MSE Trading Report for Week ending 8 March 2024

| Movement in Equity and Bond Indices: |

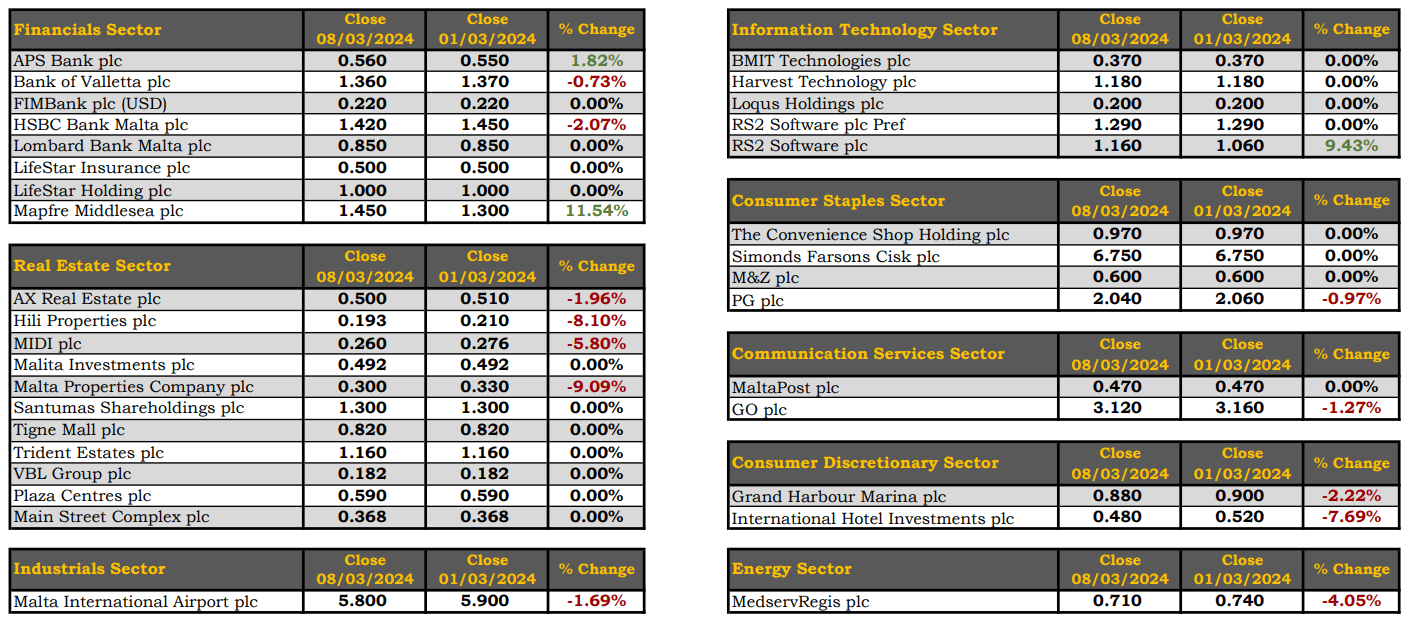

The MSE Equity Total Return Index returned to negative territory after a two consecutive week increase. The index fell 0.7%, as it closed at 8,213.665 points. The total weekly turnover, generated across 136 transactions declined significantly by €4.9m to €0.5m, when compared to the previous week. Out of 20 active equities, three closed higher while another 12 ended the week in the red.

The MSE Corporate Bonds Total Return Index did not manage to maintain the previous week’s gain, as it lost 0.2%, to close at 1,177.985 points. Out of 60 active issues, 25 headed north while another 16 closed in the opposite direction. The 4% Exalco Finance plc Secured € 2028 was the best performer, as it closed 2.9% higher at €99. On the other hand, the 3.5% AX Real Estate plc Unsecured € 2032 ended the week 5.3% lower at €90.

The MSE MGS Total Return Index headed north, gaining 0.6% as it closed at 906.130 points. A total of 29 issues were active, 21 of which advanced while another seven traded lower. The top performer was the 1.00% MGS 2031 (II), as it registered a 6.9% increase, ending the week at €86.12. Conversely, the 2.40% MGS 2052 (I) lost 16.6%, as it finished the week at the €74.10 price level.

| Market Highlights: |

International Hotel Investments plc (IHI) headed the list of negative performers, recording a loss of 7.7%. The equity closed at a weekly low of €0.48, partially losing the previous week’s gain. This was the outcome of three deals of 12,695 shares worth €6,313.

In the IT sector, RS2 Software plc Ordinary shares witnessed a significant increase in its share price of 9.4%, closing at a weekly high of €1.16. This was the outcome of two deals of 3,100 shares worth €3,176.

Malta International Airport plc observed a 1.7% decrease in its share price. The equity closedat €5.80 despite reaching a weekly high of €5.90. A total of 10,454 shares exchanged hands across 14 deals. Turnover reached €60,830 during the trading week.

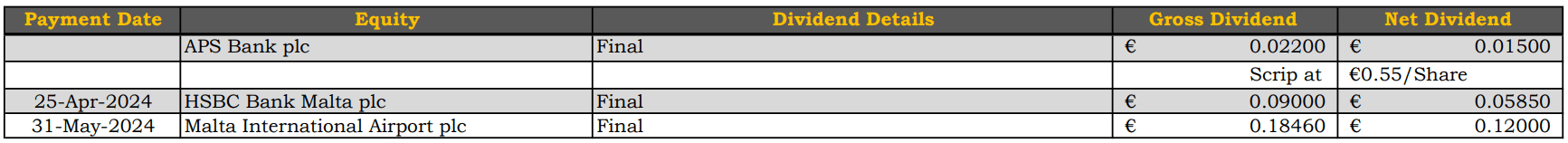

In the banking sector, HSBC Bank Malta plc witnessed a 2.1% decrease in its share price, closing at €1.42. The equity traded at a weekly high of €1.45 and a low of €1.40. A total of 13 trades of 34,982 shares were executed, generating €49,280 in turnover.

Its peer, Bank of Valletta plc, ended the week at €1.36, translating into a decline of 0.7%. This was the outcome of 19 deals involving 69,175 shares. The equity was the most liquid during the week, generating a total turnover of €93,675.

On the other side, APS Bank plc saw an increase in its share price of 1.8%, as a result of 24 deals involving 92,860 shares. The equity generated a total turnover of €51,320, closing at the €0.56 price level.

Mapfre Middlesea plc recorded a double-digit gain of 11.5%, ending the week at €1.45. A total of 1,624 shares changes ownership across four deals.

The share price of Hili Properties plc retracted by 8.1%, ending the week at €0.193. Six deals of worth €46,526 were executed.

GO plc witnessed a 1.3% decrease in its share price as seven deals worth 5,300 shares were recorded. The equity closed the week at €3.12.

A total of three deals involving 20,000 MIDI plc shares, dragged the share price in the red. The equity registered a decline of 5.8%, ending at a low of €0.26.

| Company Announcements |

The board of APS Bank plc met on March 7, 2024, and approved the Group Annual Report and Audited Financial Statements for the financial year ended 31 December 2023. APS Bank plc reported a profit after tax of €20.6 million compared to €5.8m in 2022 for the Group. The bank reported a profit after tax of €18.2 million compared to €19.2m in 2022. The board is recommending a gross scrip dividend to shareholders of €8.4 million, bringing the total dividend for the year to €11.7 million, equating to a 2023 dividend per share of €0.031 gross or €0.020 net per share.

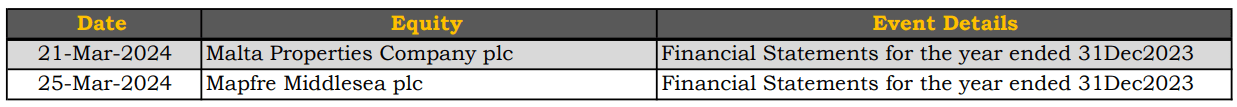

The board of Malta Properties Company plc announced that it is scheduled to meet on March 21, 2024, to consider and approve the Company’s audited financial statements for the financial year ended 31 December 2023 and to consider the declaration of a final dividend to be recommended to the Company’s AGM.

GO plc announced that the board are scheduled to meet on March 20, 2024, to consider and approve the Company’s audited financial statements for the financial year ended December 31, 2023, and to consider the declaration of a final dividend to be recommended to the company’s AGM.

IHI plc announced that it has leased the Corinthia Hotel in Prague to Czech Inns from Prague for the latter to operate this hotel as from 1 April 2024. The hotel will henceforth be marketed under a new name by Czech Inns, following a de-branding period. IHI has owned the 550-room high rise hotel since 1998. The decision to appoint a third-party lessee to operate the hotel is in line with IHI’s direction to focus its Corinthia brand solely on ultra-luxury operations whilst seeking other brands and solutions for its upscale and mid-market owned hotels.

| Market Movers by Sector: |

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]