MSE Trading Report for Week ending 06 March 2020

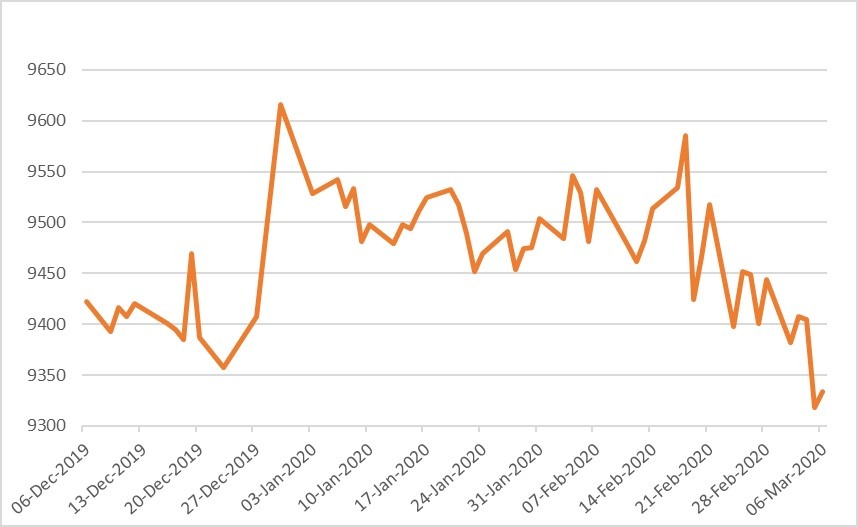

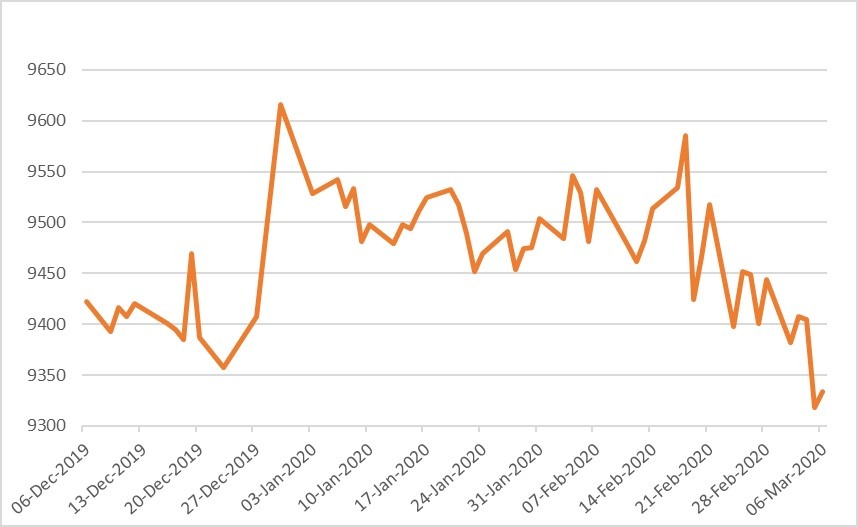

| MSE Equity Total Return Index: |

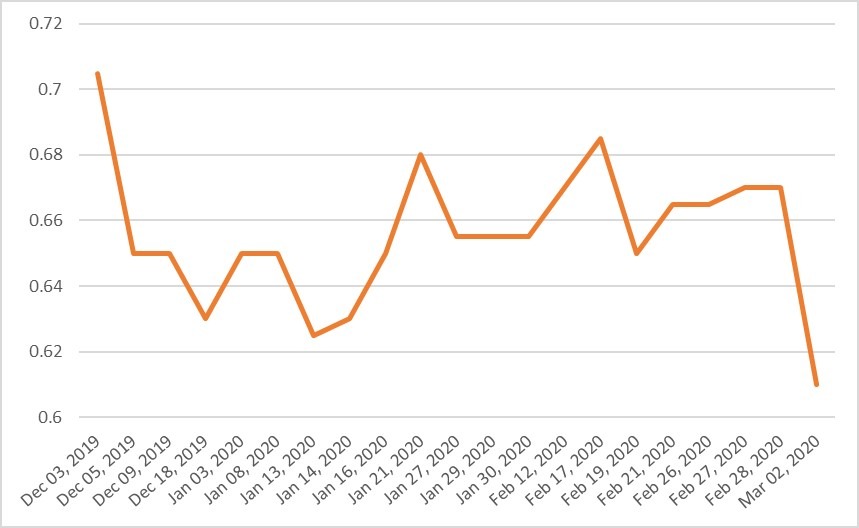

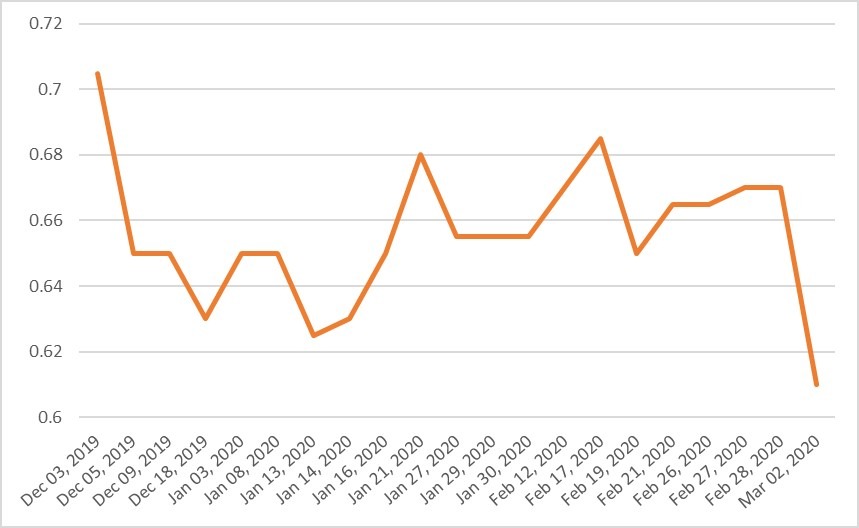

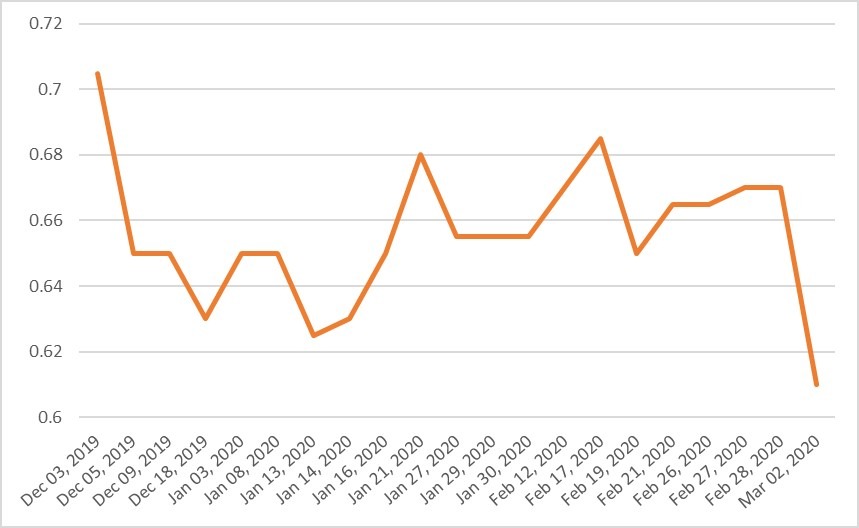

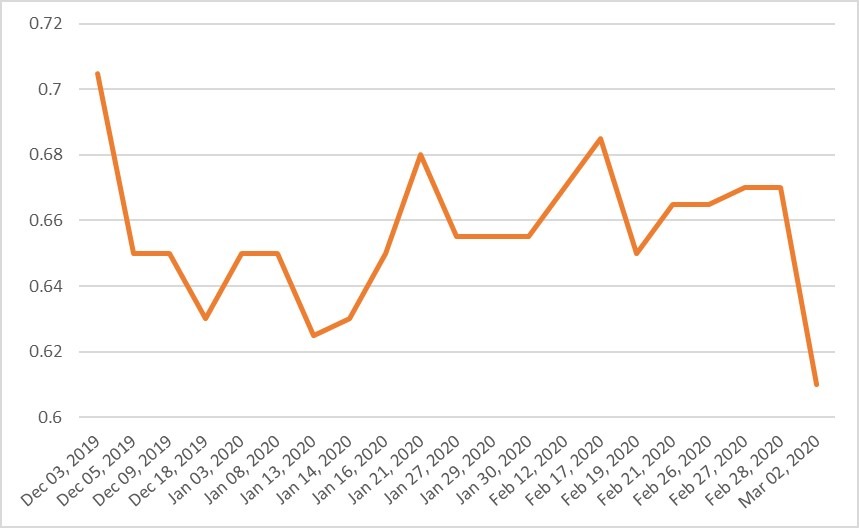

| Chart of the Week: Malta Properties Company plc |

| Highlights: |

- During a week characterised by high volatility in the international markets, the MSE Equity Total Return Index dropped by a mere 1.16% to close at 9,334.004 points. A total weekly turnover of over €3.8 million was generated over 272 deals across 17 equities.

- Malta International Airport plc registered the worst performance for the week as global fears due to the coronavirus continued to spread and affect the travel industry. The equity started off the week unchanged but declined drastically by Friday, registering a sharp decline of 11.68% to close the week at €6.05. A total of 86,911 shares were traded across 52 deals for a total value traded of €545,995.

- In the banking industry, HSBC Bank Malta plc registered a positive 0.95% movement in price as it closed at €1.06. The bank registered the highest liquidity, as total weekly turnover amounted to €1.08 million. During the week, a mix of 1,029,932 shares changed hands over 61 transactions. A final net dividend of €0.014 per share will be paid to all shareholders as at close of trading on March 5, 2020.

- Its peer, Bank of Valletta plc reached an 11-week low price of €1.025 on Thursday, but managed to recoup the loss the following day. A total of 115,577 shares were spread across 34 transactions. The bank’s previous week’s closing price of €1.05 was not altered.

- In the property sector, Malta Properties Company plc declined to €0.61 on Monday, translating into an 8.96% fall in price. Seven deals involving 34,700 shares were executed. On the other hand, eight deals involving 37,755 Malita Investments plc shares pushed the price 1.12% higher, to close at €0.90.

- Telecommunications company, GO plc, was up by 0.47%, as 93,557 shares changed hands over 16 transactions. The equity reached an eight-week high price of €4.28 but closed the week two cents lower at €4.26. Similarly, its subsidiary, BMIT Technologies plc, registered a 1.85% increase in price as it closed at €0.55. This was the outcome of 20 deals involving 229,620 shares.

- Retail conglomerate, PG plc, reached the €2.00 price level on Monday but did not manage to sustain the gain until end of week. The equity closed 0.51% lower at €1.95, as nine deals involving 222,327 shares were executed.

- In the Corporate Bond market, out of 45 active issues, 19 increased in price while another 16 closed in the opposite direction. The 4.5% Medserv plc Unsecured € 2026 headed the list of gainers as it closed 1.02% higher to close at par. On the other hand, the 4.4% Central Business Centres 2027 Euro Unsecured lost 2.90%, ending the week at €100.50.

- In the Sovereign Debt market, 21 issues were active, of which one declined while the rest advanced, as yields drifted lower amid coronavirus fears. The only negative performer was the 4.6% MGS 2020 (II) as it closed 0.19% lower at €100.71. Meanwhile, the 3% MGS 2040 (I) was up by 1.33%, ending the week at €144.46.

- In the Prospects MTF market, nine issues were active. The 5% FES Finance plc Secured € 2029 was the most liquid, as it generated a total turnover of €108,777.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. RS2 | +2.42% | |||

| 2. BMIT | +1.85% | |||

| 10 MAR 2019 | MT: FIMBank plc – Results | 3. MTP | +1.56% | |

| 11 MAR 2019 | MT: Malita Investments plc – Results | |||

| 12 MAR 2019 | MT: Mapfre Middlesea plc – Results | Worst Performers: | ||

| 1. MIA | -11.68% | |||

| 2. MPC | -8.96% | |||

| 3. MDS | -2.91% | |||

| Price (€): 06.03.2020 | Price (€): 28.02.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 9,334.004 | 9,443.594 | -1.160 | -2.930 |

| BMIT Technologies plc | 0.550 | 0.540 | 1.85 | 5.769 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.050 | 1.050 | 0.00 | -0.943 |

| FIMBank plc (USD) | 0.580 | 0.580 | 0.00 | -3.33 |

| GlobalCapital plc | 0.216 | 0.216 | 0.00 | -22.86 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | 0.00 |

| GO plc | 4.260 | 4.240 | 0.47 | 0.00 |

| Harvest Technology plc* | 1.500 | 1.500 | 0.00 | 0.00 |

| HSBC Bank Malta plc | 1.060 | 1.050 | 0.95 | -18.46 |

| International Hotel Investments plc | 0.750 | 0.770 | -2.60 | -9.64 |

| Lombard Bank plc | 2.220 | 2.220 | 0.00 | -2.63 |

| Loqus Holdings plc | 0.080 | 0.080 | 0.00 | 24.03 |

| MIDI plc | 0.480 | 0.480 | 0.00 | -11.11 |

| Medserv plc | 1.000 | 1.030 | -2.91 | -9.09 |

| Malta International Airport plc | 6.050 | 6.850 | -11.68 | -12.32 |

| Malita Investments plc | 0.900 | 0.890 | 1.12 | 0.00 |

| Mapfre Middlesea plc | 2.320 | 2.340 | -0.85 | 7.41 |

| Malta Properties Company plc | 0.610 | 0.670 | -8.96 | -3.17 |

| Main Street Complex plc | 0.570 | 0.570 | 0.00 | -5.00 |

| MaltaPost plc | 1.300 | 1.280 | 1.56 | -0.76 |

| PG plc | 1.950 | 1.960 | -0.51 | 5.98 |

| Plaza Centres plc | 1.040 | 1.030 | 0.97 | 2.97 |

| RS2 Software plc | 2.540 | 2.480 | 2.42 | 18.69 |

| Simonds Farsons Cisk plc | 11.000 | 10.900 | 0.92 | -4.35 |

| Santumas Shareholdings plc | 1.500 | 1.500 | 0.00 | 6.38 |

| Tigné Mall plc | 0.880 | 0.880 | 0.00 | -2.22 |

| Trident Estates plc | 1.570 | 1.570 | 0.00 | 1.29 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].