MSE Trading Report for Week ending 30 April 2021

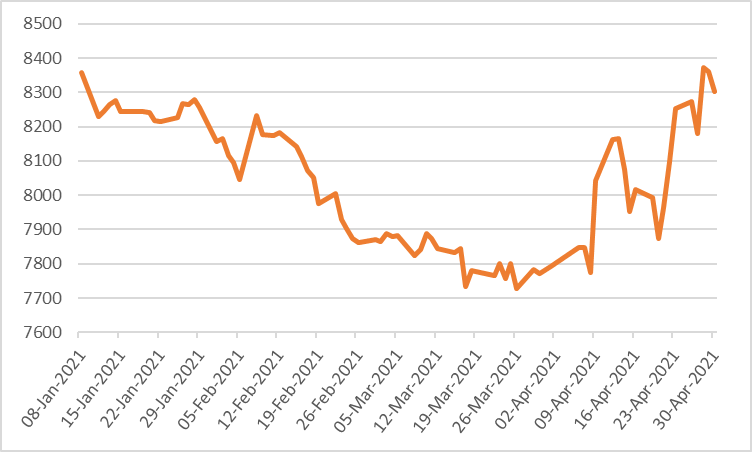

| MSE Equity Total Return Index: |

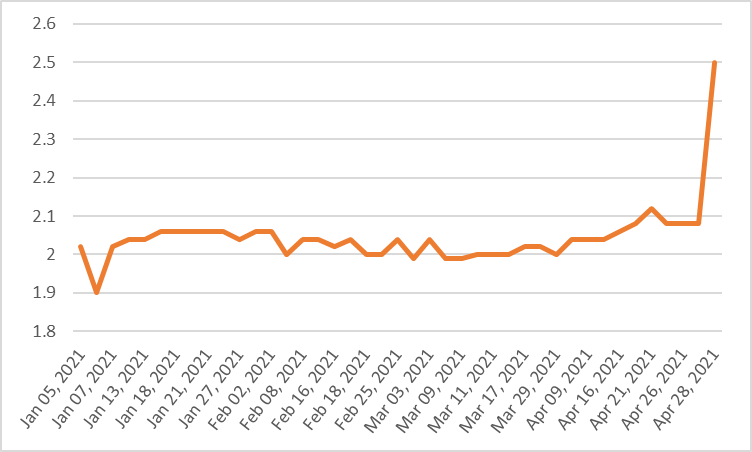

| Chart of the Week: PG plc |

| Highlights: |

- The MSE Equity Total Return Indexclosed another week in the green, as it reached 8,303.294 points – equivalent to a 0.6% weekly change and a 7% month-on-month increase. During the week, a total of 16 equities were active, four of which headed north while eight closed in the opposite direction. Total weekly turnover was lower than the previous week, as it amounted to €0.86m – generated across 118 transactions.

- Retail conglomerate, PG plc, reached another all-time-high price of €2.50, registering the best performance of 20.2%. The equity was trading flat at the beginning of the week until it spiked to €2.50 last Wednesday, as one deal of 50 shares was executed in the final minutes of trading. During the week, a total of 88,750 shares changed hands over seven deals, worth €0.18 million. From a year-to-date perspective, the equity is up by 25%.

- International Hotel Investments plc (IHI) was the most liquid equity, as it recorded a total turnover of €0.3 million. The equity started off the week at €0.70 but ended the week slightly lower at €0.68 – equivalent to a 4.6% gain. This was the result of 438,327 shares spread across 19 transactions. On the month, IHI shares gained 30%.

- Last Thursday, Bank of Valletta plc announced that the 47th Annual General Meeting is scheduled for May 20, 2021.

- The profit and loss account and balance sheet for the financial year from January 1, 2020 to December 31, 2020, and the Directors’ and Auditors’ reports thereon, shall be received and approved.

- The share price of the equity advanced by 1.1%, as 73,946 shares changed ownership across 19 deals. The banking equity closed the month of April up by 4.4% at €0.91.

- The board of RS2 Software plc approved the financial statements for the financial year ended December 31, 2020. These financial statements shall be submitted for the approval of the shareholders at the forthcoming Annual General Meeting which is scheduled to be held on June 24, 2021.

- In view of the Company’s investment and strategic growth, the board resolved that it was not recommending a distribution of dividend to utilise funds to expand the business of the Company.

- During the year under review, on consolidating all of its activities, the Group generated revenues of €26.8m up from €22.1m generated in 2019.

- As at December 31, 2020 the Group’s total assets amounted to €38.1m, whereas its current liabilities exceeded its current assets by €9.1m.

- The board noted that the loss before tax reported in the annual financial statements for the year ended December 31, 2020 amounted to €3.88m, equivalent to an 85.7% decline from the previous loss in 2019. This is in line with the 2020 forecast of €3.9.

- Actual consolidated revenues exceeded forecast by circa €1.7 million. This has been absorbed in the most part by an impairment loss on contract costs of €1.1m which related to deferred costs on a specific project which is currently on hold, and other expenses slightly exceeding forecast.

- Nevertheless, loss after tax amounted to nearly €6m, in comparison to the projected €5.2m. This represents an adverse material variance of €785,767 (-15%). The variation is mainly attributed to a higher tax expense related to a license sale by the Company to one of its subsidiaries.

- The revenue from license sale is eliminated upon consolidation, however the timing of the tax expense for the Company and the tax deduction for the subsidiary, varies under the respective jurisdictions, thus creating the material variance as compared to the projected numbers.

- During the week the equity lost 2.5%, as nine deals involving 20,083 shares dragged the price to €1.95 after trading at a weekly high of €2 and a low of €1.85.

- Last Wednesday, the board of Plaza Centres plc approved the consolidated financial statements for the year ended December 31, 2020.

- The Group generated revenue of €2.8m, equivalent to a 22.4% decline when compared to the €3.6m in 2019. Similarly, profit before tax was down by 59.2% to €0.8m.

- The Group’s total assets saw a 20.3% decline from €48.8m recorded in 2019, to the €38.9m recorded in 2020.

- Similarly, total liabilities declined to €12.2m, equivalent to a 29.7% movement.

- The directors have resolved to declare an additional net dividend to shareholders of €400,000 and accordingly, considering the interim dividend of €1m, already declared and paid, to recommend as a final net dividend to shareholders of €1.4m at the Annual General Meeting. This is scheduled to be held on June 23, 2021.

- The cut-off date for eligibility to dividends shall be May 24, 2021 and that accordingly only shareholders on the register of members on that date shall be eligible to receive the dividend, once approved by the shareholders at the Annual General Meeting.

- The equity traded once over 4,000 shares, leaving no impact on the equity’s previous week’s closing price of €0.88.

- The MSE MGS Total Return Index lost ground, as it closed 0.19% lower at 1,124.91 points. Out of 19 active issues, four registered gains while another 12 closed in the red. The 2.5% MGS 2036 (I) headed the list of gainers, as it closed 1.6% higher at €125.00. Conversely, the 4.5% MGS 2028 (II) lost 2%, as it closed at €133.25.

- The MSE Corporate Bonds Total Return Index advanced by a further 0.44%, as it reached 1,119.01 points. A total of 42 issues were active, 17 of which traded higher while another nine declined. The best performance of a 2% increase was recorded by the 3.25% AX Group 2026 and the 6% International Hotel Investments plc 2024, as they closed at €103.00 and €102.10, respectively. On the other hand, the 3.65% Stivala Group Finance plc Secured 2029 ended the week 1% lower at €102.00.

- In the Prospects MTF market, six issues were active. The 5% Luxury Living Finance plc Secured Bonds 2028 were the most liquid, as a total weekly turnover of €31,996 was generated.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. PG | +20.19% | |||

| 05 MAY 2021 | MT: Malta International Airport plc – Annual General Meeting | 2. IHI | +4.62% | |

| 07 MAY 2021 | MT: Harvest Technology plc – Annual General Meeting | 3. BOV | +1.11% | |

| 11 MAY 2021 | MT: Malita Investments plc – Annual General Meeting | |||

| 12 MAY 2021 | MT: Trident Estates plc – Annual Results | Worst Performers: | ||

| 20 MAY 2021 | MT: Bank of Valletta plc – Annual General Meeting | 1. GO | -6.45% | |

| 2. HSBC | -5.29% | |||

| 3. RS2 | -2.50% | |||

|

|

Price (€): 30.04.2021 | Price (€): 23.04.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 8,303.294 | 8,252.192 | 0.62 | -1.98 |

| BMIT Technologies plc | 0.505 | 0.500 | 1.00 | 4.77 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.910 | 0.900 | 1.11 | -4.21 |

| FIMBank plc (USD) | 0.290 | 0.290 | 0.00 | -42.00 |

| Grand Harbour Marina plc | 0.660 | 0.660 | 0.00 | -5.71 |

| GO plc | 3.480 | 3.720 | -6.45 | -1.70 |

| Harvest Technology plc | 1.450 | 1.450 | 0.00 | -2.03 |

| HSBC Bank Malta plc | 0.805 | 0.850 | -5.29 | -10.56 |

| International Hotel Investments plc | 0.680 | 0.650 | 4.62 | -5.56 |

| Lombard Bank plc | 2.000 | 2.000 | 0.00 | -15.25 |

| Loqus Holdings plc | 0.066 | 0.066 | 0.00 | -33.84 |

| LifeStar Holding plc | 0.600 | 0.600 | 0.00 | 20.00 |

| MIDI plc | 0.420 | 0.430 | -2.33 | -6.25 |

| Medserv plc | 0.830 | 0.830 | 0.00 | 5.06 |

| Malta International Airport plc | 6.200 | 6.200 | 0.00 | 0.00 |

| Malita Investments plc | 0.880 | 0.880 | 0.00 | -2.22 |

| Mapfre Middlesea plc | 2.380 | 2.380 | 0.00 | -3.25 |

| Malta Properties Company plc | 0.545 | 0.555 | -1.80 | 9.00 |

| Main Street Complex plc | 0.498 | 0.498 | 0.00 | -0.40 |

| MaltaPost plc | 1.250 | 1.270 | -1.57 | -6.02 |

| PG plc | 2.500 | 2.080 | 20.19 | 25.00 |

| Plaza Centres plc | 0.880 | 0.880 | 0.00 | -10.20 |

| RS2 Software plc | 1.950 | 2.000 | -2.50 | -2.50 |

| Simonds Farsons Cisk plc | 9.750 | 10.000 | -2.50 | 25.00 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.740 | 0.740 | -0.67 | -12.94 |

| Trident Estates plc | 1.600 | 1.600 | 0.00 | -3.61 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]