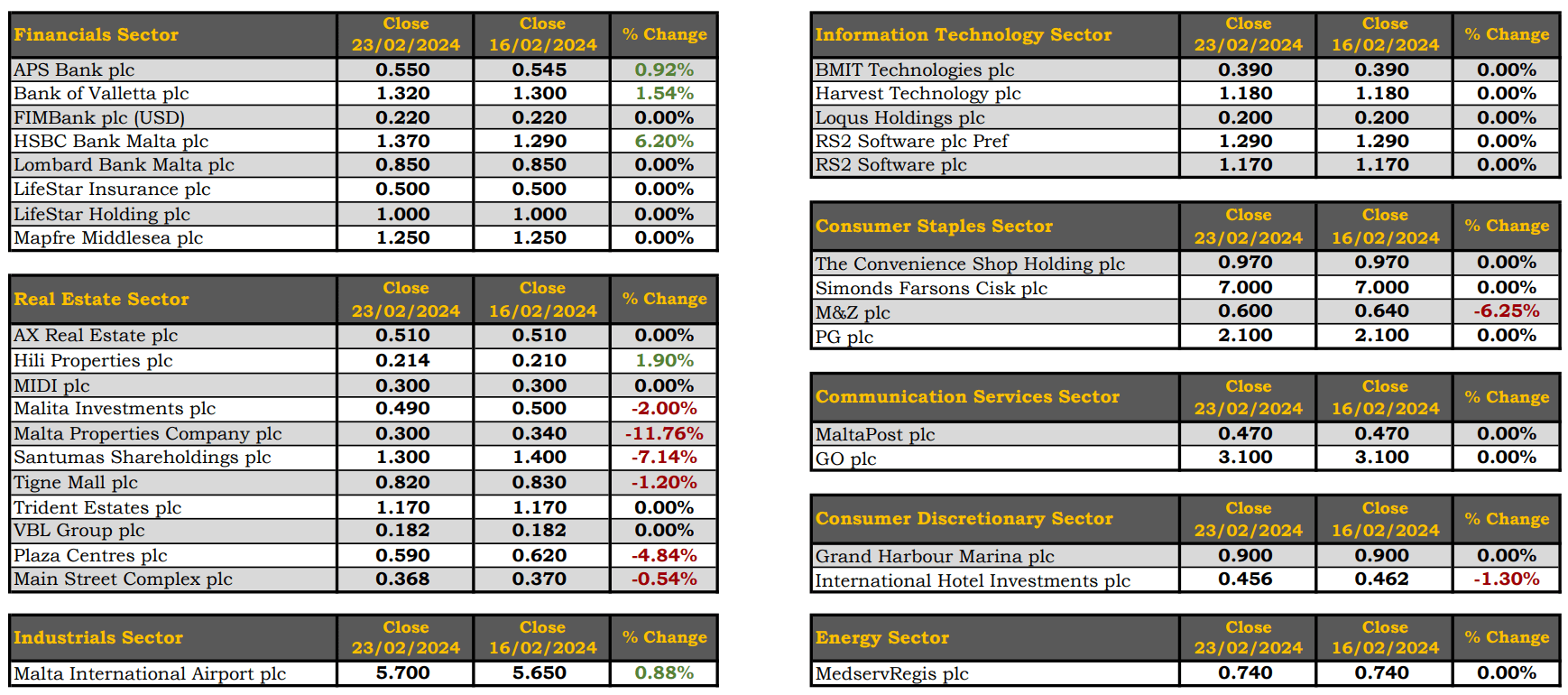

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]