MSE Trading Report for Week ending 03 March 2023

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index lost 1.2% during the week and closed at 7,506.844 points. Sixteen equities were active, as 11 lost ground while two gained. A total turnover of €0.9m was registered as a result of 117 deals. The equity index was dragged lower mostly by the declines experienced by Malta International Airport plc, International Hotel Investments plc and PG plc.

The MSE MGS Total Return Index recovered 0.3%, to end the week at 877.328 points. A total of seven bonds were active – one advanced while five declined. The best performing government bond was the 2.3% MGS 2029 which experienced an increase of 4.2%, to end the week at €98. On the contrary, the 4.5% MGS 2028 suffered the largest decline, as it dropped by 2.2% to end the week at €105.16.

The MSE Corporate Bonds Total Return Index closed the week 0.4% higher at 1,120.428 points. Out of 60 active bonds, 23 recorded an increase, whereas 18 declined. The 4.8% Mediterranean Maritime Hub Finance plc Unsecured € 2026 ended the week as the best performer with a gain of 4.2%. The price at the end of yesterday’s session read €99. On the other hand, the 4.25% CPHCL Finance plc Unsecured € 2026 suffered the biggest drop, as it declined by 5.5%, to close at €94.50.

| Market Highlights: |

The MSE Index experienced a decline primarily due to the losses of two large cap equities. Among these was Malta International Airport plc, which closed the week down by 3.4% at €5.65. During the week the equity traded between a weekly low of €5.50 and a high of €5.85. The total value of executed shares amounted to €83,313, with a volume of 14,674 shares.

International Hotel Investments plc followed suit, recording a 3.3% decline in its share price. The equity ended the week at €0.58, as a result of two deals worth €541.

Retail conglomerate, PG plc, was active on three occasions over which 2,475 shares exchanged hands. The share price declined to the €2 price level – 2.9% lower.

Simonds Farsons Cisk plc concluded the week with a negative performance, as its share price dropped by 1.4%. This was the result of seven deals executed and worth €22,337.

A sole transaction of 438 Trident Estates plc shares dragged the price 9.1% lower, closing at €1.30.

HSBC Bank Malta plc joined the list of fallers, closing the week at €1.03. This was the result of a 1% decline in the share price, as 91,622 shares were traded across 14 deals. HSBC is up 45% year-to-date.

In the IT Services sector, RS2 Software plc Ordinary Shares registered a 0.9% negative movement in price. The equity closed the week at €1.15, after 5,558 shares exchanged hands across four deals.

Bank of Valletta plc (BOV) was the most liquid equity during the week, recording a total turnover of €447,889 executed across 39 transactions. The equity closed flat at €0.93.

On the other hand, Lombard Bank Malta plc advanced by 5.3%, to close at €1. This was the outcome of two deals worth €15,776.

Similarly, five deals of 80,775 MaltaPost plc shares pushed the share price 5.3% higher to €1. Since the beginning of the year, the equity declined by 8.3%.

| Announcements: |

The board of GO plc is scheduled to meet on March 15, 2023, to consider and approve the company’s audited financial statements for the financial year ended December 31, 2022, and to recommend and consider the declaration of a final dividend at the company’s AGM.

APS Bank plc announced that a marketing brief will take place on March 9, 2023, following the approval of the bank’s and group’s audited financial statements for the year ended December 31, 2022.

AX Real Estate plc (AXR) announced that the company’s AGM will be held on April 26, 2023. The company also announced that the board resolved to approve the company’s audited financial statements for the financial year ended October 31, 2022. AXR reported a profit after tax for the year of €7.1m on revenues of €11.4m. The directors do not recommend the payment of a final dividend.

Loqus Holdings plc announced that the directors have approved the half-yearly report of the Company for the six months ended December 31, 2022. During the period, the group generated revenue at a level equivalent to that of the corresponding period in 2021, which was approximately €5.2m. However, the group’s profit after tax for same period was €561,280, representing a 35% decrease.

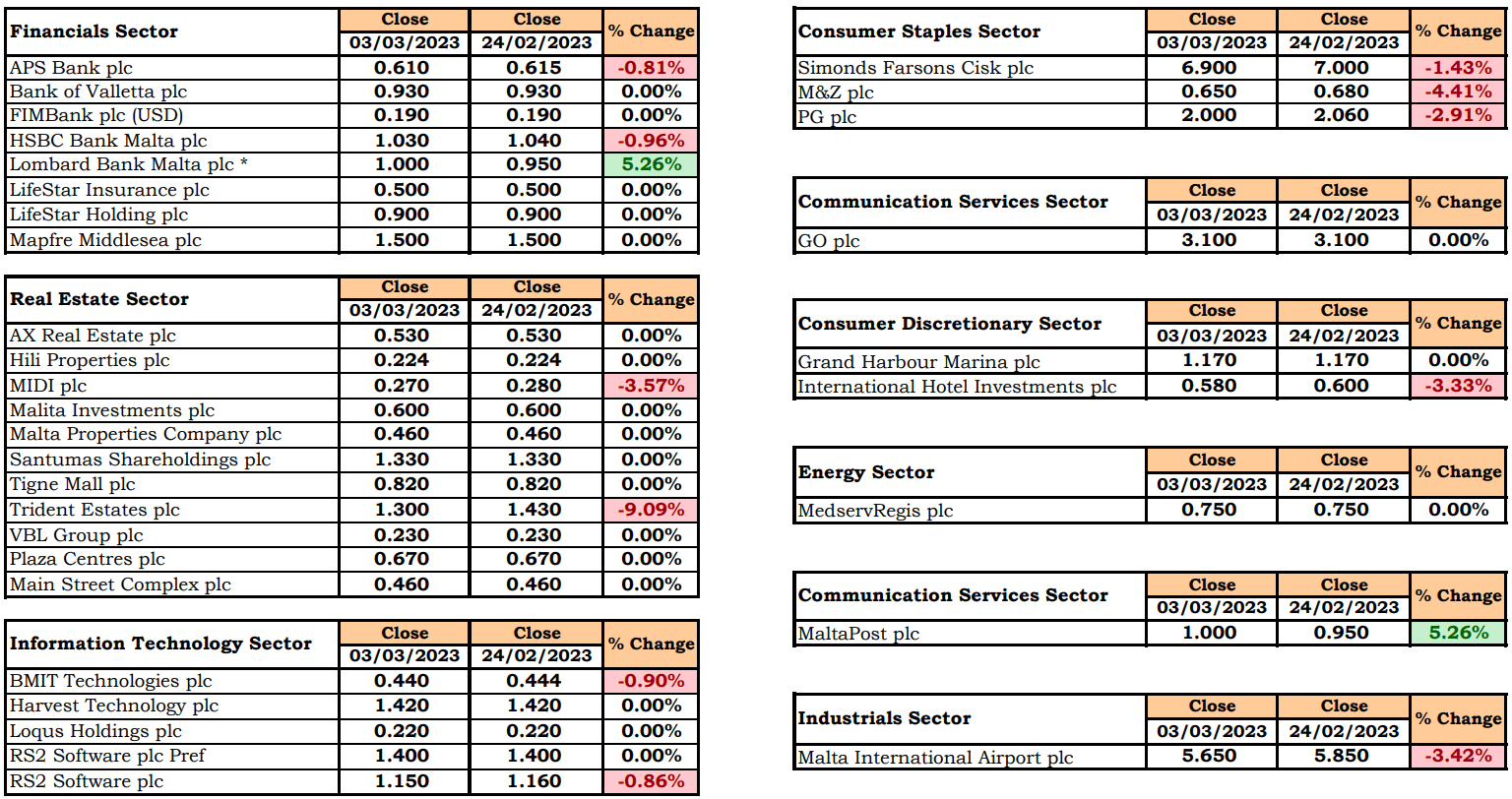

| Market Movers by Sector: |

| Upcoming Events: |

| 16 March 2023 | MT: MaltaPost plc – Dividend Payment Date |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]